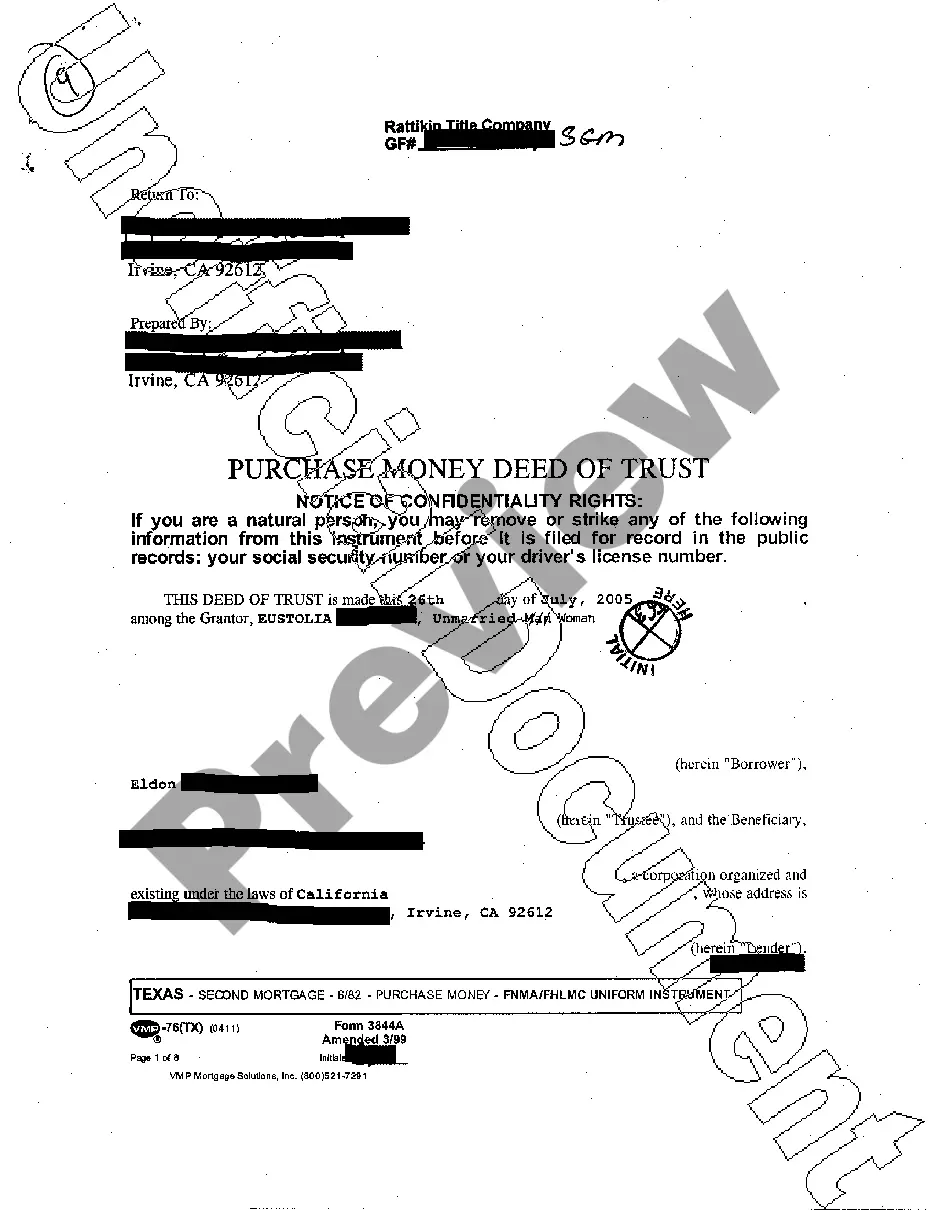

Abilene Texas Purchase Money Deed of Trust is a legal document used in the real estate industry that establishes a lien on a property to secure the repayment of a loan used to purchase the property. This type of deed of trust is commonly used in real estate transactions in Abilene, Texas, as it allows lenders to have a claim on the property in case of default by the borrower. The Abilene Texas Purchase Money Deed of Trust is a written agreement between the borrower (the buyer) and the lender (often a financial institution or mortgage company). It outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any provisions for late payments or default. There are several types of Abilene Texas Purchase Money Deed of Trust, including: 1. Traditional Purchase Money Deed of Trust: This is the standard form used in most residential real estate transactions. It involves a lender providing funds directly to the borrower to purchase the property, and the deed of trust is then recorded to establish the lender's lien on the property. 2. Wraparound Purchase Money Deed of Trust: In this type of arrangement, the borrower already has an existing loan on the property, and a new loan is "wrapped around" the existing loan. The wraparound deed of trust includes both the original loan and the new loan, and the lender of the new loan assumes responsibility for making payments on the existing loan. 3. Seller-Financed Purchase Money Deed of Trust: In some cases, the seller of the property may offer to finance the purchase themselves instead of using a traditional lender. This type of deed of trust is used when the seller provides the funds to the buyer and holds a mortgage on the property until the debt is repaid. 4. Refinance Purchase Money Deed of Trust: If a borrower refinances their existing mortgage, a new purchase money deed of trust is typically created to reflect the new loan terms agreed upon with the lender. It's important for both parties involved in an Abilene Texas Purchase Money Deed of Trust to understand their rights and responsibilities. The lender has the right to foreclose on the property if the borrower fails to repay the loan as agreed upon. The borrower, on the other hand, has the right to enjoy the use and ownership of the property as long as they meet their loan obligations. In conclusion, the Abilene Texas Purchase Money Deed of Trust is a crucial document in real estate transactions, securing the loan used to purchase a property. Different types of this deed of trust vary based on the financing arrangements, including traditional, wraparound, seller-financed, and refinance options. It's essential for both parties to consult with legal professionals or real estate agents familiar with local laws and regulations to ensure a smooth and legally binding transaction.

