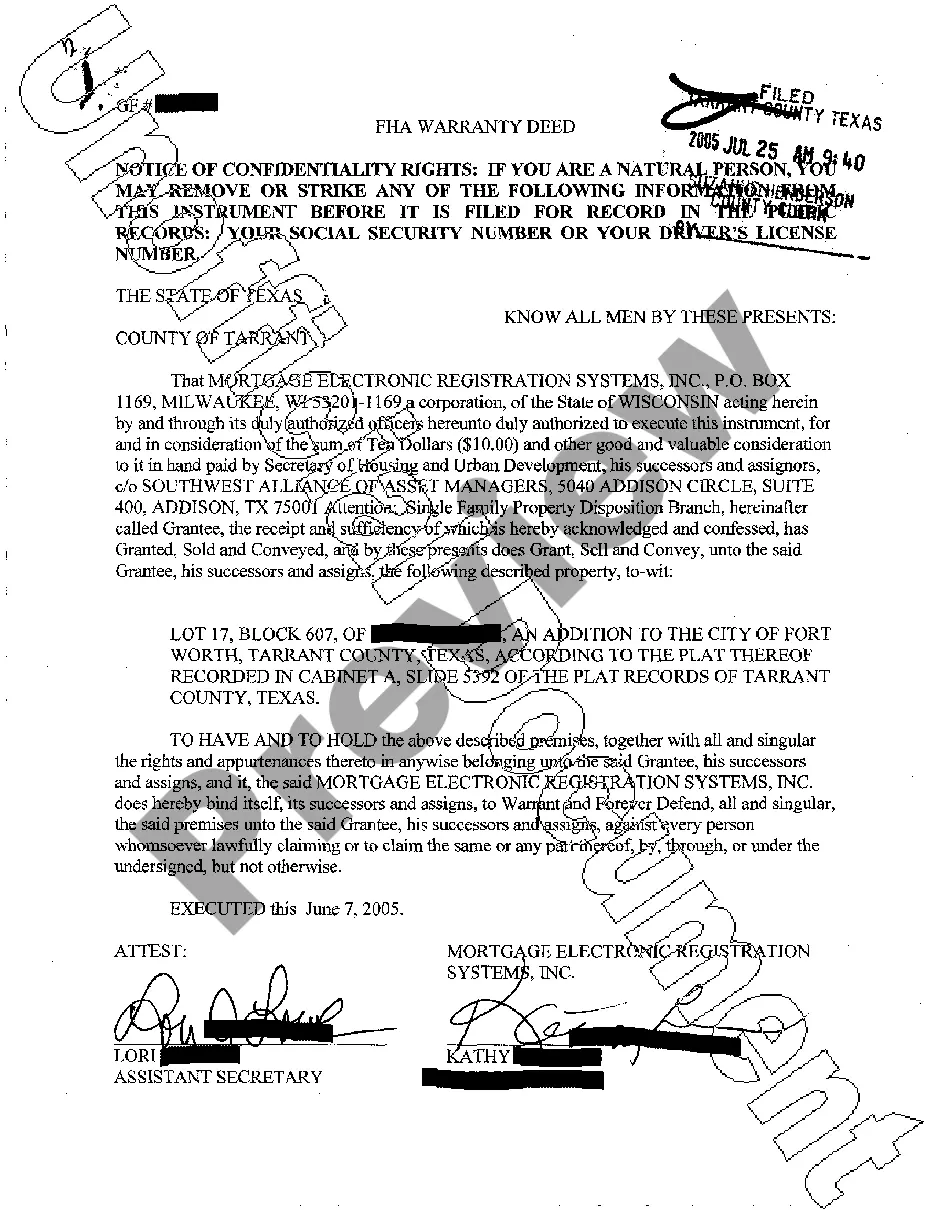

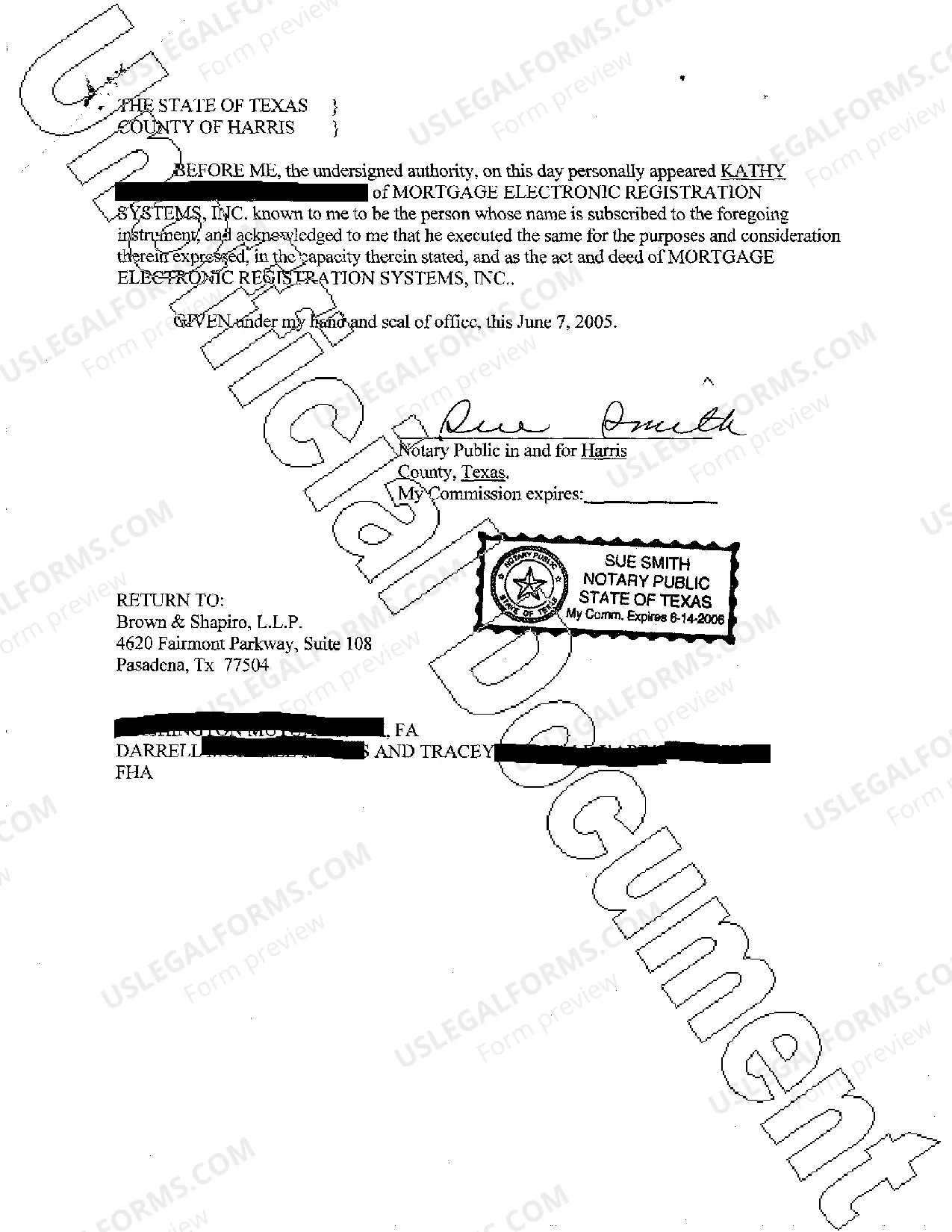

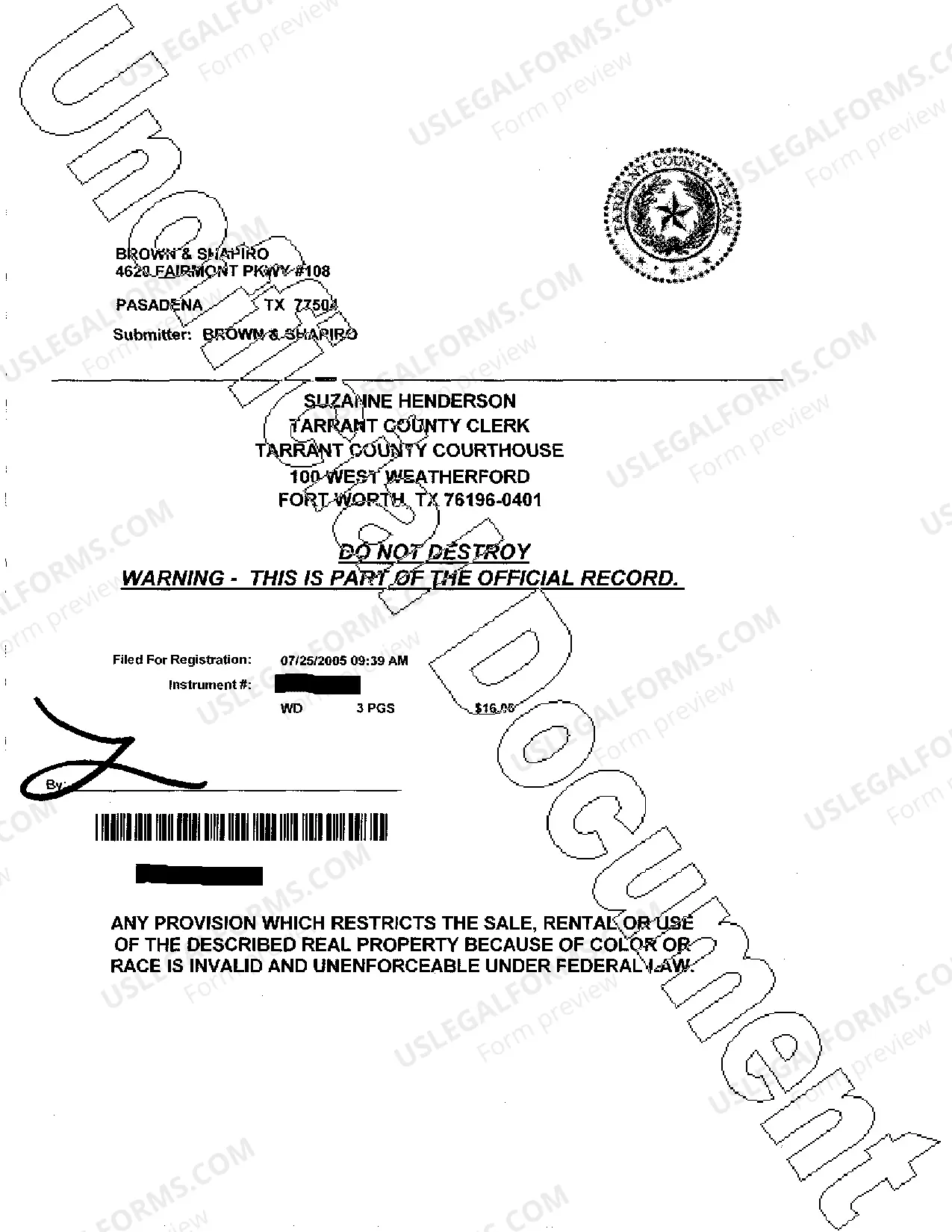

Plano, Texas FHA Warranty Deed — A Comprehensive Guide A Plano, Texas FHA Warranty Deed refers to a legal document used for transferring real estate ownership in Plano, Texas, under the regulations and guidelines set by the Federal Housing Administration (FHA). This type of deed guarantees that the property being transferred is free from any undisclosed claims, defects, or liens that could cloud the title. The FHA warranty deed in Plano, Texas provides an added layer of protection to both buyers and sellers involved in real estate transactions. It assures buyers that the property they are purchasing has a clear and marketable title, meaning that there are no legal issues or outstanding debts tied to the property that could affect their ownership rights. The Plano, Texas FHA warranty deed includes specific keywords like "FHA," "warranty deed," and "Plano, Texas" to ensure the document adheres to the local jurisdiction's regulations and the FHA guidelines. Types of Plano, Texas FHA Warranty Deeds: 1. General