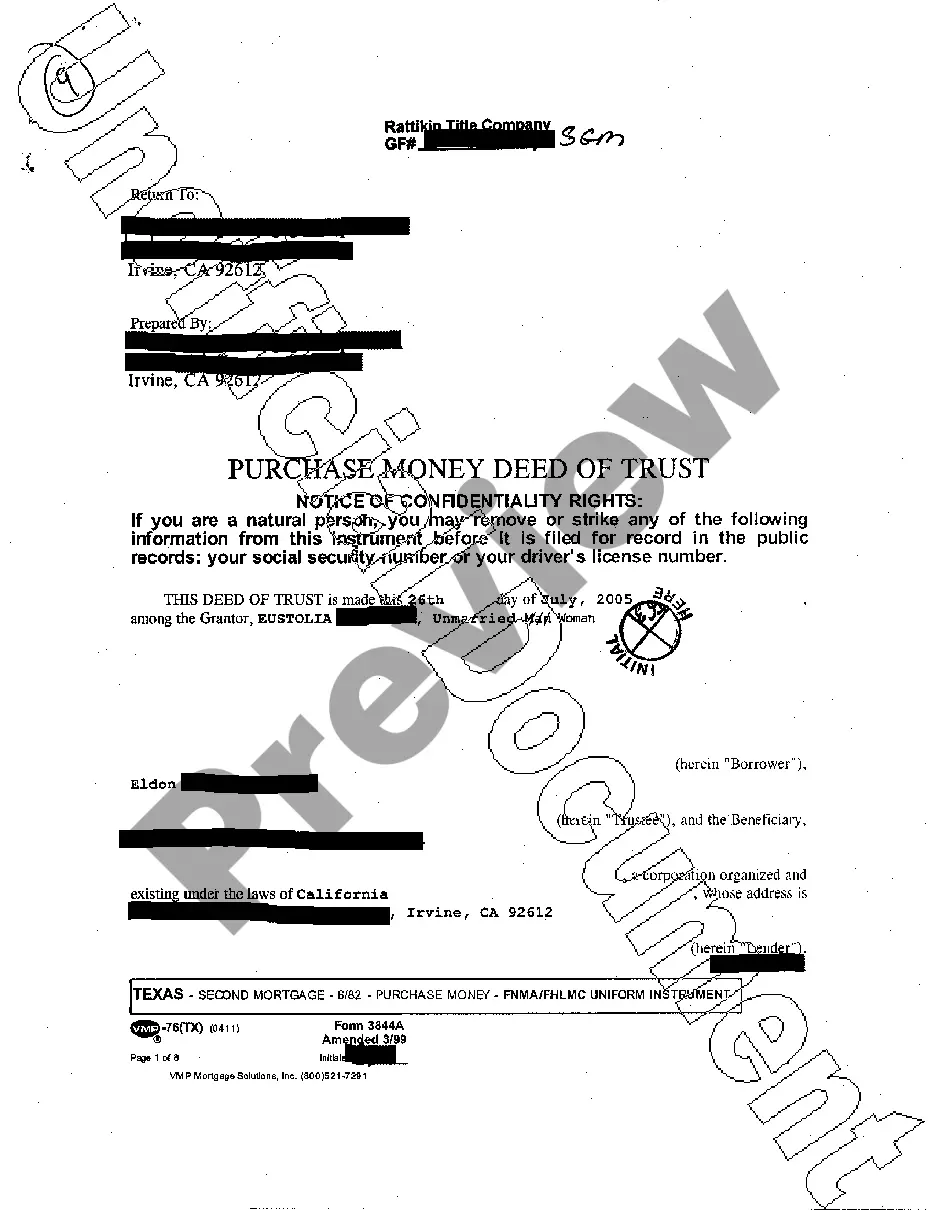

The Odessa Texas Purchase Money Deed of Trust is a legal document that serves as a means of securing and guaranteeing a loan used by a buyer to purchase real estate in the city of Odessa, Texas. This deed of trust is a common practice in real estate transactions and is used to protect the interests of the lender. The Odessa Texas Purchase Money Deed of Trust involves three parties: the borrower (buyer), the lender (usually a financial institution), and the trustee (a neutral third party who holds the legal title to the property until the loan is fully paid off). The buyer, also known as the trust or, pledges the property as collateral to secure the loan obtained from the lender, also called the beneficiary. This legal document outlines the terms and conditions of the loan, including the amount borrowed, the interest rate, the repayment terms, and any additional provisions or agreements between the buyer and the lender. The buyer is required to make regular monthly payments towards the loan, which includes both interest and principle, in accordance with the agreed-upon schedule. In the event that the buyer fails to make timely payments or defaults on the loan, the lender has the right to initiate foreclosure proceedings. The trustee, acting as a neutral party, has the authority to sell the property through a public auction to recover the outstanding loan amount. Upon successful completion of the loan repayment, the trustee releases the legal title to the borrower. Different types of Odessa Texas Purchase Money Deed of Trust may include: 1. Fixed-Rate Deed of Trust: This type of deed of trust carries a fixed interest rate, meaning the interest rate remains constant throughout the loan term. 2. Adjustable-Rate Deed of Trust: Also known as an ARM, this type of deed of trust has an interest rate that fluctuates over time based on prevailing market conditions. The interest rate may be fixed for an initial period and then adjust periodically. 3. Balloon Deed of Trust: A balloon payment is a large lump-sum payment due at the end of the loan term. This type of deed of trust allows for smaller monthly payments throughout the loan term, with the remaining balance due as a balloon payment. 4. Wraparound Deed of Trust: This type of deed of trust allows the buyer to obtain additional financing without refinancing the original loan. The new loan "wraps around" the existing one, combining the two into a single payment. 5. Assumable Deed of Trust: This type of deed of trust allows the buyer to assume the loan and take over the payments from the original borrower. This can be advantageous if the interest rate is lower than current market rates. In summary, the Odessa Texas Purchase Money Deed of Trust is an essential legal document that outlines the terms and conditions of a loan used to purchase real estate in Odessa, Texas. Understanding the various types of deeds of trust can help buyers make informed decisions based on their specific financial circumstances and goals.

Odessa Texas Purchase Money Deed of Trust

Description

How to fill out Odessa Texas Purchase Money Deed Of Trust?

We continually aim to minimize or avert legal harm when navigating intricate legal or financial issues.

To achieve this, we seek attorney services that are typically quite costly.

Nevertheless, not every legal issue is exceptionally complicated. Many of them can be managed independently.

US Legal Forms is an online repository of current DIY legal forms that encompass everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button adjacent to it. If you misplace the document, you can always re-download it in the My documents section.

- Our platform empowers you to handle your issues without the need for a lawyer.

- We provide access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

- Utilize US Legal Forms whenever you require the Odessa Texas Purchase Money Deed of Trust or any other document simply and securely.

Form popularity

FAQ

Tennessee requires trustees who hold legal title to secured real property on behalf of a lender to be one of the following: a Tennessee resident; a Tennessee corporation or non-Tennessee corporation whose principal place of business is Tennessee; or. an individual whose principal place of employment is in Tennessee.

Texas is a title theory state, where a lender holds the title to a borrower's property in a Deed of Trust.

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

A deed of trust is drafted by a solicitor, normally during the conveyancing process when buying, however you can draft a deed of trust after you purchase. You can only have a deed of trust to protect your money in a property if you hold it as tenants in common.

Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

The lender and the borrower together designate who will act as the trustee; both parties must agree with the decision before finalizing the deed of trust. Lenders may use a trustee with whom they are acquainted, so long they are not affiliated. The trustee must also agree to the designation.