Collin Texas Purchase Money Deed of Trust is a legal document used in real estate transactions in Collin County, Texas. It is a type of security instrument that secures a lender's interest in a property during a home purchase where the funds from the loan are being used to finance the purchase. A Purchase Money Deed of Trust serves as a lien on the property, providing the lender with the right to foreclose in the event of default on the loan. This document is commonly used in Collin County, Texas, to protect the lender's investment while allowing the borrower to acquire the property. The Collin Texas Purchase Money Deed of Trust includes key components such as: 1. Parties involved: It outlines the names of the borrower (property buyer), the lender (financial institution or individual), and the trustee (a neutral third party who holds legal title to the property until the loan is repaid). 2. Property description: It contains a detailed description of the property being purchased, including its address, legal description, and any other identifying information necessary to identify the property. 3. Loan terms: It outlines the loan amount, interest rate, repayment schedule, and other financial terms agreed upon between the borrower and the lender. This section also includes provisions for late payment penalties, prepayment options, and other conditions. 4. Security interest: The Collin Texas Purchase Money Deed of Trust grants the lender a security interest in the property, giving them the right to foreclose and sell the property if the borrower defaults on the loan. Different types of Collin Texas Purchase Money Deed of Trust include: 1. Fixed-rate Purchase Money Deed of Trust: This type of deed of trust has a fixed interest rate for the duration of the loan term, providing stability for both the borrower and the lender. 2. Adjustable-rate Purchase Money Deed of Trust: In this type of deed of trust, the interest rate is adjustable, meaning it may change at predetermined intervals based on market conditions or other factors specified in the loan agreement. 3. Balloon Payment Purchase Money Deed of Trust: This type of deed of trust involves the repayment of a large portion of the loan in one lump sum, typically at the end of a shorter loan term. This allows for lower monthly payments but requires a significant payment at the end. Overall, the Collin Texas Purchase Money Deed of Trust is crucial in real estate transactions in Collin County. It protects both the borrower and the lender by establishing the terms of the loan, securing the lender's interest in the property, and ensuring a smooth and legally binding home purchase process.

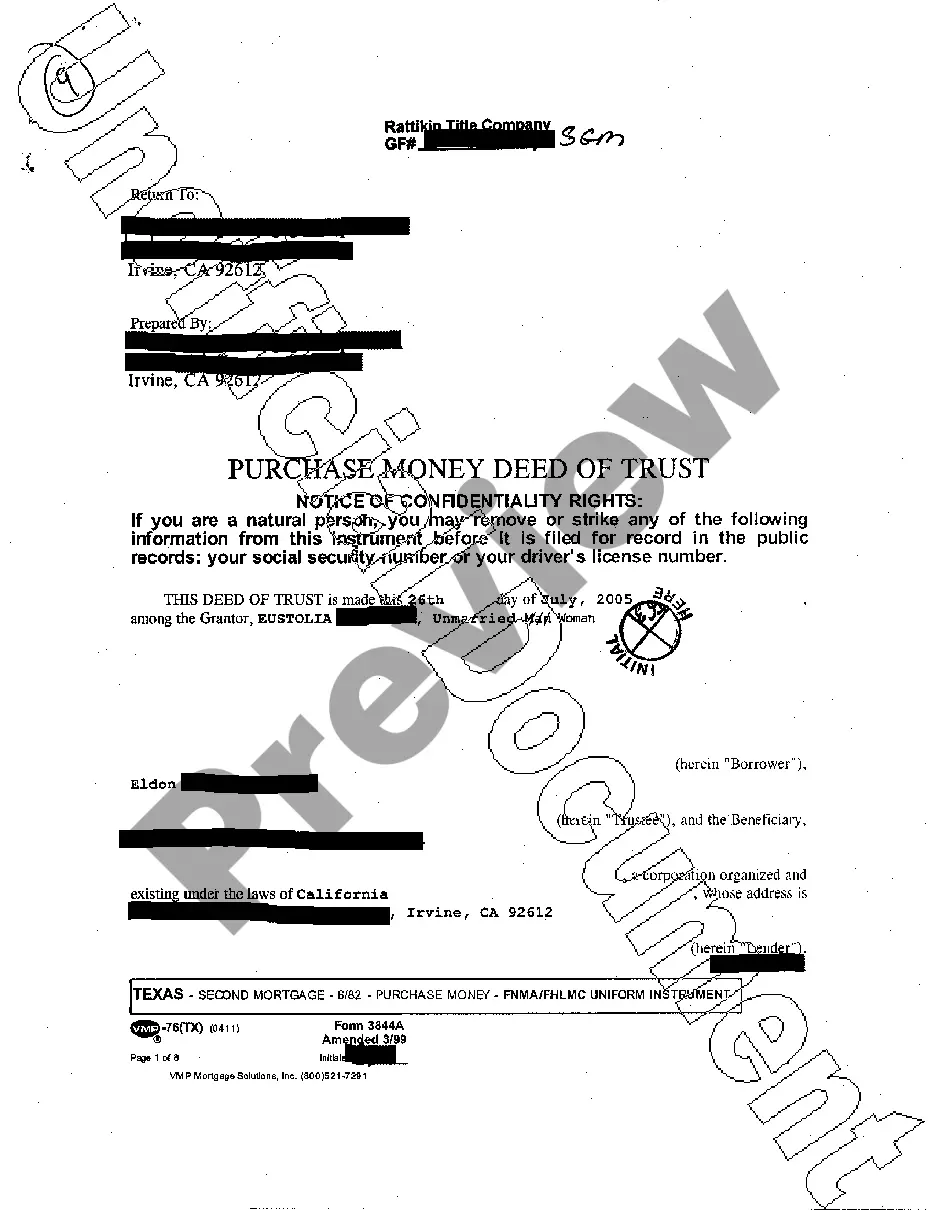

Collin Texas Purchase Money Deed of Trust

Description

How to fill out Collin Texas Purchase Money Deed Of Trust?

If you are searching for a valid form, it’s impossible to find a better service than the US Legal Forms website – one of the most comprehensive libraries on the web. With this library, you can get a huge number of form samples for business and individual purposes by categories and states, or keywords. With the advanced search feature, discovering the most up-to-date Collin Texas Purchase Money Deed of Trust is as easy as 1-2-3. In addition, the relevance of each record is proved by a group of professional lawyers that on a regular basis review the templates on our website and revise them in accordance with the newest state and county demands.

If you already know about our platform and have an account, all you need to receive the Collin Texas Purchase Money Deed of Trust is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the form you need. Check its description and utilize the Preview function (if available) to see its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to get the appropriate file.

- Affirm your selection. Select the Buy now option. Next, select the preferred pricing plan and provide credentials to register an account.

- Make the transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Get the form. Choose the format and save it to your system.

- Make modifications. Fill out, edit, print, and sign the received Collin Texas Purchase Money Deed of Trust.

Every form you save in your user profile has no expiration date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you want to have an extra version for editing or creating a hard copy, feel free to come back and save it again whenever you want.

Take advantage of the US Legal Forms extensive library to get access to the Collin Texas Purchase Money Deed of Trust you were seeking and a huge number of other professional and state-specific samples in a single place!