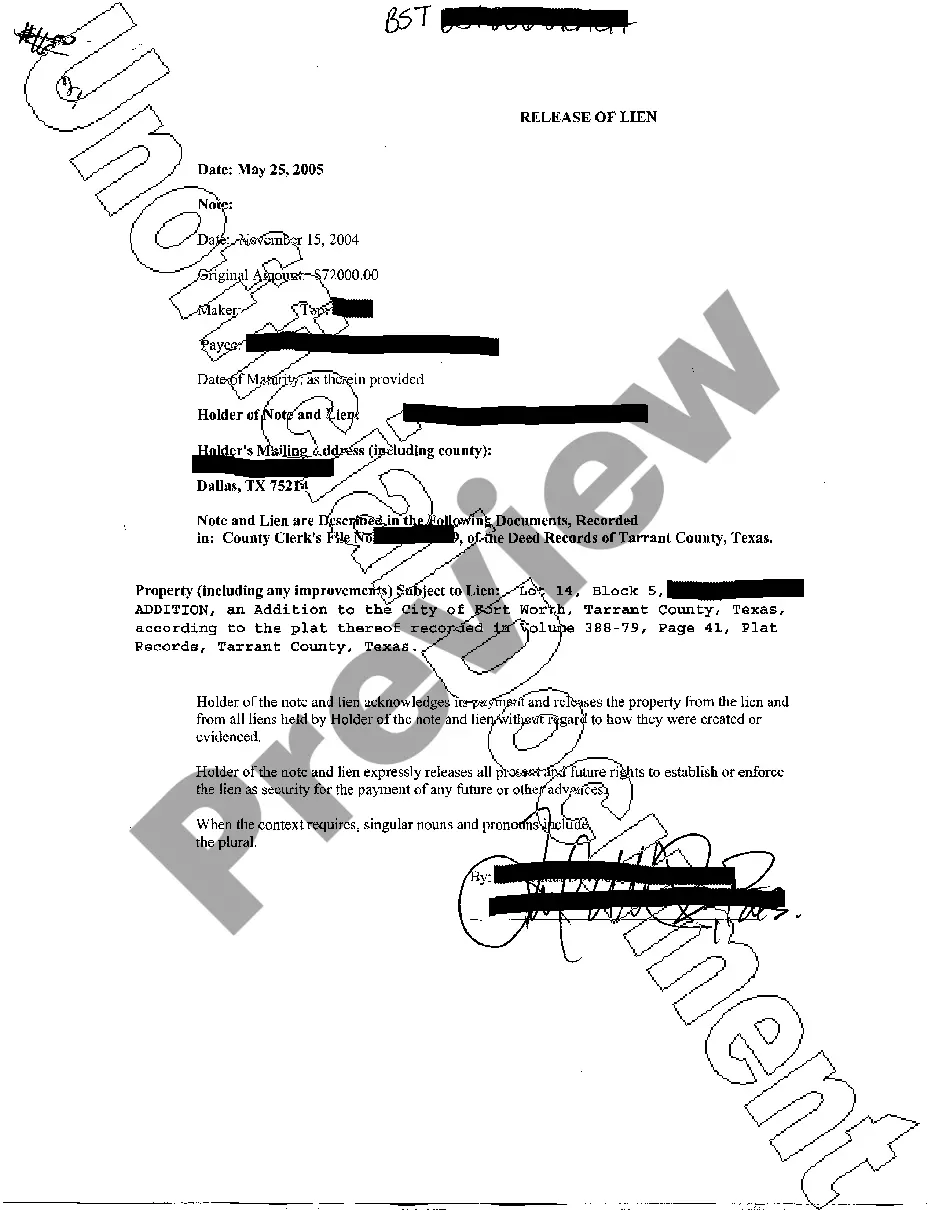

Dallas Texas Release of Lien: A Detailed Description and Types In Dallas, Texas, a release of lien refers to a legal document that releases a property from the claim of a creditor or contractor, thereby ensuring clear ownership and title for the property owner. This document serves as proof that the property owner has satisfied the debt or obligation associated with the lien, enabling them to sell, transfer, or refinance their property without any encumbrances. A Dallas Texas Release of Lien is typically issued by the lien holder (creditor or contractor) upon receiving full payment or satisfaction of the debt owed. This document is crucial for property owners as it protects their interests and establishes a clean ownership status. There are various types of Dallas Texas Release of Lien, which provide clarity on the specific circumstances under which a lien is released. Here are some key types of releases commonly associated with liens in Dallas: 1. Conditional Release of Lien: This type of release is issued when a partial payment has been made to the lien holder, but the full debt has not yet been cleared. It grants temporary relief by partially releasing the lien, allowing the property owner to proceed with specific activities, such as property improvements or conducting sales, while still remaining liable for the remaining debt. 2. Unconditional Release of Lien: An unconditional release of lien is granted when the lien holder has received full payment for the debt or obligation associated with the lien. This release is considered permanent, eliminating any further claims on the property. It offers complete peace of mind to the property owner, assuring them that they have fulfilled their obligations and can freely utilize, transfer, or finance their property. 3. Release of Lien Upon Progress Payment: This type of release is commonly used in construction projects that involve multiple payments based on the progress made. It allows the property owner to release a portion of the lien upon payment for specific phases or milestones in the project. It signifies the completion and payment of a specific portion, while ensuring ongoing protection for the remainder of the debt. 4. Release of Lien Bond: In certain cases, a property owner may choose to obtain a release of lien bond instead of directly satisfying the debt. This bond provides an alternative to cash payment and acts as a financial guarantee that ensures the lien holder will be compensated if the debt is not cleared. It allows the property owner to proceed with transactions while addressing the payment obligation separately. A Dallas Texas Release of Lien is an essential legal document that protects the interests of both property owners and lien holders. It establishes clear ownership and title for the property owner while providing assurance to the lien holder that their debt will be satisfied. Understanding the different types of releases associated with liens helps property owners navigate these situations effectively, ensuring a smoother property transfer or financing process.

Dallas Texas Release of Lien

Description

How to fill out Dallas Texas Release Of Lien?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney solutions that, usually, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Dallas Texas Release of Lien or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Dallas Texas Release of Lien complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Dallas Texas Release of Lien is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!