The Grand Prairie Texas Supplemental Indenture to Consolidated Mortgage is a legal document that serves as an additional agreement to a primary mortgage in the city of Grand Prairie, Texas. This supplemental indenture modifies or adds specific terms or provisions outlined in the consolidated mortgage agreement. Keywords: Grand Prairie Texas, Supplemental Indenture, Consolidated Mortgage, legal document, agreement, primary mortgage, terms, provisions. Different types of Grand Prairie Texas Supplemental Indenture to Consolidated Mortgage may include: 1. Modification Supplemental Indenture: This type of supplemental indenture is created when the parties involved wish to modify certain terms or provisions of the original consolidated mortgage agreement. It is commonly utilized when adjustments need to be made to interest rates, payment schedules, or loan terms. 2. Addition Supplemental Indenture: An addition supplemental indenture is prepared when parties involved in the consolidated mortgage agreement decide to add new terms or provisions. This could include incorporating additional collateral to the mortgage, adding or removing co-borrowers, or adjusting the rights and obligations of the parties involved. 3. Extension Supplemental Indenture: This type of supplemental indenture is executed when the duration of the original consolidated mortgage agreement needs to be extended. It outlines the new period agreed upon for repayment, reflecting any modified terms or conditions. 4. Release Supplemental Indenture: A release supplemental indenture is created to release a portion of the property covered under the original consolidated mortgage agreement. This may occur when a borrower has successfully paid off a specific portion of the mortgage or if there is a need to release collateral that is no longer necessary to secure the loan. 5. Foreclosure Supplemental Indenture: In situations where foreclosure proceedings are initiated, a foreclosure supplemental indenture may be created. It establishes the terms and conditions of the foreclosure process, including the rights and obligations of both the borrower and the lender. Overall, the Grand Prairie Texas Supplemental Indenture to Consolidated Mortgage is a legally binding document that allows for modifications, additions, extensions, releases, or foreclosure proceedings to be carried out on the original consolidated mortgage agreement in Grand Prairie, Texas.

Grand Prairie Texas Supplemental Indenture to Consolidated Mortgage

State:

Texas

City:

Grand Prairie

Control #:

TX-JW-0197

Format:

PDF

Instant download

This form is available by subscription

Description

Supplemental Indenture to Consolidated Mortgage

The Grand Prairie Texas Supplemental Indenture to Consolidated Mortgage is a legal document that serves as an additional agreement to a primary mortgage in the city of Grand Prairie, Texas. This supplemental indenture modifies or adds specific terms or provisions outlined in the consolidated mortgage agreement. Keywords: Grand Prairie Texas, Supplemental Indenture, Consolidated Mortgage, legal document, agreement, primary mortgage, terms, provisions. Different types of Grand Prairie Texas Supplemental Indenture to Consolidated Mortgage may include: 1. Modification Supplemental Indenture: This type of supplemental indenture is created when the parties involved wish to modify certain terms or provisions of the original consolidated mortgage agreement. It is commonly utilized when adjustments need to be made to interest rates, payment schedules, or loan terms. 2. Addition Supplemental Indenture: An addition supplemental indenture is prepared when parties involved in the consolidated mortgage agreement decide to add new terms or provisions. This could include incorporating additional collateral to the mortgage, adding or removing co-borrowers, or adjusting the rights and obligations of the parties involved. 3. Extension Supplemental Indenture: This type of supplemental indenture is executed when the duration of the original consolidated mortgage agreement needs to be extended. It outlines the new period agreed upon for repayment, reflecting any modified terms or conditions. 4. Release Supplemental Indenture: A release supplemental indenture is created to release a portion of the property covered under the original consolidated mortgage agreement. This may occur when a borrower has successfully paid off a specific portion of the mortgage or if there is a need to release collateral that is no longer necessary to secure the loan. 5. Foreclosure Supplemental Indenture: In situations where foreclosure proceedings are initiated, a foreclosure supplemental indenture may be created. It establishes the terms and conditions of the foreclosure process, including the rights and obligations of both the borrower and the lender. Overall, the Grand Prairie Texas Supplemental Indenture to Consolidated Mortgage is a legally binding document that allows for modifications, additions, extensions, releases, or foreclosure proceedings to be carried out on the original consolidated mortgage agreement in Grand Prairie, Texas.

