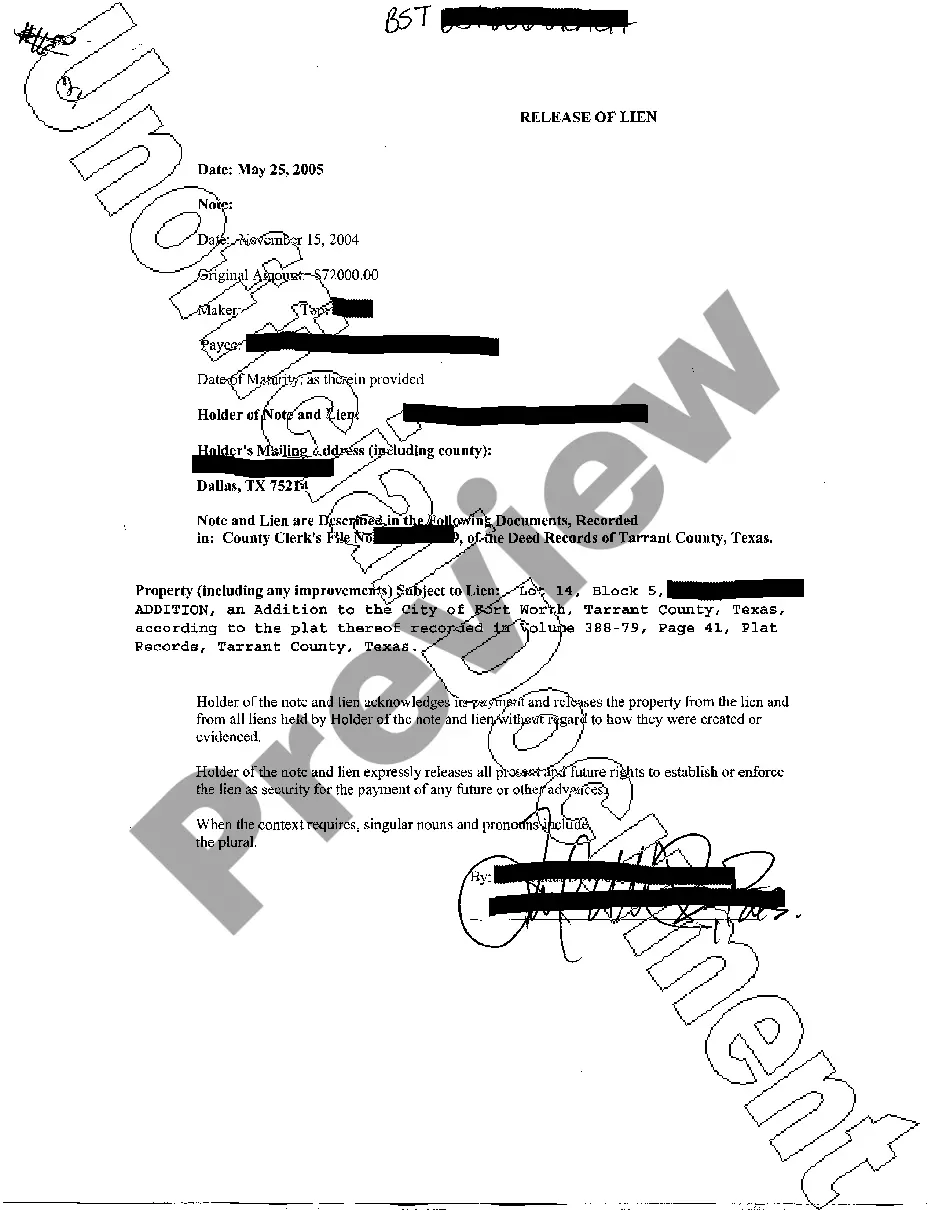

Arlington, Texas Release of Lien: A Comprehensive Guide In Arlington, Texas, a release of lien is an essential legal document that serves as proof of the full satisfaction of a debt or claim related to a property. This document releases the previously established lien, thereby ensuring that the property owner has clear title and is free from any encumbrances. Whether you are a property owner, contractor, or lender, understanding the release of lien process in Arlington, Texas, is crucial to protect your rights and interests. Types of Arlington, Texas Release of Lien: 1. Mechanics Lien Release: This type of release is commonly used in the construction industry. When contractors, subcontractors, or suppliers provide labor, materials, or services for a construction project, they may file a mechanics lien to secure payment. Once the debt is satisfied, a mechanics lien release is required to remove the lien from the property. 2. Property Tax Lien Release: Property owners who fail to pay their property taxes may face a tax lien on their property. Once the delinquent taxes are paid in full, the owner receives a release of lien, certifying that the property tax debt is resolved. This release ensures that the property remains free from any tax-related claims. 3. Mortgage Lien Release: If a property owner successfully pays off their mortgage loan, the lender provides a mortgage lien release. This document serves as evidence that the property is no longer pledged as collateral for the loan and is free from any mortgage-related obligations. 4. Judgment Lien Release: In situations where a property owner has a court-ordered judgment against them for unpaid debts, a judgment lien may be placed on their property. Once the debt is satisfied, the party who filed the judgment lien must release it through a judgment lien release, ensuring that the property is no longer encumbered. Process of Obtaining a Release of Lien in Arlington, Texas: 1. Identify the type of lien: Determine the specific type of lien affecting the property and its underlying cause, such as unpaid project expenses, delinquent taxes, or a court judgment. 2. Satisfy the debt: Pay off the debt or resolve the underlying issue that led to the lien. This may involve settling outstanding bills, clearing tax arbitrages, or meeting court-ordered payment obligations. 3. Draft a Release of Lien: Prepare a legally binding release of lien document that includes essential details such as the property owner's name, lien holder's name, details of the debt or claim, and a statement acknowledging the debt satisfaction. 4. Notarize the document: Schedule an appointment with a notary public to notarize the release of lien. The notary will verify the identity of the signatories and witness the document signing. 