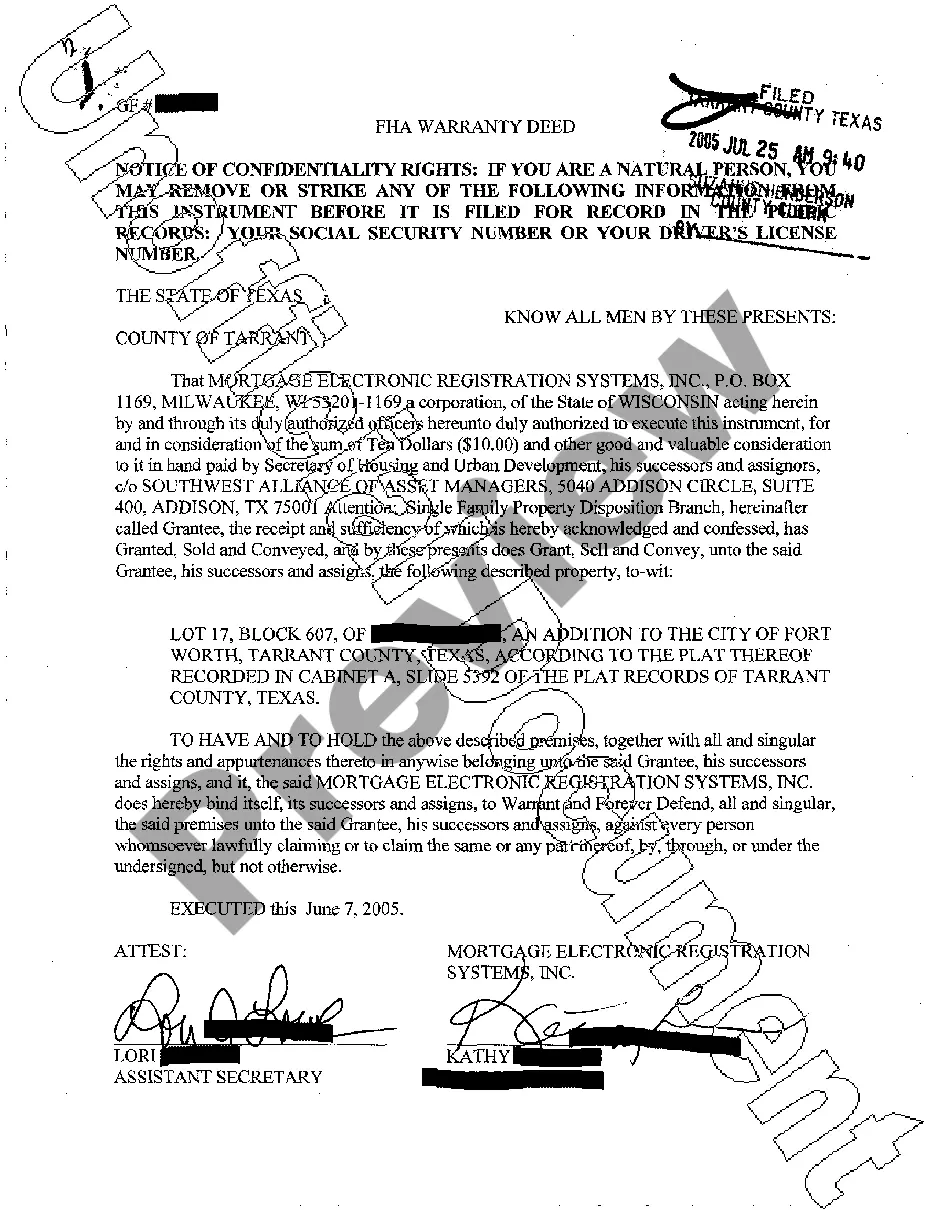

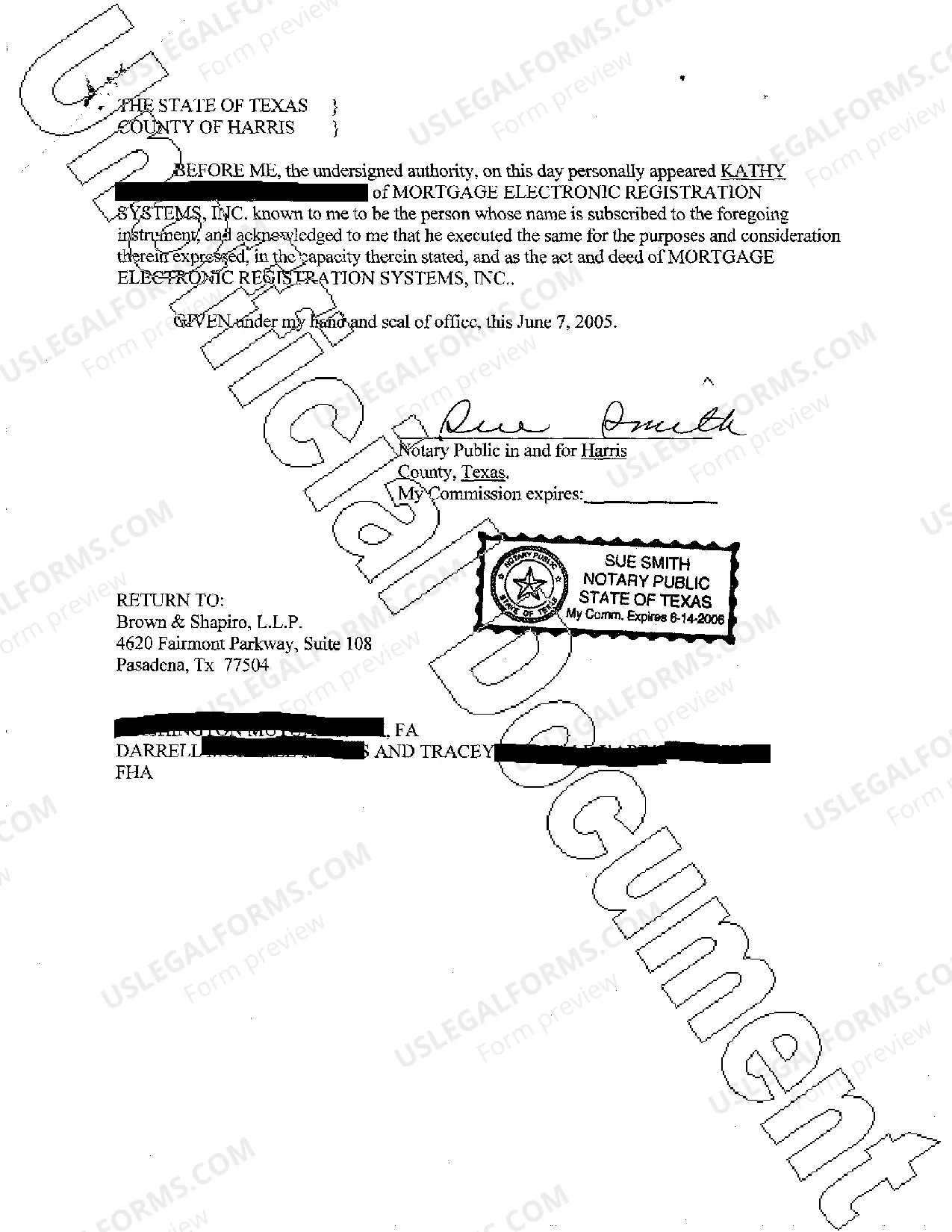

A Grand Prairie Texas FHA Warranty Deed is a legal document used in real estate transactions to transfer ownership of a property from one party to another. It provides a guarantee from the seller (granter) to the buyer (grantee) that the property is free from any liens, encumbrances, or claims, except those previously stated in the deed. This warranty deed is specifically designed to meet the requirements of the Federal Housing Administration (FHA), which plays a crucial role in ensuring access to affordable housing for residents in the United States. The FHA requires certain guidelines and standards to be met during the property transaction, and a Grand Prairie Texas FHA Warranty Deed helps fulfill these requirements. There are a few different types of FHA warranty deeds that may be used in Grand Prairie, Texas, depending on the specific circumstances of the real estate transaction: 1. General Warranty Deed: This is the most common type of warranty deed used in real estate transactions. It provides the highest level of protection for the buyer, as it guarantees the granter's ownership and protects against any claims against the property, whether they arose before or during the granter's ownership. 2. Special Warranty Deed: This type of warranty deed offers a more limited guarantee compared to a general warranty deed. It only protects the grantee against any claims that may have arisen during the granter's ownership and does not extend to claims that existed before the granter acquired the property. 3. Quitclaim Deed: While not technically an FHA warranty deed, a quitclaim deed is sometimes used in certain situations. It is commonly used when the granter may not have full knowledge or control over the property's ownership history. A quitclaim deed transfers whatever interest the granter has in the property but does not provide any guarantees or warranties about the property's title. When using a Grand Prairie Texas FHA Warranty Deed, it is crucial to comply with all FHA guidelines and local regulations to ensure a smooth and lawful transfer of property ownership. It is highly advisable to consult with a real estate attorney or a qualified professional familiar with FHA regulations to ensure all requirements are met accordingly.

