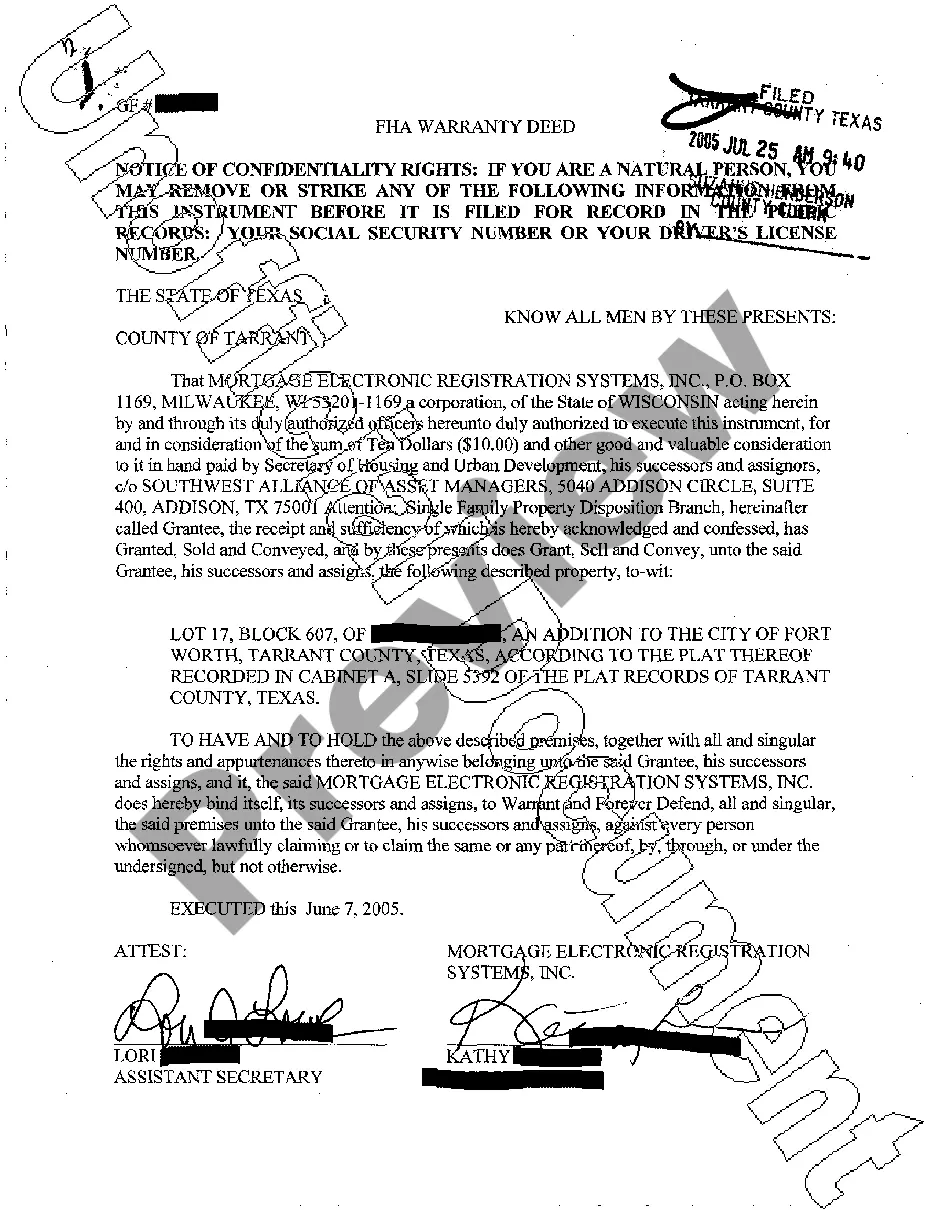

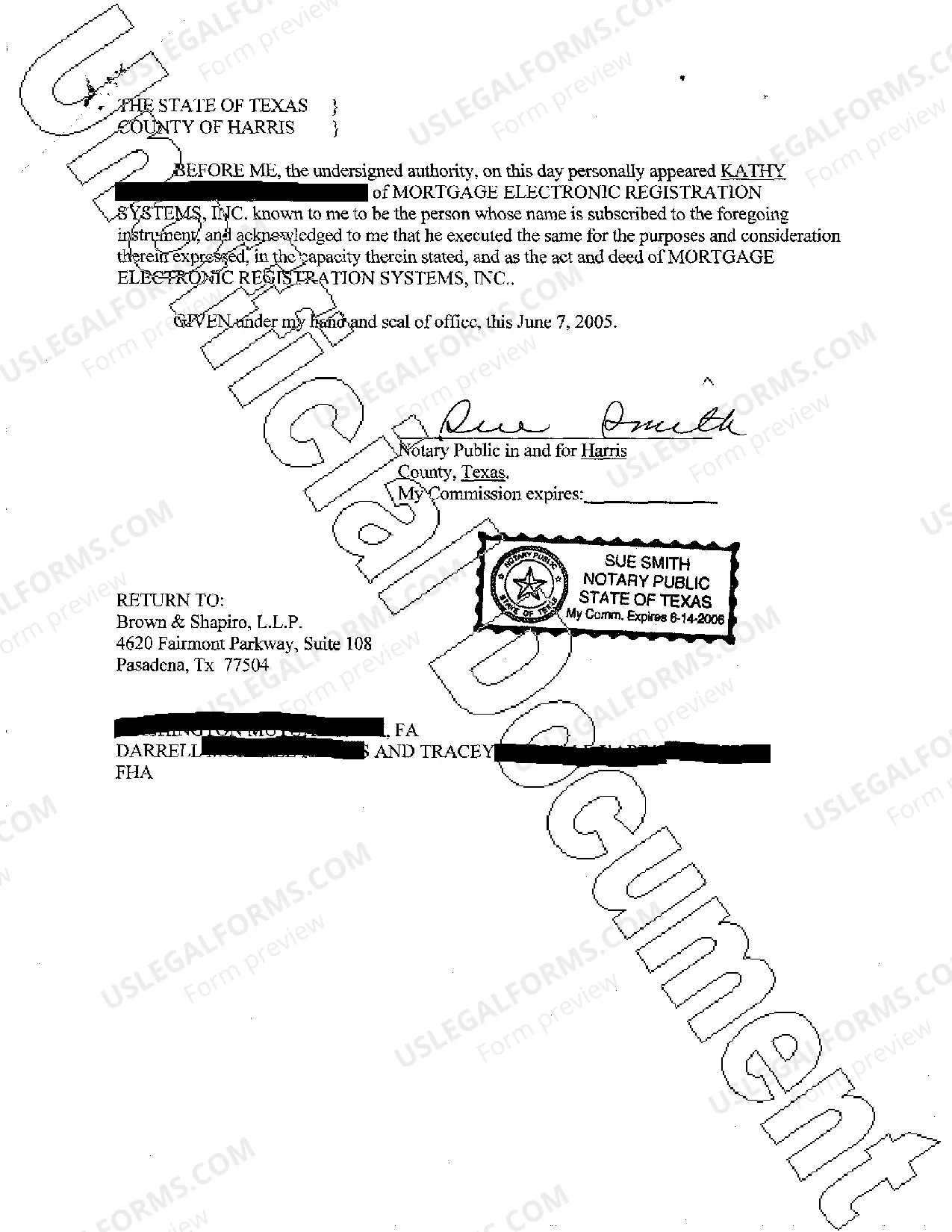

A Sugar Land Texas FHA Warranty Deed is a legal document used in real estate transactions that provides a guarantee that the property being sold is free from any title defects or claims. This type of deed is commonly used in FHA (Federal Housing Administration) loans, which are loans provided by FHA-approved lenders and insured by the government. The Sugar Land Texas FHA Warranty Deed ensures that the property title is clear and marketable, giving the buyer peace of mind that they will not face any legal issues regarding ownership. The seller, also known as the granter, warrants that they have the legal right to sell the property and that there are no undisclosed liens, encumbrances, or other title defects. There are various types of Sugar Land Texas FHA Warranty Deeds, including: 1. General Warranty Deed: This type of deed offers the most extensive protection to the buyer, as it guarantees the title against any and all claims, even those that arose before the granter owned the property. 2. Special Warranty Deed: With a special warranty deed, the granter only warrants that they have not created any defects or claims on the title during their ownership of the property. It offers a limited guarantee compared to a general warranty deed. 3. Quitclaim Deed: While not commonly used with FHA loans, a quitclaim deed can still be used. It transfers the granter's interest in the property, but does not provide any warranties or guarantees regarding the title. When obtaining an FHA loan, it's important for both buyers and sellers in Sugar Land, Texas, to understand the implications and requirements associated with the FHA Warranty Deed. It is recommended to consult with a real estate attorney or a qualified title company to ensure all legal aspects are properly addressed and the proper documents are executed during the transaction. Whether buying or selling a property in Sugar Land, Texas, utilizing an FHA Warranty Deed can provide added protection and assurance, allowing for smooth and secure real estate transactions.

Sugar Land Texas FHA Warranty Deed

Description

How to fill out Sugar Land Texas FHA Warranty Deed?

Are you looking for a trustworthy and affordable legal forms provider to get the Sugar Land Texas FHA Warranty Deed? US Legal Forms is your go-to solution.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of separate state and area.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Sugar Land Texas FHA Warranty Deed conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is good for.

- Start the search over if the form isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Sugar Land Texas FHA Warranty Deed in any provided file format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting hours researching legal papers online for good.