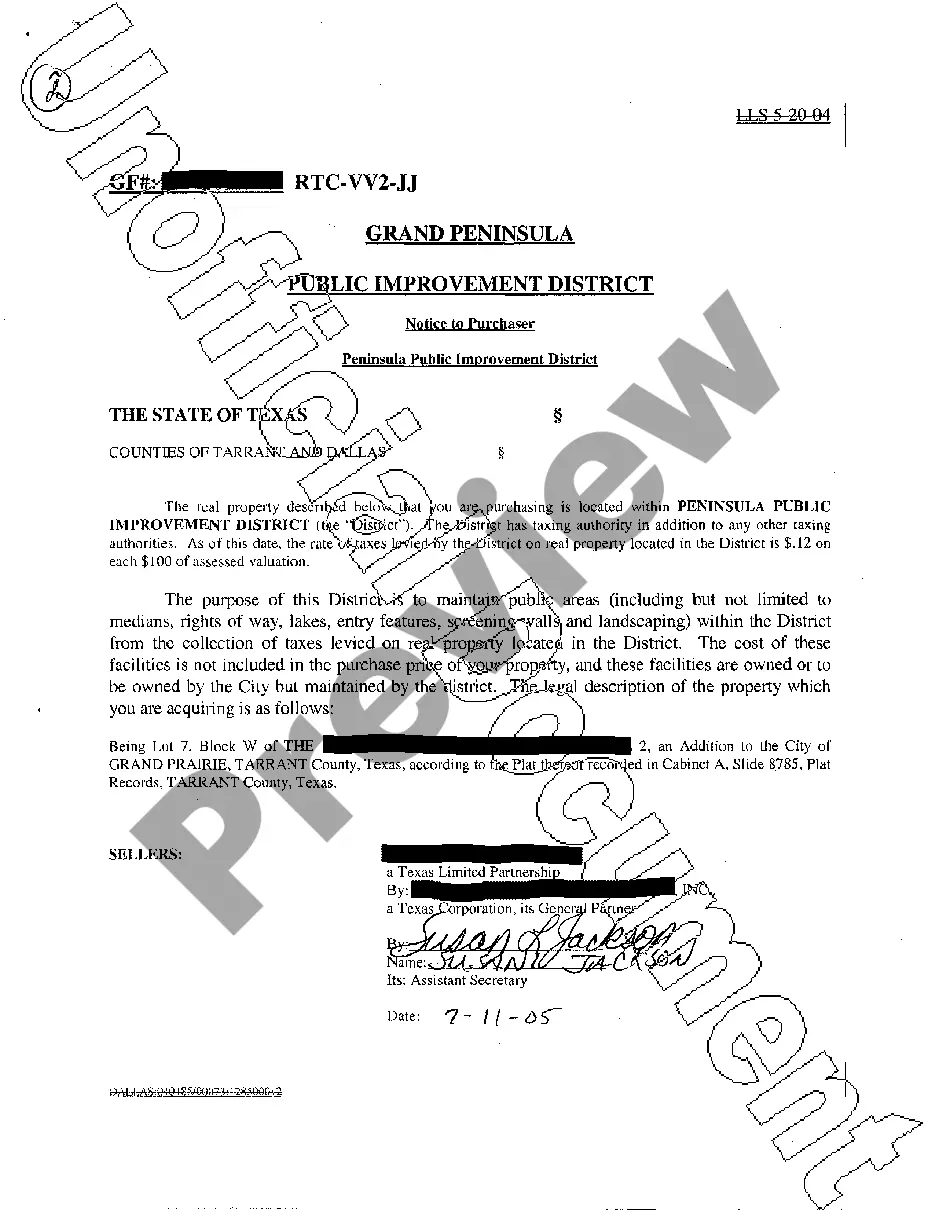

Fort Worth Texas Public Improvement District Notice to Purchaser

Description

How to fill out Texas Public Improvement District Notice To Purchaser?

Take advantage of the US Legal Forms and gain instant access to any form sample you require.

Our convenient platform featuring thousands of documents streamlines the process of locating and obtaining nearly any document sample you need.

You can save, complete, and validate the Fort Worth Texas Public Improvement District Notice to Purchaser in just a few minutes instead of spending hours online searching for a suitable template.

Utilizing our library is an excellent method to enhance the security of your document submissions.

If you have not created a profile yet, follow the instructions below.

Open the page with the template you need. Ensure that it is the template you were aiming to find: verify its title and description, and use the Preview feature when it is accessible. Otherwise, use the Search field to find the suitable one.

- Our expert attorneys routinely review all documents to ensure that the forms are applicable to a specific state and adhere to current laws and regulations.

- How do you obtain the Fort Worth Texas Public Improvement District Notice to Purchaser.

- If you already possess a profile, simply Log In to your account.

- The Download option will be available on all the documents you review.

- In addition, you can access all previously saved files via the My documents menu.

Form popularity

FAQ

A Public Improvement District is a special district created by a City or County under the authority of Chapter 372 of the Texas Local Code. The statute allows for a city or county to levy a special assessment against properties within the District to pay for improvements to the properties within the District.

The first place to check is with the seller. However, since some PIDs may no longer charge assessments, the seller might not be aware the property is in a PID. The next place to look is the county tax records. PIDs, like MUDs, are listed as entities on a tax bill.

While MUDs typically focus on water services, a PID tax would pay for: Enhanced landscape. Additional open space. Lakes and fountains.

A Public Improvement District is a special district created by a City or County under the authority of Chapter 372 of the Texas Local Code. The statute allows for a city or county to levy a special assessment against properties within the District to pay for improvements to the properties within the District.

A PID is a Public Improvement District. This basically means an entity that has been created by the city or county to levy a special tax for specific improvements to a specific neighborhood. Examples might include roads, moving utilities underground, etc.

Unlike a MUD, a PID is not a political entity. Some developments use a PID instead of a HOA since PID assessments are tax deductible. Unlike tax rates for MUDs, these assessments are fixed once the bonds are sold. PIDs are funded through bonds secured by liens against the property.

Public Improvement Districts (PIDs) are defined geographical areas established to provide specific types of improvements or maintenance, which are financed by assessments against the property owners within the area.

Property identification number(PID) A Property identification number (PID) is a unique identification number issued by tax assessor of the particular jurisdiction (local or state authorities) to the parcels of the property.

A PID is a Public Improvement District. This basically means an entity that has been created by the city or county to levy a special tax for specific improvements to a specific neighborhood. Examples might include roads, moving utilities underground, etc.

While MUDs typically focus on water services, a PID tax would pay for: Enhanced landscape. Additional open space. Lakes and fountains.