Brownsville Texas Purchase Money Deed of Trust, also known as a PM DOT, is a legal document used in real estate transactions in Brownsville, Texas. It serves as a security instrument that guarantees the repayment of a loan used to purchase a property. Here is a detailed description of the Brownsville Texas Purchase Money Deed of Trust and its various types: 1. Definition: A Purchase Money Deed of Trust is a legally binding contract used when a borrower obtains financing from a lender to purchase a property in Brownsville, Texas. The deed serves as collateral for the loan, giving the lender the right to foreclose on the property if the borrower defaults on the loan. 2. Parties Involved: The key parties involved in a Brownsville Texas Purchase Money Deed of Trust are the borrower (property buyer), the lender (usually a bank or financial institution), and the trustee (an independent third party responsible for holding the deed on behalf of the lender). 3. Types of Brownsville Texas Purchase Money Deed of Trust: a. Traditional Purchase Money Deed of Trust: This is the most common form, where the lender directly provides the funds for the property purchase. The borrower signs a promissory note detailing the loan terms, and the lender records the deed to secure the loan against the property. b. Seller Financing Purchase Money Deed of Trust: In some cases, the seller of the property may act as the lender, financing the buyer's purchase directly. The seller becomes the beneficiary, and the buyer and seller execute a purchase money deed of trust to secure the loan. c. Refinance Purchase Money Deed of Trust: This type of deed of trust is used when a borrower refinances their existing loan, often seeking better terms or lower interest rates. The borrower obtains a new loan that replaces the original one, and a new purchase money deed of trust is executed to secure the refinanced loan. d. Assumption Purchase Money Deed of Trust: In certain situations, a buyer may take over the existing mortgage loan of the seller instead of obtaining a new loan. In such cases, the buyer assumes the original seller's loan and executes an assumption purchase money deed of trust to secure their obligations. In summary, the Brownsville Texas Purchase Money Deed of Trust is a crucial document that outlines the terms and conditions of a loan used to purchase a property. It provides security to the lender and is essential for establishing legal ownership rights. Understanding the different types of Pilots allows borrowers and sellers to navigate various financing options available in Brownsville, Texas.

Brownsville Texas Purchase Money Deed of Trust

State:

Texas

City:

Brownsville

Control #:

TX-JW-0169

Format:

PDF

Instant download

This form is available by subscription

Description

Purchase Money Deed of Trust

Brownsville Texas Purchase Money Deed of Trust, also known as a PM DOT, is a legal document used in real estate transactions in Brownsville, Texas. It serves as a security instrument that guarantees the repayment of a loan used to purchase a property. Here is a detailed description of the Brownsville Texas Purchase Money Deed of Trust and its various types: 1. Definition: A Purchase Money Deed of Trust is a legally binding contract used when a borrower obtains financing from a lender to purchase a property in Brownsville, Texas. The deed serves as collateral for the loan, giving the lender the right to foreclose on the property if the borrower defaults on the loan. 2. Parties Involved: The key parties involved in a Brownsville Texas Purchase Money Deed of Trust are the borrower (property buyer), the lender (usually a bank or financial institution), and the trustee (an independent third party responsible for holding the deed on behalf of the lender). 3. Types of Brownsville Texas Purchase Money Deed of Trust: a. Traditional Purchase Money Deed of Trust: This is the most common form, where the lender directly provides the funds for the property purchase. The borrower signs a promissory note detailing the loan terms, and the lender records the deed to secure the loan against the property. b. Seller Financing Purchase Money Deed of Trust: In some cases, the seller of the property may act as the lender, financing the buyer's purchase directly. The seller becomes the beneficiary, and the buyer and seller execute a purchase money deed of trust to secure the loan. c. Refinance Purchase Money Deed of Trust: This type of deed of trust is used when a borrower refinances their existing loan, often seeking better terms or lower interest rates. The borrower obtains a new loan that replaces the original one, and a new purchase money deed of trust is executed to secure the refinanced loan. d. Assumption Purchase Money Deed of Trust: In certain situations, a buyer may take over the existing mortgage loan of the seller instead of obtaining a new loan. In such cases, the buyer assumes the original seller's loan and executes an assumption purchase money deed of trust to secure their obligations. In summary, the Brownsville Texas Purchase Money Deed of Trust is a crucial document that outlines the terms and conditions of a loan used to purchase a property. It provides security to the lender and is essential for establishing legal ownership rights. Understanding the different types of Pilots allows borrowers and sellers to navigate various financing options available in Brownsville, Texas.

