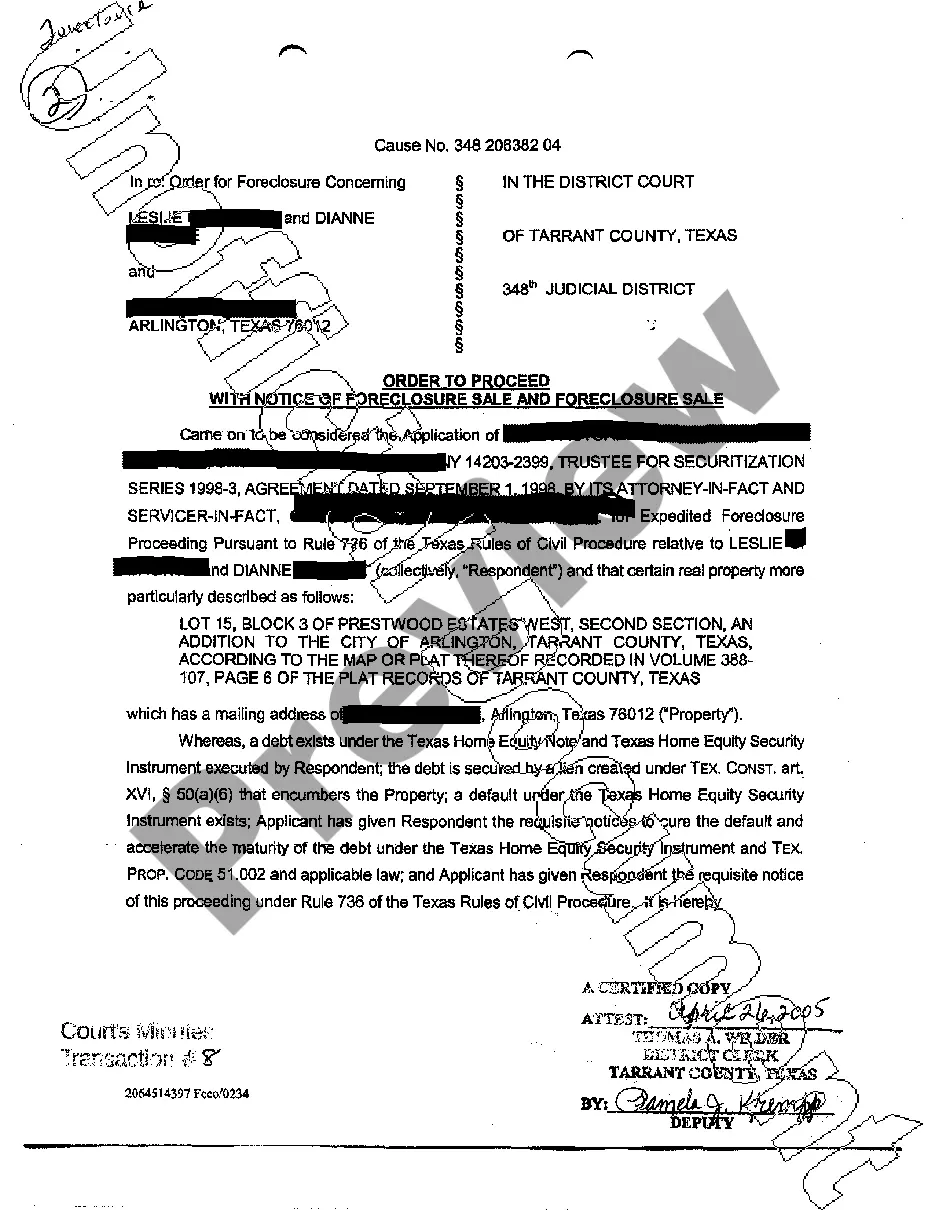

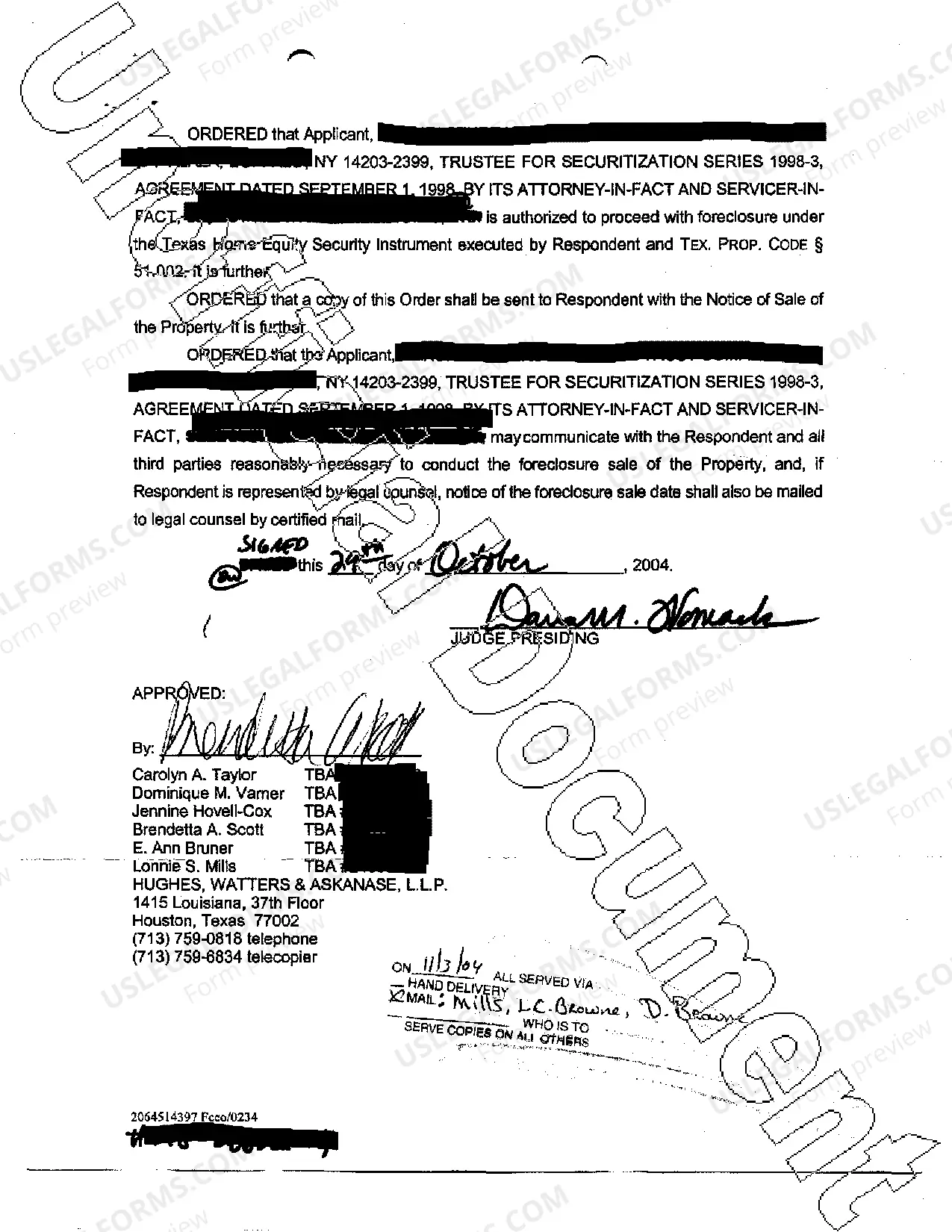

In San Antonio, Texas, an Order to Proceed with Notice of Foreclosure Sale is a legal document issued by a court that authorizes the initiation of a foreclosure process on a property. This order is typically obtained by a lender or mortgage holder when the borrower defaults on their loan payments, leading to the foreclosure of the property. The Order to Proceed with Notice of Foreclosure Sale signifies that the court approves the lender's request to proceed with the foreclosure process. It is an essential step in the legal proceedings and allows the lender to move forward with notifying the borrower and conducting a foreclosure sale. Once the Order to Proceed with Notice of Foreclosure Sale is granted, the lender must issue a Notice of Foreclosure Sale to the borrower. This notice serves as official notification to the borrower that their property will be put up for sale. It includes relevant details such as the date, time, and location of the foreclosure sale. The foreclosure sale, also known as a sheriff's sale or trustee's sale, is the final stage of the foreclosure process. It is an auction where the property is sold to recover the outstanding debt owed by the borrower. The proceeds from the sale are used to repay the unpaid loan amount, interest, and legal fees associated with the foreclosure. There are different types of San Antonio, Texas Orders to Proceed with Notice of Foreclosure Sale and foreclosure sales, including: 1. Judicial Foreclosure: This is a foreclosure process that involves a court hearing and requires the lender to file a lawsuit to obtain an Order to Proceed with Notice of Foreclosure Sale. The court oversees the entire foreclosure process, ensuring that all legal requirements are met. 2. Non-Judicial Foreclosure: Also known as a power of sale foreclosure, this process does not require court involvement. Instead, the lender follows a specific set of foreclosure procedures outlined in the loan documents. If these procedures are followed accurately, the lender can proceed with the foreclosure sale without obtaining an Order to Proceed with Notice of Foreclosure Sale from the court. 