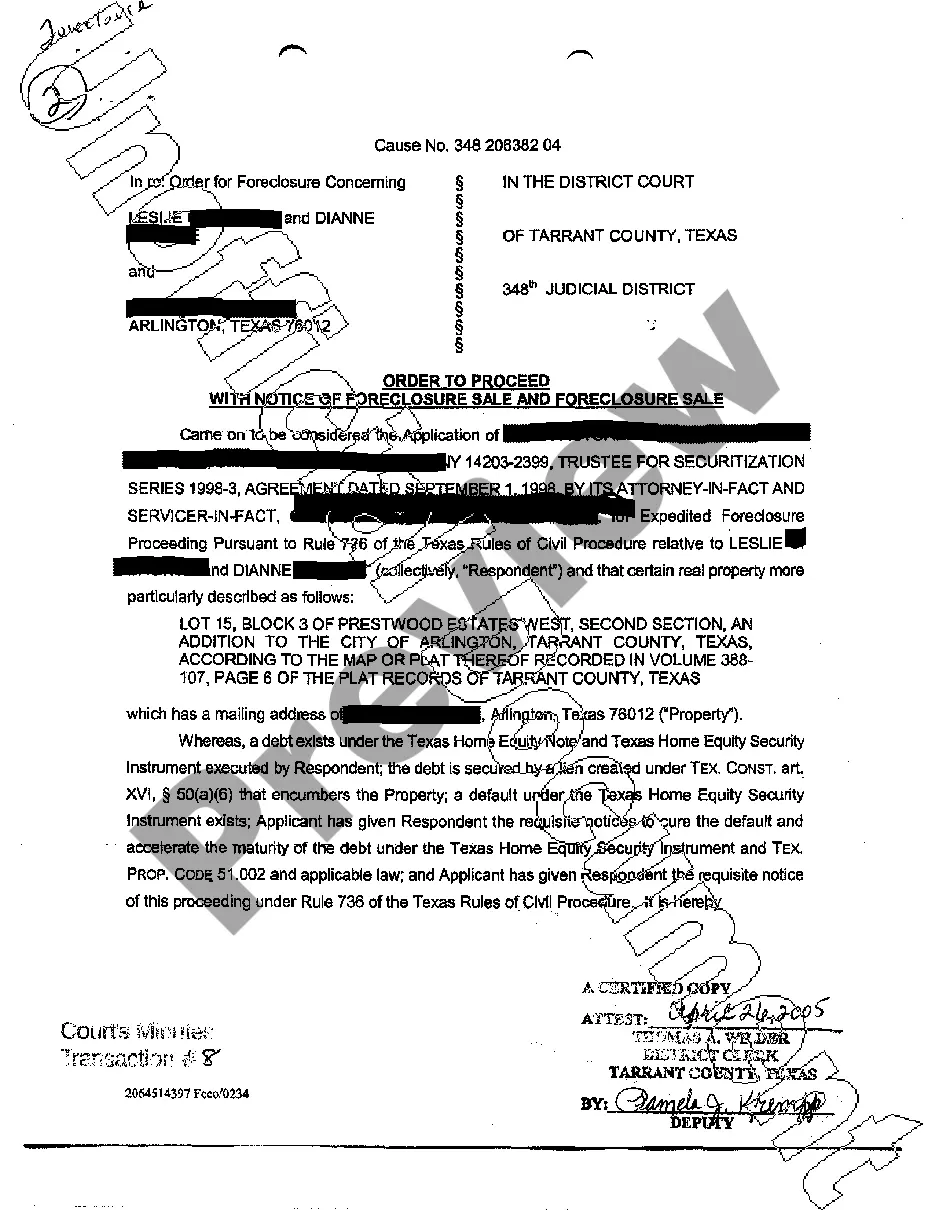

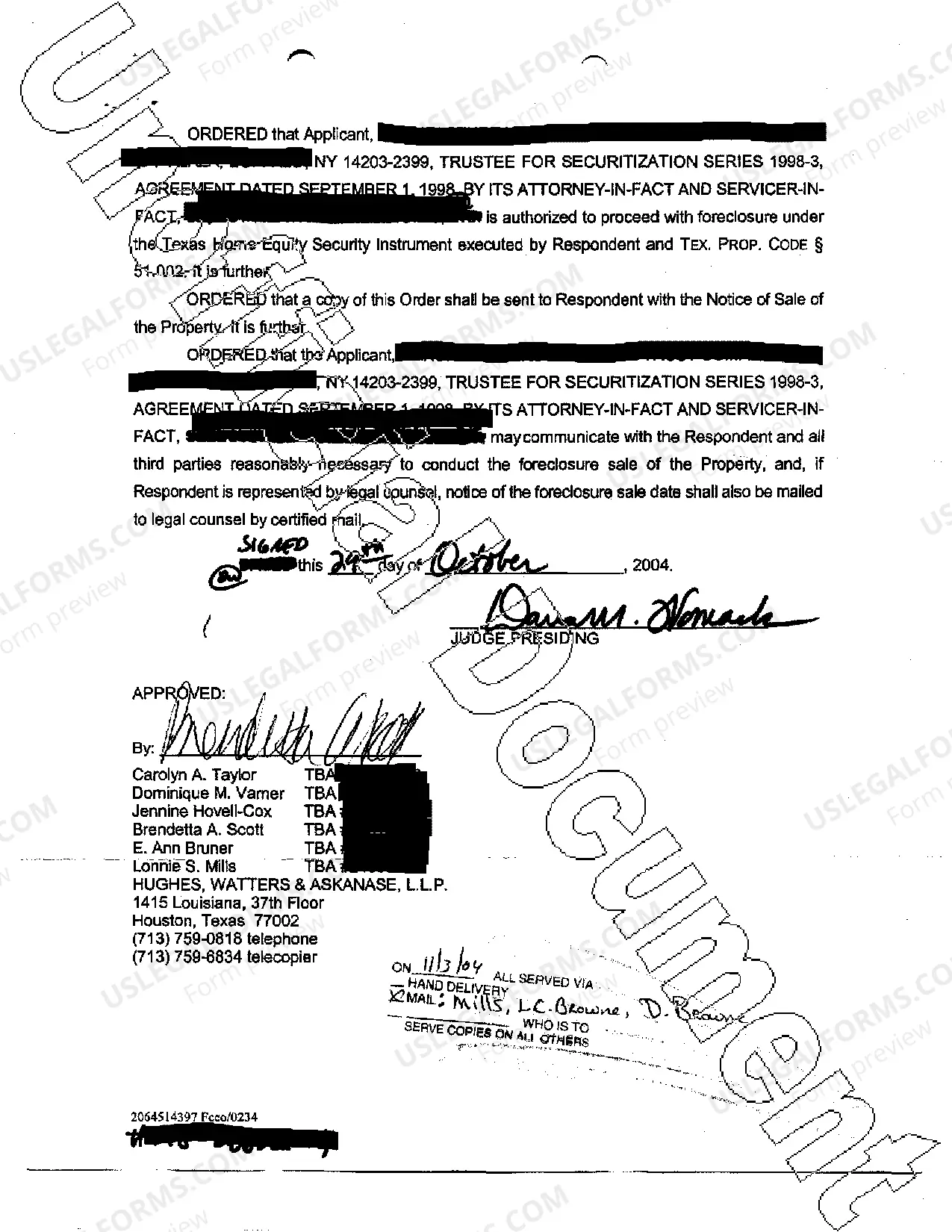

Dallas, Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale is a legal process that occurs when a homeowner defaults on their mortgage payments, leading the lender to initiate foreclosure proceedings to recover the outstanding debt. This detailed description will outline the steps involved in this process, along with the different types of foreclosure sales in Dallas, Texas. In Dallas, Texas, when a homeowner falls behind on their mortgage payments, the lender usually sends a Notice of Default to inform them of the delinquency. If the homeowner fails to address the issue and bring their payments up to date within a specified timeframe, the lender will file a lawsuit seeking an Order to Proceed with Notice of Foreclosure Sale. This lawsuit is typically filed in the local court where the property is located. Once the lender receives the Order to Proceed with Notice of Foreclosure Sale from the court, they can proceed with scheduling a foreclosure sale. The lender is required to provide notice of the foreclosure sale to the homeowner and any other parties with a vested interest in the property, such as other lien holders or tenants. This notice must include the details of the sale, including the date, time, and location. There are primarily two types of foreclosure sales that can occur in Dallas, Texas. The first type is a Non-Judicial Foreclosure Sale, also known as a Trustee's Sale. This type of foreclosure sale does not require court intervention, and the lender can proceed with the sale as outlined in the deed of trust or mortgage agreement. The sale is typically conducted by a trustee chosen by the lender, and the property is sold to the highest bidder at a public auction. The second type is a Judicial Foreclosure Sale, which involves court oversight throughout the entire process. In this type of foreclosure, the lender files a lawsuit against the homeowner, and the court oversees the sale to ensure it is fair and conducted in accordance with the law. The property is usually sold at a public auction, and the highest bidder becomes the new owner. It is important to note that the foreclosure process in Dallas, Texas can be complex, and homeowners facing foreclosure should seek legal counsel to understand their rights and options. Additionally, non-judicial foreclosure sales are more common in Texas due to the state's