Grand Prairie Texas FHA Warranty Deed

Description

How to fill out Grand Prairie Texas FHA Warranty Deed?

Make use of the US Legal Forms and have immediate access to any form template you want. Our helpful platform with a huge number of document templates makes it easy to find and obtain almost any document sample you want. You are able to save, complete, and sign the Grand Prairie Texas FHA Warranty Deed in just a couple of minutes instead of browsing the web for several hours seeking the right template.

Using our collection is an excellent strategy to increase the safety of your form submissions. Our experienced attorneys regularly review all the records to make certain that the templates are relevant for a particular region and compliant with new laws and polices.

How do you obtain the Grand Prairie Texas FHA Warranty Deed? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. Furthermore, you can find all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the tips listed below:

- Find the form you need. Make certain that it is the template you were seeking: verify its name and description, and utilize the Preview option when it is available. Otherwise, use the Search field to find the appropriate one.

- Start the saving procedure. Click Buy Now and select the pricing plan you prefer. Then, sign up for an account and process your order using a credit card or PayPal.

- Download the file. Indicate the format to obtain the Grand Prairie Texas FHA Warranty Deed and change and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and reliable form libraries on the web. Our company is always ready to help you in any legal case, even if it is just downloading the Grand Prairie Texas FHA Warranty Deed.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!