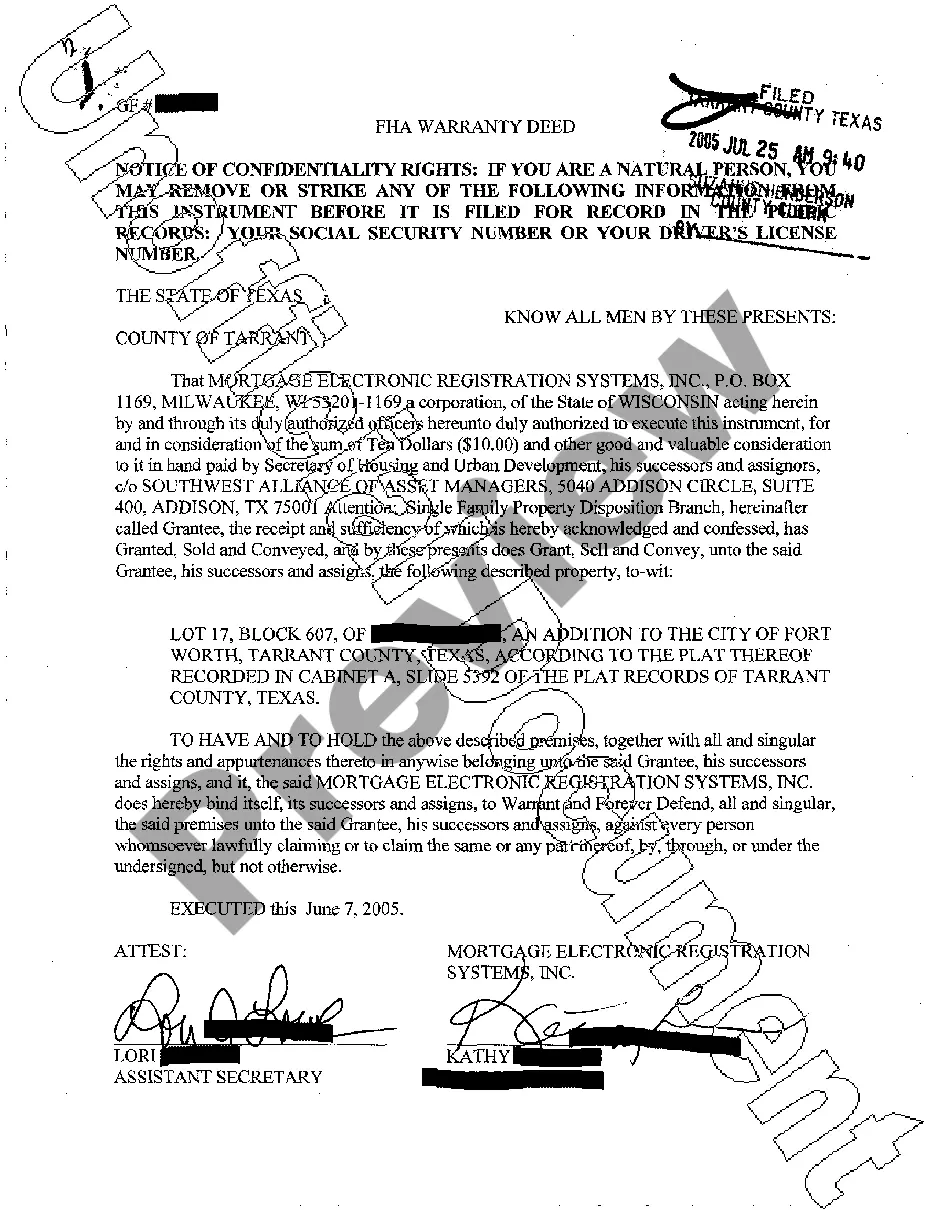

Edinburg Texas FHA Warranty Deed: Understanding the Basics and Variations In Edinburg, Texas, an FHA Warranty Deed is a legal document that provides assurance to a property buyer regarding the ownership and condition of the property. This type of deed is commonly used in real estate transactions involving a property financed through the Federal Housing Administration (FHA). The FHA Warranty Deed is designed to protect the interests of both the buyer and the lender. It guarantees that the property is free from any existing liens or encumbrances, and that the seller has the legal authority to transfer ownership. This gives the buyer peace of mind, as they can be confident that they are acquiring a property with clear ownership rights. Different Types of Edinburg Texas FHA Warranty Deeds: 1. General Warranty Deed: This is the most common type of warranty deed used in Edinburg, Texas. It guarantees the property title against any defects or claims that may have arisen at any point in the property's history. 2. Special Warranty Deed: This type of warranty deed offers a lesser level of protection compared to the general warranty deed. It only guarantees against defects and claims that may have occurred during the seller's ownership of the property. 3. Quitclaim Deed: While not technically an FHA Warranty Deed, the quitclaim deed is worth mentioning as it is occasionally used in Edinburg, Texas real estate transactions. Unlike warranty deeds, the quitclaim deed does not guarantee the condition or ownership of the property. It simply transfers whatever interest the seller may have in the property to the buyer. It's important to note that an FHA Warranty Deed is often required when obtaining financing through the FHA loan program. The FHA requires a clear and marketable title to ensure the property serves as adequate collateral for the loan. When acquiring a property in Edinburg, Texas with FHA financing, it is essential to engage the services of a qualified real estate attorney or title company. These professionals will ensure that the proper type of warranty deed is used and that all necessary legal requirements are met. By doing so, both the buyer and the lender can have confidence in the transaction and the security of the property.

Edinburg Texas FHA Warranty Deed

Description

How to fill out Edinburg Texas FHA Warranty Deed?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Edinburg Texas FHA Warranty Deed gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Edinburg Texas FHA Warranty Deed takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Edinburg Texas FHA Warranty Deed. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!