laws and the use of deeds of trust instead of mortgages. In summary, the Dallas, Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale is a legal process initiated by lenders when homeowners default on their mortgage payments. The two main types of foreclosure sales in Dallas, Texas include Non-Judicial Foreclosure Sales and Judicial Foreclosure Sales. Homeowners in this situation should consult with an attorney to navigate the foreclosure process effectively.

Dallas Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale

Description

How to fill out Dallas Texas Order To Proceed With Notice Of Foreclosure Sale And Foreclosure Sale?

If you are searching for a relevant form, it’s impossible to find a more convenient platform than the US Legal Forms website – probably the most considerable libraries on the internet. Here you can get thousands of form samples for organization and individual purposes by categories and states, or key phrases. Using our advanced search function, getting the latest Dallas Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale is as easy as 1-2-3. Additionally, the relevance of every record is proved by a team of skilled lawyers that on a regular basis check the templates on our website and update them based on the most recent state and county demands.

If you already know about our system and have a registered account, all you need to get the Dallas Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have opened the form you want. Check its information and use the Preview feature to see its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to find the needed record.

- Confirm your choice. Click the Buy now button. After that, pick the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the template. Indicate the format and save it to your system.

- Make changes. Fill out, edit, print, and sign the obtained Dallas Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale.

Every single template you save in your user profile does not have an expiry date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to receive an additional version for editing or creating a hard copy, feel free to return and download it once more at any moment.

Make use of the US Legal Forms professional catalogue to gain access to the Dallas Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale you were looking for and thousands of other professional and state-specific templates on one platform!