Irving, Texas Supplemental Indenture to Consolidated Mortgage acts as a legal agreement that modifies or adds specific provisions to an existing consolidated mortgage in the city of Irving, Texas. This document holds significant importance in the real estate arena, ensuring the rights and obligations of both lenders and borrowers are clearly defined and protected. The Irving, Texas Supplemental Indenture to Consolidated Mortgage outlines additional terms, conditions, and covenants that are agreed upon by all parties involved. It may serve different purposes based on the specific context and requirements of the situation. Some notable types of Irving, Texas Supplemental Indenture to Consolidated Mortgage include: 1. Modification Indenture: This type of supplemental indenture is utilized when certain changes need to be made to the original terms of the consolidated mortgage. These changes may involve adjustments to payment schedules, interest rates, loan durations, or any other relevant clause. 2. Extension Indenture: An extension indenture is effective when the parties involved wish to extend the maturity date of the consolidated mortgage. This allows borrowers more time to repay the loan, providing flexibility and potentially better aligning with their financial capabilities. 3. Subordination Indenture: In some cases, a supplemental indenture is used to establish the subordination of liens or other debts associated with the consolidated mortgage. This means that the claim of one lender may be ranked lower in priority compared to another lender, ensuring proper order during foreclosure or other legal actions. 4. Collateral Addition Indenture: This type of supplemental indenture comes into play when additional collateral is added to the original consolidated mortgage. It outlines the terms and conditions related to the new property or asset being used to secure the loan, providing clarity and protection for all parties involved. 5. Release Indenture: A release indenture may be executed when a portion of the collateral securing the consolidated mortgage is being released. It ensures that the borrower and lender formally acknowledge the removal of assets from the mortgage, potentially guiding the remaining terms of the loan. Overall, the Irving, Texas Supplemental Indenture to Consolidated Mortgage provides a means to modify, extend, or clarify the terms of an existing consolidated mortgage. It safeguards the interests of all parties involved and plays a crucial role in the real estate and lending industry in Irving, Texas.

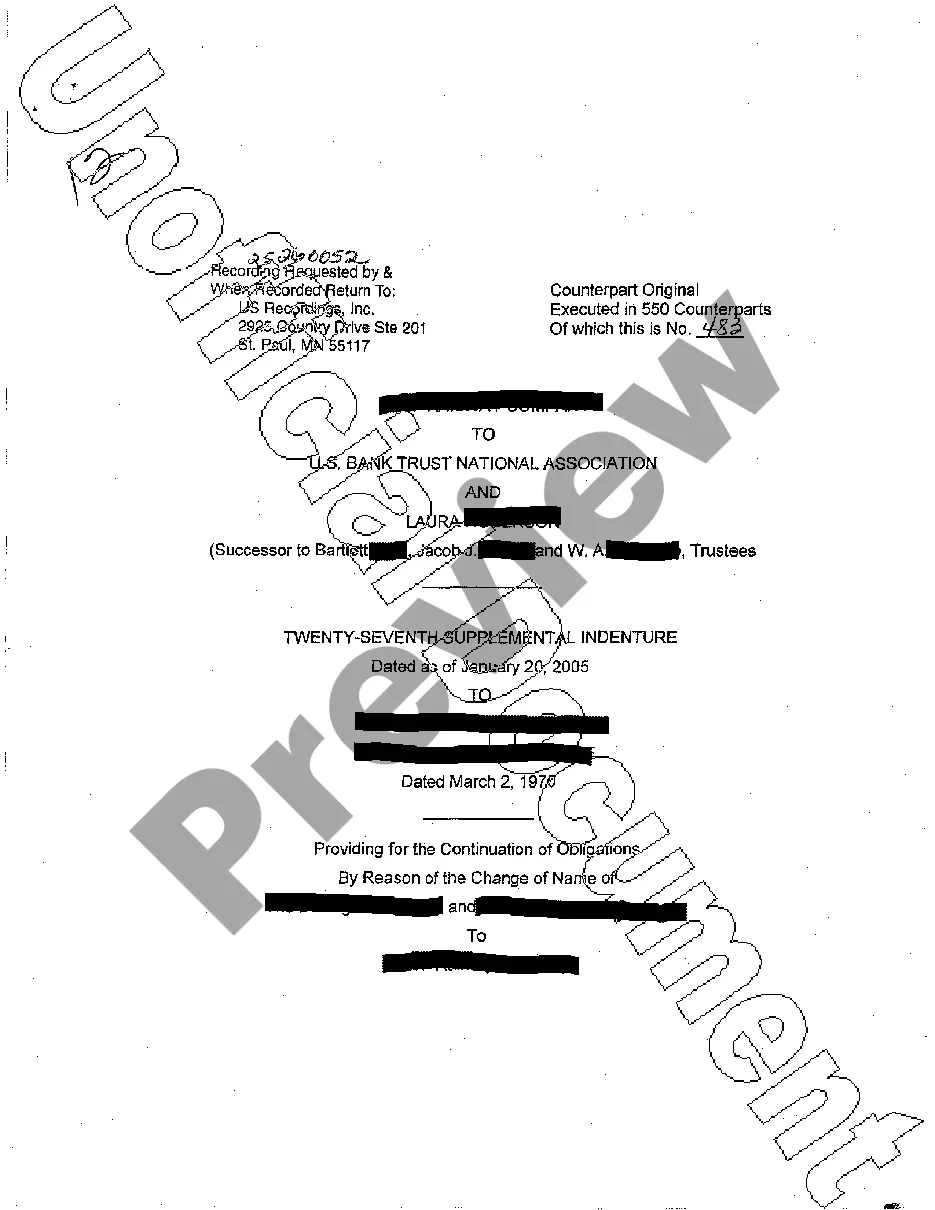

Irving Texas Supplemental Indenture to Consolidated Mortgage

Description

How to fill out Irving Texas Supplemental Indenture To Consolidated Mortgage?

If you are searching for a relevant form template, it’s impossible to find a more convenient platform than the US Legal Forms site – probably the most considerable libraries on the internet. With this library, you can find a huge number of templates for business and individual purposes by types and regions, or keywords. With our high-quality search function, getting the most recent Irving Texas Supplemental Indenture to Consolidated Mortgage is as easy as 1-2-3. In addition, the relevance of each and every record is proved by a group of skilled attorneys that on a regular basis check the templates on our platform and revise them according to the newest state and county regulations.

If you already know about our system and have a registered account, all you should do to get the Irving Texas Supplemental Indenture to Consolidated Mortgage is to log in to your user profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have opened the form you need. Check its information and use the Preview function to check its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to find the proper record.

- Confirm your choice. Choose the Buy now option. Following that, choose your preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Get the form. Select the format and download it to your system.

- Make adjustments. Fill out, edit, print, and sign the acquired Irving Texas Supplemental Indenture to Consolidated Mortgage.

Every form you add to your user profile has no expiration date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you want to get an extra copy for editing or creating a hard copy, you can return and save it again at any time.

Take advantage of the US Legal Forms extensive catalogue to get access to the Irving Texas Supplemental Indenture to Consolidated Mortgage you were seeking and a huge number of other professional and state-specific samples on a single website!