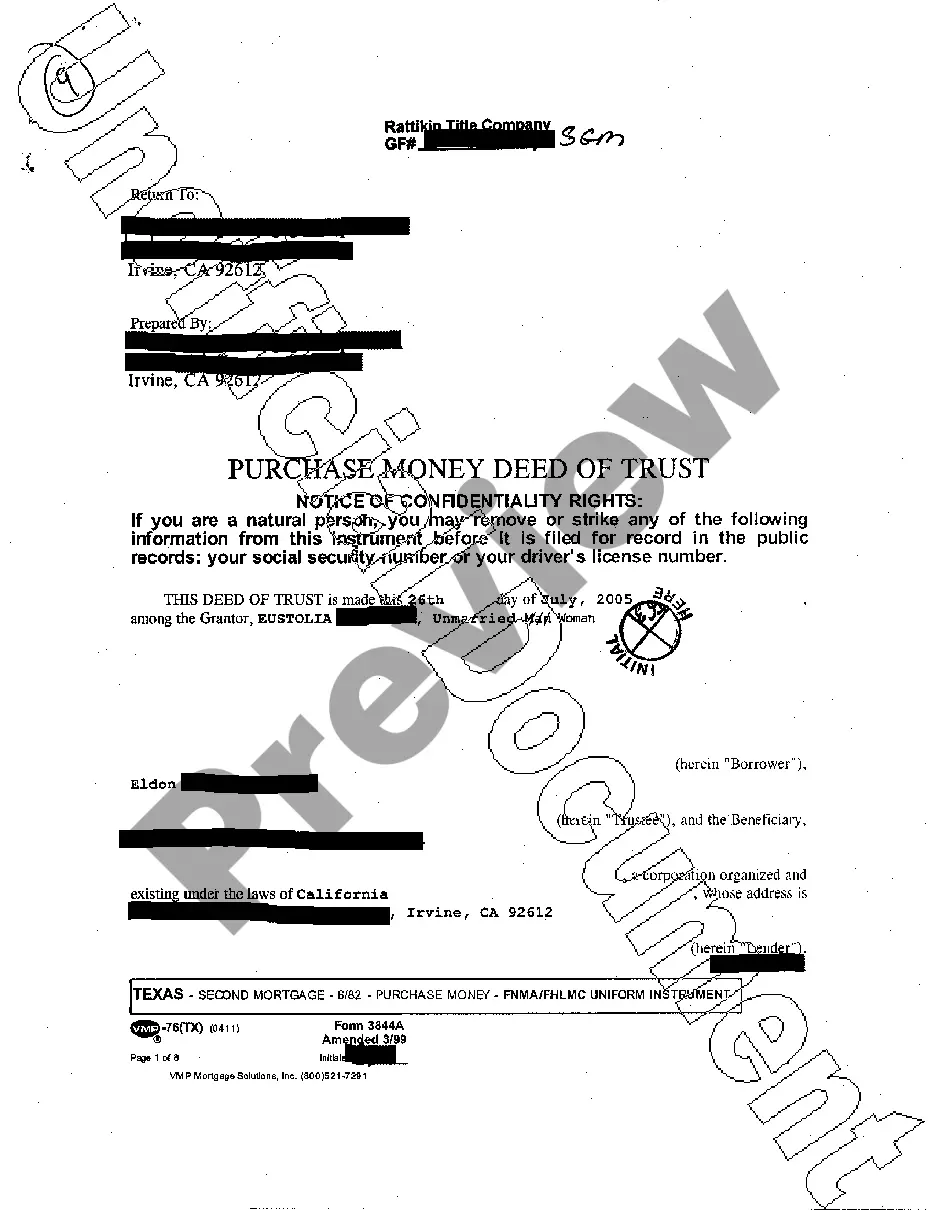

Sugar Land Texas Purchase Money Deed of Trust is a legal document used in real estate transactions to secure a loan for the purchase of a property in Sugar Land, Texas. This type of deed of trust is specifically created to protect the interests of the lender or mortgagee by granting them a lien on the property being purchased. Keywords: Sugar Land Texas Purchase Money Deed of Trust, real estate transactions, loan, property, lender, mortgagee, lien. There are two main types of Sugar Land Texas Purchase Money Deed of Trust: 1. Traditional Purchase Money Deed of Trust: This type of deed of trust is commonly used in Sugar Land, Texas, and involves a lender providing funds to the buyer for the purchase of a property. The buyer then executes a promissory note, promising to repay the loan along with mortgage interest. As security for the loan, a deed of trust is created, allowing the lender to place a lien on the property. If the borrower fails to repay the loan as agreed, the lender has the right to foreclose on the property and recover their investment. 2. Wraparound Purchase Money Deed of Trust: This type of deed of trust is used when the buyer purchases a property using a combination of their own funds, a subordinate loan, and the seller's existing mortgage. The wraparound deed of trust consolidates the seller's existing mortgage and the supplemental loan into a single, larger loan. The buyer then makes a single monthly payment to the seller, who in turn continues paying the original lender. This type of deed of trust allows the buyer to finance a property without needing to obtain a traditional mortgage. In summary, a Sugar Land Texas Purchase Money Deed of Trust is a crucial legal document used in real estate transactions to secure a loan for purchasing a property in Sugar Land, Texas. Both the traditional and wraparound types of deed of trust offer different financial options for buyers, providing flexibility and security in property purchases.

Sugar Land Texas Purchase Money Deed of Trust

Description

How to fill out Sugar Land Texas Purchase Money Deed Of Trust?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone with no legal education to create this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform provides a massive library with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you want the Sugar Land Texas Purchase Money Deed of Trust or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Sugar Land Texas Purchase Money Deed of Trust in minutes using our trusted platform. If you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

However, in case you are unfamiliar with our platform, make sure to follow these steps prior to obtaining the Sugar Land Texas Purchase Money Deed of Trust:

- Ensure the template you have chosen is good for your area because the rules of one state or county do not work for another state or county.

- Preview the document and read a brief description (if available) of scenarios the document can be used for.

- In case the form you picked doesn’t meet your requirements, you can start again and search for the suitable document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Sugar Land Texas Purchase Money Deed of Trust once the payment is through.

You’re all set! Now you can proceed to print the document or complete it online. Should you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.