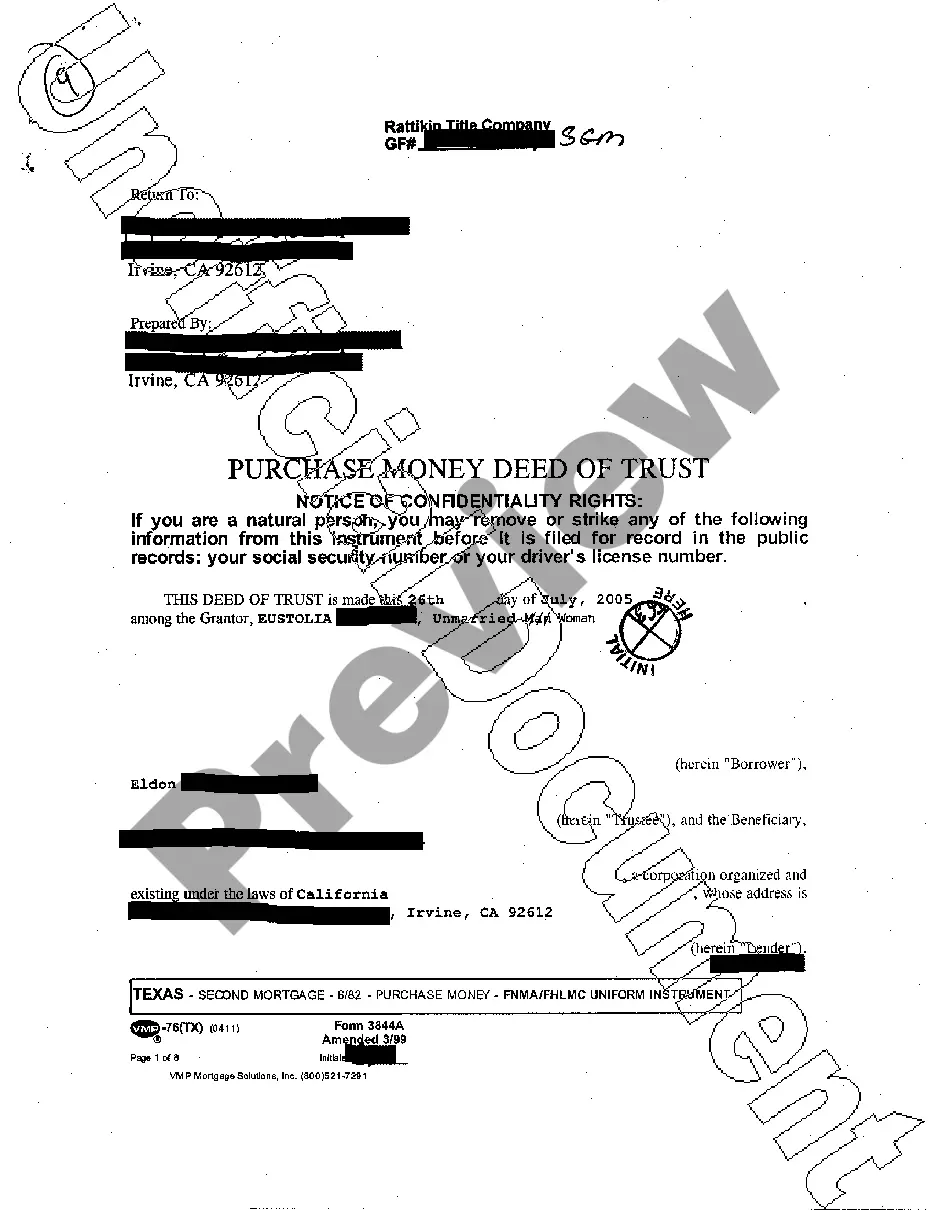

Free preview

How to fill out Brownsville Texas Purchase Money Deed Of Trust?

If you’ve already utilized our service before, log in to your account and save the Brownsville Texas Purchase Money Deed of Trust on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Brownsville Texas Purchase Money Deed of Trust. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!