Warranty Deed: This type of deed offers the highest level of protection for buyers as it guarantees the property's title against any claims, even those arising from previous owners. 2. Special Warranty Deed: Unlike the general warranty deed, a special warranty deed only guarantees the title against claims or defects that occurred during the seller's ownership. It does not cover any issues that may have existed prior to the seller's ownership. 3. Quitclaim Deed: Although not specifically an FHA warranty deed, it is worth mentioning as another type of deed commonly used in Plano, Texas. A quitclaim deed transfers the ownership rights from the seller to the buyer without providing any warranties or guarantees regarding the property's title. It simply transfers the ownership interest the seller has at the time of the transaction. It is essential to understand that the FHA warranty deed is typically used in Plano, Texas when real estate transactions involve FHA financing. The FHA, a government agency, offers mortgage insurance on loans made by FHA-approved lenders, providing additional protection to lenders in case of borrower default. In conclusion, a Plano, Texas FHA warranty deed ensures a clear and marketable title for the buyer, protecting their investment in real estate transactions. It provides peace of mind to both parties involved and is designed to comply with FHA guidelines and local regulations. Understanding the different types of Plano, Texas FHA warranty deeds can help buyers and sellers choose the appropriate deed based on their specific circumstances and level of protection desired.

Plano Texas FHA Warranty Deed

Description

How to fill out Plano Texas FHA Warranty Deed?

Are you looking for a trustworthy and inexpensive legal forms provider to buy the Plano Texas FHA Warranty Deed? US Legal Forms is your go-to option.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Plano Texas FHA Warranty Deed conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the form is intended for.

- Restart the search in case the form isn’t suitable for your specific scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Plano Texas FHA Warranty Deed in any available format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal paperwork online once and for all.