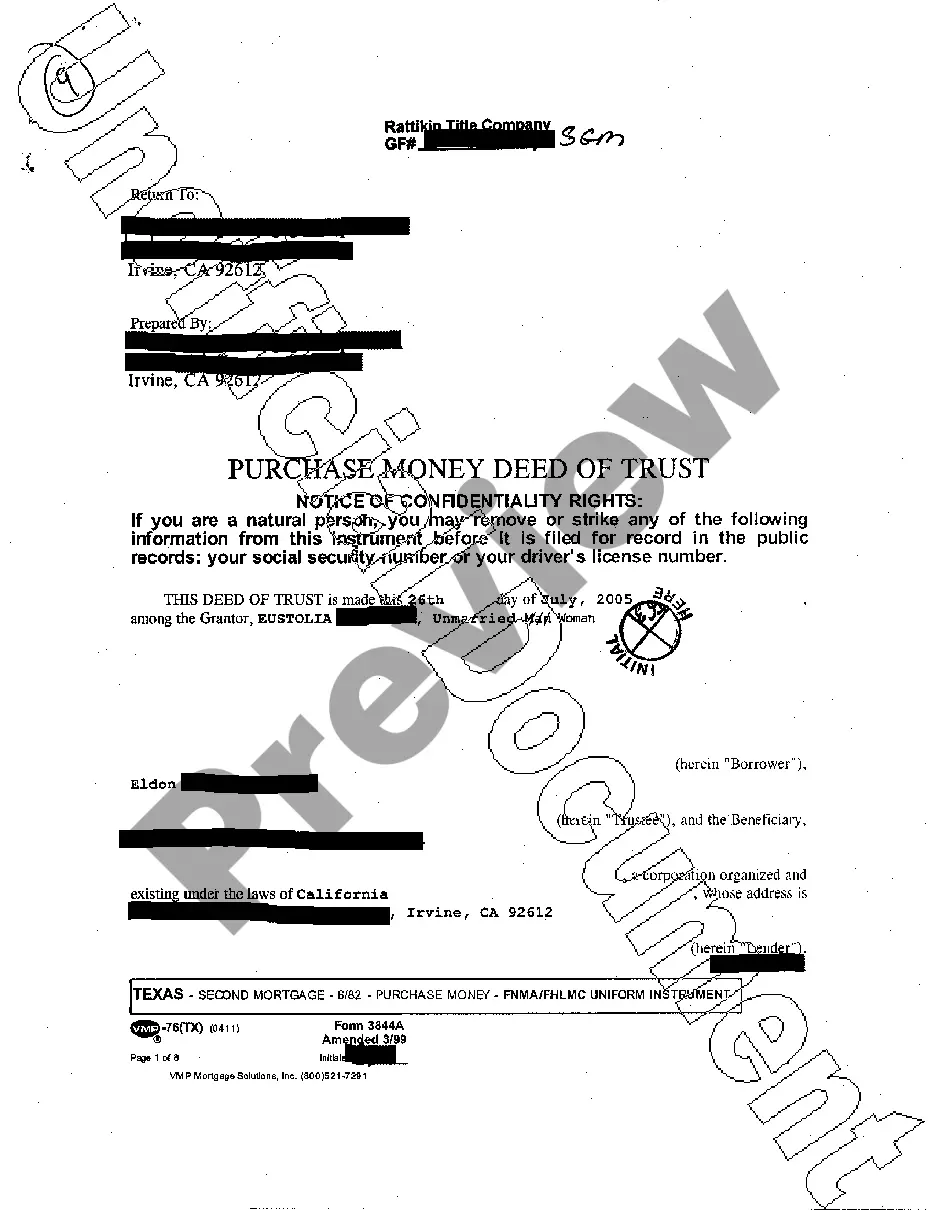

Irving Texas Purchase Money Deed of Trust is a legal document relevant to real estate transactions in Irving, Texas. It serves as a security instrument used to secure a loan or mortgage against a property. A Purchase Money Deed of Trust in Irving, Texas is typically utilized when a buyer purchases a property with the assistance of a mortgage loan. The lender provides the necessary funds for purchasing the property, and in return, the buyer executes a Deed of Trust in favor of the lender, creating a lien on the property as collateral for the loan. Keywords: Irving Texas, Purchase Money Deed of Trust, real estate transactions, security instrument, loan, mortgage, property, lender, buyer, Deed of Trust, lien, collateral. There are no specific types of Irving Texas Purchase Money Deeds of Trust, as the concept remains the same regardless of the property type or specific circumstances. However, variations may exist based on specific loan terms, borrower qualifications, or lender requirements. These variations are generally negotiated and customized to suit the needs of both the borrower and the lender. In Irving, Texas, some key components of a Purchase Money Deed of Trust typically include: 1. Principal amount: The total loan amount being provided by the lender. 2. Interest rate: The interest rate at which the loan will accrue. 3. Repayment terms: The agreed-upon schedule for loan repayments, usually in the form of monthly installments. 4. Default provisions: Details outlining the consequences and remedies in case of borrower default, including foreclosure rights granted to the lender. 5. Insurance and taxes: Requirements for the borrower to maintain adequate property insurance and remain current on property taxes. 6. Prepayment options: Any provisions allowing the borrower to pay off the loan before the agreed-upon term, potentially with prepayment penalties. By executing a Purchase Money Deed of Trust in Irving, Texas, both the borrower and lender ensure their interests are protected throughout the loan term. The borrower obtains the necessary funds to purchase the property while the lender secures their investment through the collateral of the property itself. In summary, the Irving Texas Purchase Money Deed of Trust is a significant legal document used in real estate transactions. It establishes a lien on the purchased property in favor of the lender until the loan is repaid.

Irving Texas Purchase Money Deed of Trust

Description

How to fill out Irving Texas Purchase Money Deed Of Trust?