3. Tax Foreclosure: In cases where property taxes remain unpaid, the local government may initiate a tax foreclosure. This process involves the sale of the property to recover the delinquent taxes owed. The government entity conducting the foreclosure sale follows its specific procedures and regulations. It is important for borrowers to seek legal advice and explore options to avoid foreclosure once they receive an Order to Proceed with Notice of Foreclosure Sale. They can potentially negotiate with the lender for loan modification, repayment plans, or explore other alternatives to retain ownership of their property.

Divorce And Foreclosure San Antonio

Description

How to fill out San Antonio Texas Order To Proceed With Notice Of Foreclosure Sale And Foreclosure Sale?

No matter the social or professional standing, completing legal documents is a regrettable requirement in today’s society.

It is often nearly impossible for someone without a legal education to create such documents from the ground up, primarily because of the intricate language and legal nuances they entail.

This is where US Legal Forms comes to your aid.

Confirm that the template you select is tailored to your locality since the laws applicable in one state or area may not be relevant in another.

Review the document and read a brief description (if available) of the situations for which the document can be utilized.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents applicable to virtually any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to enhance their efficiency with our DIY papers.

- Whether you require the San Antonio Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale or any other documentation valid in your region, with US Legal Forms, everything is accessible at your convenience.

- Here’s how to quickly obtain the San Antonio Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale using our trustworthy service.

- If you’re already a customer, simply Log In to your account to download the required form.

- However, if you’re new to our platform, follow these steps before acquiring the San Antonio Texas Order to Proceed with Notice of Foreclosure Sale and Foreclosure Sale.

Form popularity

FAQ