5. File and record: Submitted the notarized release of lien to the appropriate government office or authority responsible for recording property documents. This filing ensures that the release is officially recorded in the public records, providing evidence of the lien's release. Note: It is crucial to follow the specific procedures outlined by Arlington, Texas laws and regulations for each type of release of lien. Consulting with an attorney specializing in real estate or property law can provide valuable guidance throughout the release of lien process. Conclusion: A release of lien in Arlington, Texas is a critical document that clears the title of a property from any encumbrances or debts. Whether it be mechanics liens, property tax liens, mortgage liens, or judgment liens, understanding the various types of releases available is essential for property owners and stakeholders involved in real estate transactions. By following the proper procedures and obtaining a valid release of lien, property owners can rest assured that their property is free from any claims or legal disputes.

Arlington Texas Release of Lien

Description

How to fill out Arlington Texas Release Of Lien?

Utilize the US Legal Forms and gain instant access to any document you desire.

Our user-friendly site with numerous document templates streamlines the process of locating and obtaining almost any document sample you need.

You can download, fill out, and validate the Arlington Texas Release of Lien within minutes instead of spending hours online searching for an appropriate template.

Using our collection is a fantastic approach to enhance the security of your document submissions.

If you haven’t set up an account yet, follow the instructions below.

Locate the form you need. Ensure that it is the form you were looking for: check its title and description, and utilize the Preview feature if available. Alternatively, use the Search box to find the required one.

- Our experienced legal experts regularly review all forms to ensure that the templates are applicable to a specific state and adhere to current laws and regulations.

- How can you obtain the Arlington Texas Release of Lien.

- If you have a subscription, simply Log Into your account.

- The Download option will be available for all the samples you access.

- Additionally, you can retrieve any previously saved documents from the My documents section.

Form popularity

FAQ

8 Ways To Find The Owner Of A Property Check Your Local Assessor's Office.Check With The County Clerk.Go To Your Local Library.Ask A Real Estate Agent.Talk To A Title Company.Use The Internet.Talk To A Lawyer.Knock On Their Door Or Leave A Note.

The County Clerk's office maintains Official Public Records beginning in 1836. The records include deeds, land patent records, mortgages, judgments and tax liens.

If the project is located in Tarrant county, then yes, you will want to record your lien with the Tarrant County Clerk's office.

In order to conduct a property title search on your own without paying a lawyer or a title company, you should head to your county clerk's office. In Texas, each county clerk's office is responsible for keeping detailed property records ? these records are public, and therefore available for you to view.

Texas property records are available at the tax assessor's office or the county recorder's office in the county where the property is located.

You can search, view, and purchase copies of your document using our online public access site at .