Are you looking for a reliable and cost-effective provider of legal documents to obtain the Irving Texas Purchase Money Deed of Trust? US Legal Forms is your ideal choice.

Whether you need a simple contract to establish rules for living with your partner or a collection of documents to facilitate your separation or divorce process through the courts, we have everything you need. Our platform provides over 85,000 current legal document templates for individual and business purposes. All templates we offer are tailored and based on the specific regulations of each state and locality.

To acquire the document, you must Log Into your account, locate the desired template, and hit the Download button adjacent to it. Please remember that you can retrieve your previously purchased document templates anytime from the My documents section.

Are you a newcomer to our service? No problem. You can create an account with great ease; however, make sure to do the following beforehand.

Now, you can establish your account. Next, choose a subscription plan and move forward with the payment. Once the payment is complete, download the Irving Texas Purchase Money Deed of Trust in any format available. You can revisit the site whenever necessary and download the form again at no extra cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to the hours spent trying to understand legal forms online.

- Check if the Irving Texas Purchase Money Deed of Trust meets the regulations of your state and locality.

- Review the specifics of the form (if provided) to determine its suitability for your needs.

- Reinitiate the search if the template does not align with your legal needs.

Form popularity

FAQ

Determining whether a deed of trust or a mortgage is better often depends on your needs. A deed of trust can offer a more streamlined foreclosure process in Texas, making it favorable for lenders. However, mortgages might provide more flexibility for borrowers regarding repayment terms. Ultimately, evaluating your specific situation is vital to decide which option works best for you.

Texas is one of the few states that is a ?deed of trust? state. While many people take out a mortgage to purchase real estate, which is a loan borrowed from a bank to finance the purchase of a home, in most states, there are only two parties named on this legal document ? the lender (bank) and the borrower (homeowner).

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

There are a variety of deeds that are recognized in Texas, but the four most common deeds seen are general warranty deeds, special warranty deeds, no warranty deeds, and quitclaims.

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.