A supplemental indenture is a legal document that serves as an amendment or extension to a consolidated mortgage agreement. In the case of College Station, Texas, a supplemental indenture can be a crucial component of a consolidated mortgage, allowing for specific modifications or additions to the original agreement. The College Station, Texas Supplemental Indenture to Consolidated Mortgage is a document that outlines additional terms or conditions regarding a consolidated mortgage in the context of College Station, Texas. This supplemental indenture is typically created to address specific requirements, preferences, or circumstances particular to the region. Keywords: College Station, Texas, supplemental indenture, consolidated mortgage, amendment, extension, legal document, modified terms, additional conditions, requirements, preferences, region-specific. Different types of College Station, Texas Supplemental Indenture to Consolidated Mortgage may include specialized provisions related to property zoning, land use restrictions, local ordinances, or unique regulations specific to College Station, Texas. These supplemental indentures can be designed to address issues such as environmental considerations, historic preservation requirements, or community development initiatives within the city. Examples of specific types of College Station, Texas Supplemental Indenture to Consolidated Mortgage could be: 1. College Station, Texas Supplemental Indenture to Consolidated Mortgage for Planned Unit Developments (Puds): This type of supplemental indenture may focus on outlining the rules and regulations governing planned communities within College Station, Texas, including architectural guidelines, common area maintenance, and homeowner association requirements. 2. College Station, Texas Supplemental Indenture to Consolidated Mortgage for Agricultural Properties: This supplemental indenture could cater to the unique needs and restrictions imposed on agricultural lands in College Station, Texas. It may contain provisions related to farming practices, water usage, or any other agricultural-specific regulations. 3. College Station, Texas Supplemental Indenture to Consolidated Mortgage for Historic Districts: This type of supplemental indenture may be applicable to properties located in designated historic districts of College Station, Texas. It could focus on preserving and maintaining historical features, facade requirements, and renovation restrictions to ensure the preservation of the area's cultural heritage. In conclusion, the College Station, Texas Supplemental Indenture to Consolidated Mortgage is a legal document that amends a consolidated mortgage agreement to address region-specific requirements or circumstances. Different types of supplemental indentures may exist based on specific property types or regulatory considerations within College Station, Texas.

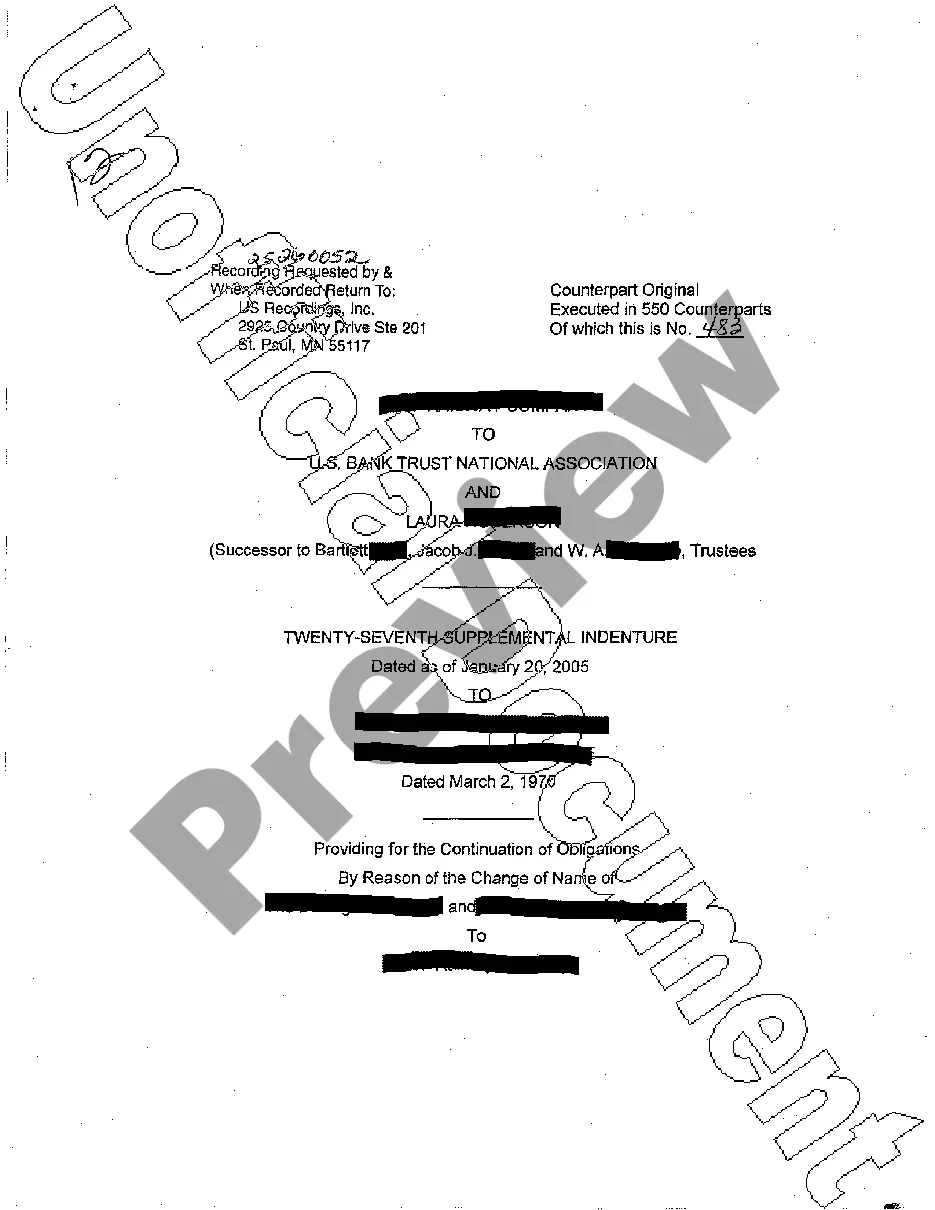

College Station Texas Supplemental Indenture to Consolidated Mortgage

Description

How to fill out College Station Texas Supplemental Indenture To Consolidated Mortgage?

Take advantage of the US Legal Forms and obtain instant access to any form you need. Our helpful website with a huge number of document templates simplifies the way to find and obtain almost any document sample you will need. It is possible to export, complete, and certify the College Station Texas Supplemental Indenture to Consolidated Mortgage in a couple of minutes instead of browsing the web for hours seeking an appropriate template.

Utilizing our collection is a superb way to raise the safety of your record filing. Our professional attorneys on a regular basis check all the documents to ensure that the templates are appropriate for a particular region and compliant with new acts and regulations.

How do you get the College Station Texas Supplemental Indenture to Consolidated Mortgage? If you already have a subscription, just log in to the account. The Download button will appear on all the documents you view. In addition, you can find all the earlier saved documents in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Open the page with the form you require. Make certain that it is the template you were seeking: check its name and description, and make use of the Preview option when it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Select the format to obtain the College Station Texas Supplemental Indenture to Consolidated Mortgage and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and reliable template libraries on the web. We are always ready to help you in virtually any legal process, even if it is just downloading the College Station Texas Supplemental Indenture to Consolidated Mortgage.

Feel free to make the most of our platform and make your document experience as efficient as possible!