Title: Collin Texas Supplemental Indenture to Consolidated Mortgage: Exploring Its Key Aspects and Types Introduction: Collin Texas Supplemental Indenture to Consolidated Mortgage refers to a legal document that amends or adds clauses to an existing mortgage contract between a borrower and a lender in the context of Collin County, Texas. This supplemental agreement plays a crucial role in modifying or enhancing specific terms of the original mortgage agreement, ensuring parties' rights and obligations are accurately reflected. There are several types of Collin Texas Supplemental Indentures to Consolidated Mortgage catering to diverse scenarios. Let's delve deeper into this topic to gain a comprehensive understanding. Key Concepts and Clauses: 1. Collateral Property: The supplementary indenture describes the property that serves as collateral for the mortgage, ensuring its identification and inclusion in the agreement. This protects the lender's interest in case of default. 2. Modification of Terms: This type of supplemental document allows for changes to be made to the original mortgage terms such as interest rates, payment schedules, maturity date extensions, and prepayment options. These modifications align the mortgage with the borrower's evolving needs and financial circumstances. 3. Additional Funds: In certain cases, borrowers may require additional funds or loans related to the initial mortgage. The supplemental indenture outlines the terms and conditions of such additional funding, ensuring proper documentation and protection for both parties. 4. Lien Priority: When a supplemental indenture is executed, it may address the lien priority of the mortgage in relation to other debts secured by the same collateral. This clarification ensures the lender's position in the event of foreclosure or subsequent liens. 5. Collin Texas Specifics: Since Collin Texas Supplemental Indenture relates specifically to properties within Collin County, Texas, the agreement may also incorporate local legal requirements, land-use regulations, and any other pertinent state-specific provisions. Different Types of Collin Texas Supplemental Indentures to Consolidated Mortgage: 1. Rate Adjustment Indenture: This type amends the interest rate and related terms to reflect current market conditions or borrower creditworthiness changes. 2. Extension Indenture: If a borrower requires additional time to satisfy the mortgage's obligations, this supplemental indenture extends the maturity date and adjusts relevant terms to accommodate the extended timeline. 3. Rehabilitation Loan Indenture: When a property needs significant repairs or renovations, this supplemental agreement facilitates the inclusion of rehabilitation loans while outlining repayment terms and any additional collateral requirements. 4. Assumption Indenture: When an existing mortgage is assumed by a new borrower, this type of supplemental indenture establishes the transfer of liability and any modified terms applicable to the assumption. Conclusion: Collin Texas Supplemental Indenture to Consolidated Mortgage is a crucial legal document that allows for modifications, extensions, additional funds, or assumption of mortgages within Collin County, Texas. Its purpose is to ensure that both borrowers and lenders have a clear understanding of the revised terms and obligations. Understanding the different types of supplemental indentures helps individuals navigate the complexities of mortgage agreements while safeguarding their interests.

Collin Texas Supplemental Indenture to Consolidated Mortgage

Description

How to fill out Collin Texas Supplemental Indenture To Consolidated Mortgage?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Collin Texas Supplemental Indenture to Consolidated Mortgage becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Collin Texas Supplemental Indenture to Consolidated Mortgage takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

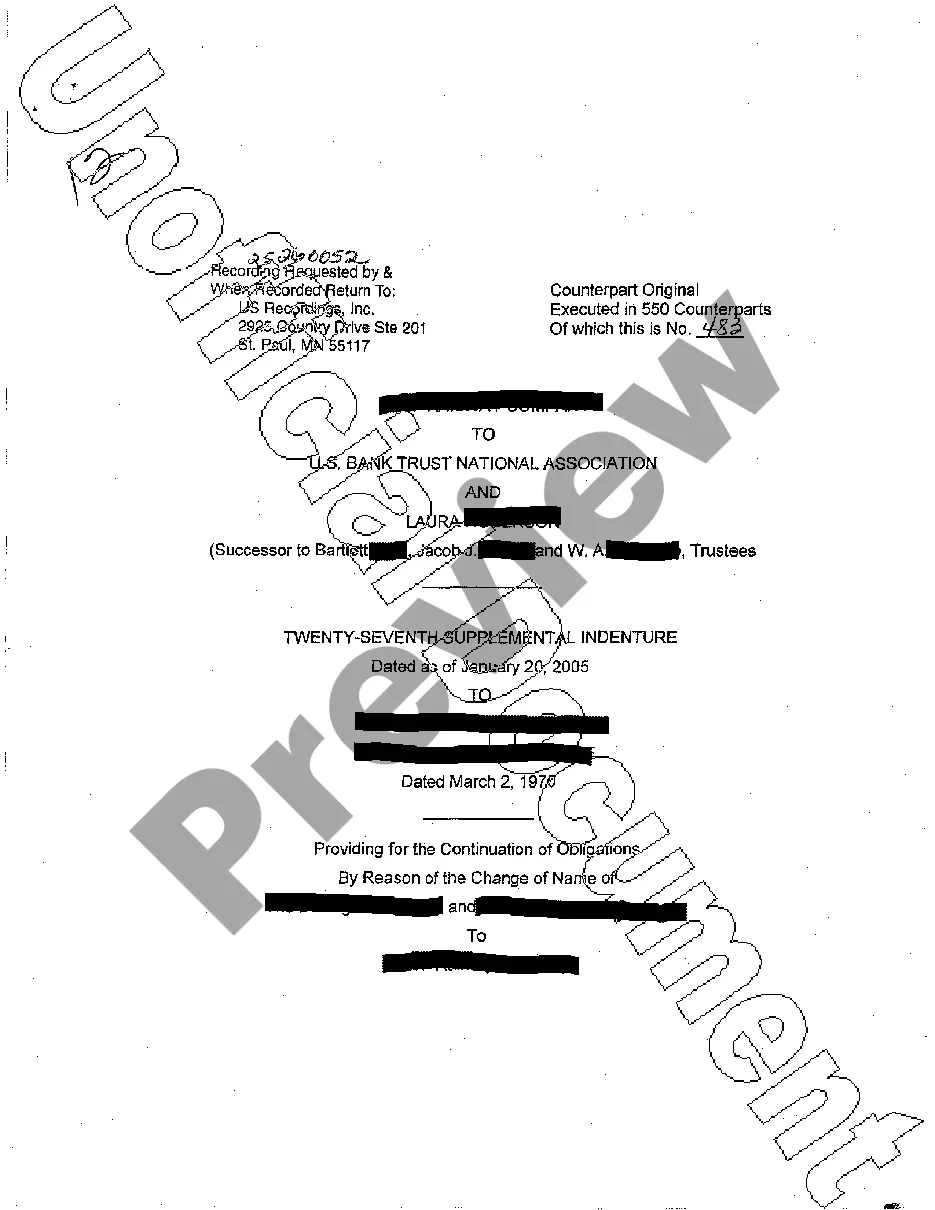

- Look at the Preview mode and form description. Make sure you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Collin Texas Supplemental Indenture to Consolidated Mortgage. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!