Abilene Texas Purchase Money Deed of Trust

Description

How to fill out Abilene Texas Purchase Money Deed Of Trust?

If you have previously utilized our service, Log In to your account and retrieve the Abilene Texas Purchase Money Deed of Trust to your device by selecting the Download button. Ensure your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business requirements!

- Ensure you’ve located an appropriate document. Review the description and use the Preview feature, if accessible, to verify if it satisfies your requirements. If it does not, employ the Search tab above to find the right one.

- Buy the template. Select the Buy Now button and pick a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or use the PayPal option to finalize the transaction.

- Receive your Abilene Texas Purchase Money Deed of Trust. Choose the file format for your document and store it on your device.

- Complete your document. Print it out or use online professional editors to fill it in and sign it electronically.

Form popularity

FAQ

A deed of trust is drafted by a solicitor, normally during the conveyancing process when buying, however you can draft a deed of trust after you purchase. You can only have a deed of trust to protect your money in a property if you hold it as tenants in common.

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

What is a Purchase Money Trust? In trusts and estates law, a purchase money resulting trust is a type of trust that is created when an individual contributes funds to purchase a particular property, but instructs the seller to transfer title to the property to a different individual.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

There are a variety of deeds that are recognized in Texas, but the four most common deeds seen are general warranty deeds, special warranty deeds, no warranty deeds, and quitclaims. If you need a deed drafted or have any questions regarding these deeds or any other real property conveyance tools, please contact us.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

Whilst you do not need a solicitor to prepare a Declaration of Trust, it is always advisable to seek professional advice. For many people, your home is your biggest asset and having a Declaration of Trust in place is the best way to protect your investment.

Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

You may obtain Texas land records, including deeds, from the county clerk in the Texas county in which the property is located. You can search online for a deed in some counties, or else request the deed from the clerk in person, by mail, phone, fax or email.