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can. You miss your second payment. When your lender calls, it is important to pick up the phone and speak to your lender.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. Foreclosure and COVD-19 Relief. The Bottom Line.

How does foreclosure work in Georgia? Georgia is a ?non-judicial foreclosure? state. That means the lender can foreclose on your home without filing suit or appearing in court before a judge. The procedures for foreclosure are spelled out in the Official Code of Georgia, Sections 44-14-162 through 44-14-162.4.

The most common foreclosure process in Texas is non-judicial foreclosure, which means the lender can foreclose without going to court so long as the deed of trust contains a power of sale clause. Non-judicial foreclosure is most common with purchase money loans as well as rate-and-term refinances.

Power of sale is a mortgage clause that permits the lender to foreclose on and sell a property in default in order to recover the remainder of the loan. This clause, which is legal in many U.S. states, allows for a foreclosure process that circumvents the courts for speedier outcomes.

How Long Does Foreclosure Take? In Georgia, the foreclosure process can vary depending on your circumstances. However, on average, it takes about one to three weeks to complete. If your property was sold at a foreclosure auction, the eviction process takes about 14 to 30 days.

Texas foreclosures occur quickly. In just 60 days an uncontested foreclosure can be completed. If the lender seeks a delay or if the borrower contests the foreclosure or files for bankruptcy then it will take longer to foreclose on the property.

Under Texas law, a lender has to use a quasi-judicial process to foreclose a home equity loan. In this process, the lender must get a court order approving the foreclosure before conducting a nonjudicial foreclosure. Also, Texas law doesn't allow deficiency judgments following the foreclosure of a home equity loan.

The Texas foreclosure process has roughly 160 days from start to finish until a home goes into auction, so knowing where you stand can help you decide what might be the next best course of action. Foreclosure is awful, to say the least.