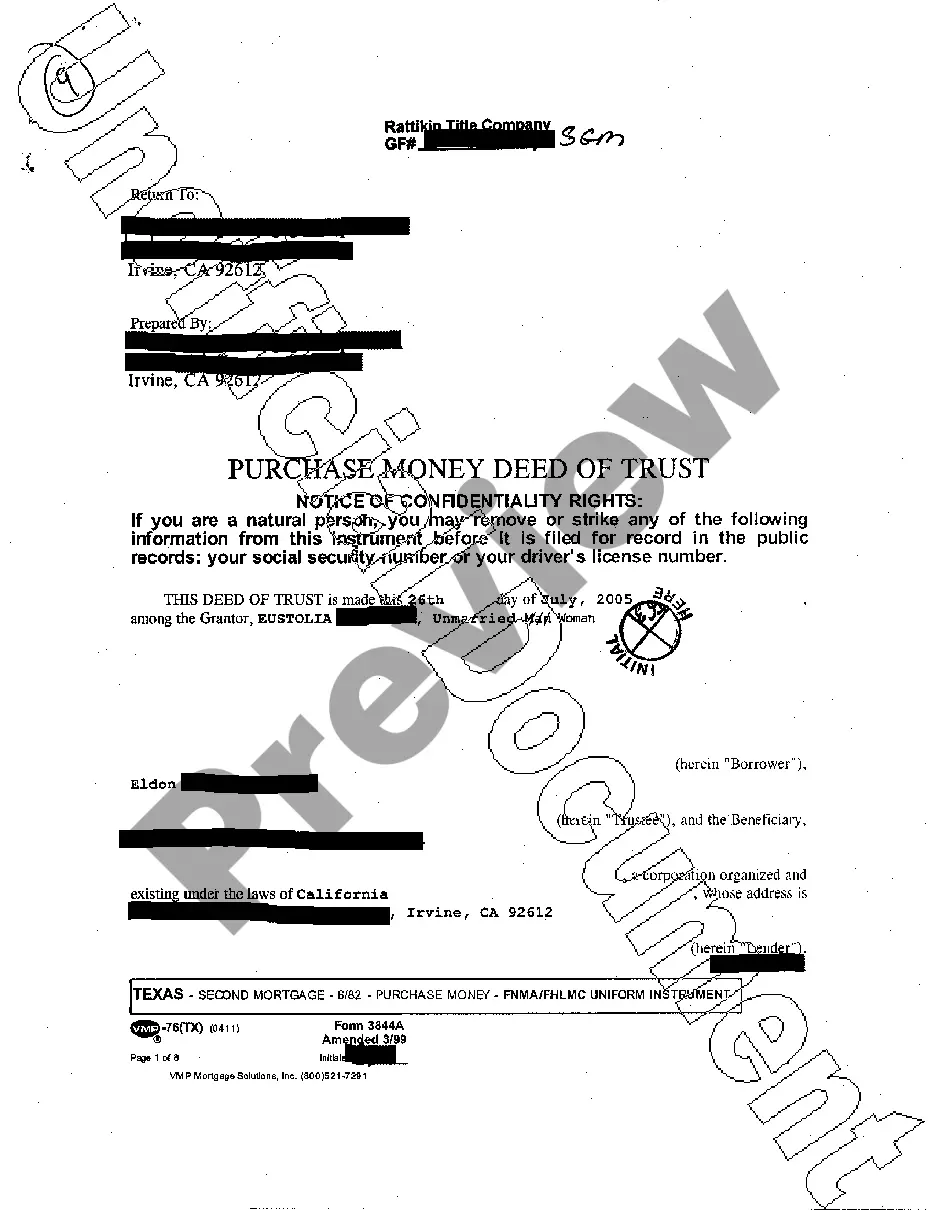

Harris Texas Purchase Money Deed of Trust is a legal document that is commonly used in real estate transactions in Harris County, Texas. This deed of trust serves as a security instrument, securing a loan that is used by the borrower (buyer) to purchase the property. Keywords: Harris Texas, Purchase Money Deed of Trust, real estate transactions, security instrument, loan, borrower, property. In Harris County, Texas, the Purchase Money Deed of Trust is a crucial document that enables borrowers to finance the purchase of a property. This legal instrument serves as a security agreement, providing lenders with a recourse if the borrower defaults on the loan. The essence of this arrangement is to protect the lender's interest in the property until the loan is repaid in full. There are a few different types of Harris Texas Purchase Money Deed of Trust, each with its own specific characteristics. These types include: 1. Fixed Rate Purchase Money Deed of Trust: This type of deed of trust specifies a fixed interest rate, which remains constant over the course of the loan term. Borrowers can plan their mortgage payments accordingly, as the interest rate won't change. 2. Adjustable Rate Purchase Money Deed of Trust: This variation allows for the interest rate to fluctuate based on market conditions. The interest rate may be fixed for an initial period and then adjusted periodically, potentially affecting the borrower's monthly payment over time. 3. Government-Insured Purchase Money Deed of Trust: Under this category, the loan is insured by a government agency like the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). It offers certain benefits to borrowers, such as reduced down payments or lenient credit requirements. When entering into a Purchase Money Deed of Trust, both parties must agree on the terms and conditions outlined in the contract. The document typically includes the legal description of the property, borrower's name, lender's name, loan amount, interest rate, repayment schedule, and any additional provisions negotiated between the parties involved. It's important for borrowers in Harris County, Texas, to thoroughly review the terms of the Purchase Money Deed of Trust before signing. Consulting with a real estate attorney or a knowledgeable professional can help ensure a clear understanding of the obligations, rights, and consequences associated with this legal agreement. In conclusion, the Harris Texas Purchase Money Deed of Trust is an essential document in real estate transactions, enabling buyers to secure funding for property purchases. Understanding the different types, their features, and seeking proper legal counsel can help borrowers make informed decisions, while protecting both parties' interests throughout the loan repayment process.

Harris Texas Purchase Money Deed of Trust

Description

How to fill out Harris Texas Purchase Money Deed Of Trust?

If you are looking for a relevant form, it’s extremely hard to find a more convenient service than the US Legal Forms site – one of the most extensive libraries on the internet. With this library, you can get a huge number of form samples for business and personal purposes by types and regions, or key phrases. With our high-quality search option, finding the newest Harris Texas Purchase Money Deed of Trust is as elementary as 1-2-3. In addition, the relevance of each and every document is proved by a team of professional lawyers that regularly check the templates on our website and revise them in accordance with the newest state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Harris Texas Purchase Money Deed of Trust is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions below:

- Make sure you have found the sample you require. Read its information and make use of the Preview option (if available) to check its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to get the appropriate record.

- Confirm your choice. Select the Buy now option. After that, select the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the template. Choose the format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the acquired Harris Texas Purchase Money Deed of Trust.

Every single template you add to your account does not have an expiry date and is yours forever. You can easily gain access to them via the My Forms menu, so if you want to get an extra version for enhancing or printing, you may return and export it once again at any moment.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Harris Texas Purchase Money Deed of Trust you were seeking and a huge number of other professional and state-specific samples on a single platform!