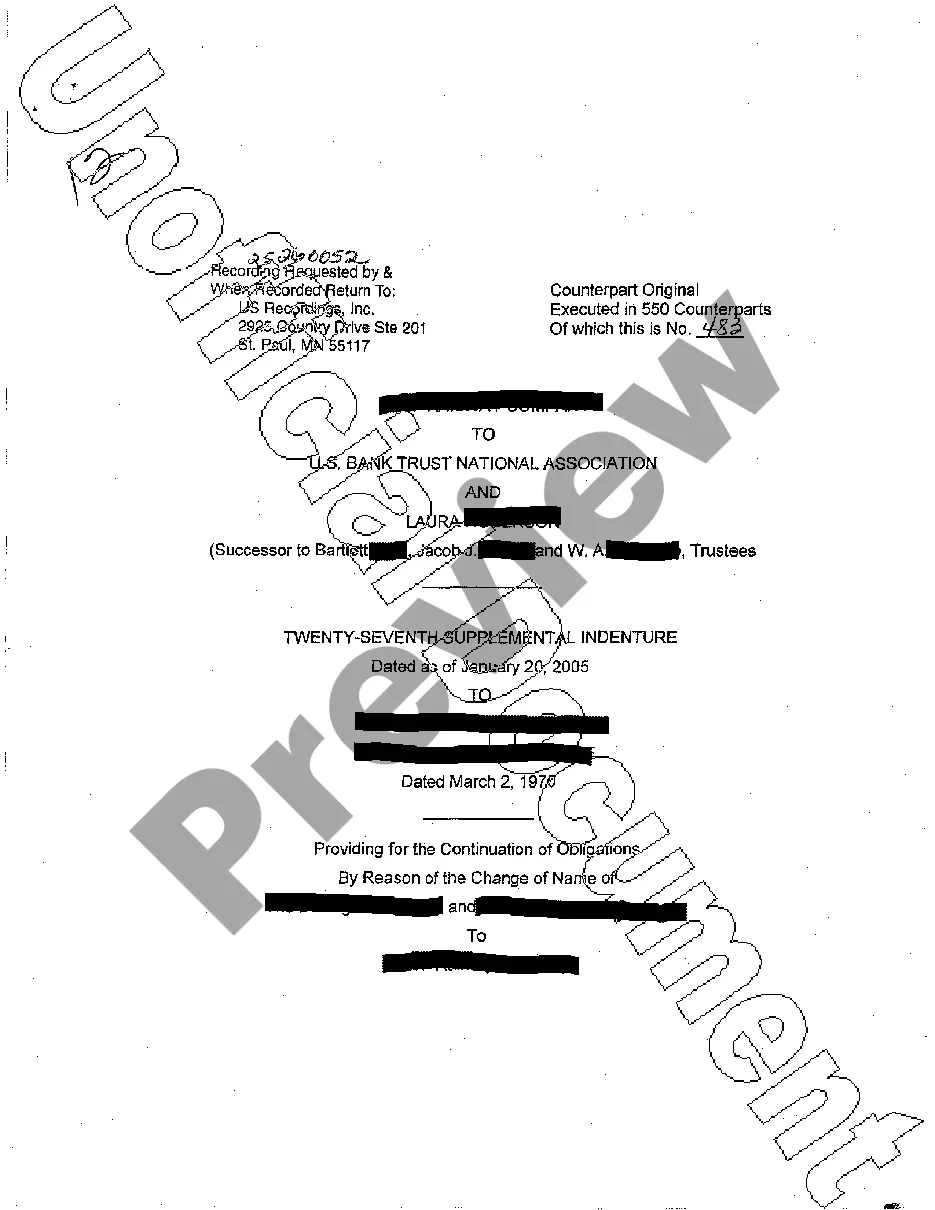

Free preview

How to fill out Grand Prairie Texas Supplemental Indenture To Consolidated Mortgage?

If you’ve already used our service before, log in to your account and save the Grand Prairie Texas Supplemental Indenture to Consolidated Mortgage on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Grand Prairie Texas Supplemental Indenture to Consolidated Mortgage. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!