Title: McKinney Texas Supplemental Indenture to Consolidated Mortgage: A Comprehensive Overview Keywords: McKinney Texas, Supplemental Indenture, Consolidated Mortgage, Types Introduction: The McKinney Texas Supplemental Indenture to Consolidated Mortgage is a legal document that plays a crucial role in the real estate industry. It serves as an addendum to the consolidated mortgage, providing additional terms, conditions, or modifications to the original mortgage agreement. This detailed description aims to provide a comprehensive understanding of McKinney Texas Supplemental Indenture to Consolidated Mortgage, exploring its purpose, significance, and potential types. Definition and Purpose: A McKinney Texas Supplemental Indenture to Consolidated Mortgage is a legal instrument used to modify certain provisions of an existing consolidated mortgage agreement. It outlines additional obligations, revisions, or restrictions that either supplement or amend the original terms. The purpose of this supplemental indenture is to address specific circumstances that arise after executing the consolidated mortgage, ensuring the agreement remains relevant and adaptable to changing property-related requirements. Significance and Benefits: The inclusion of a supplemental indenture in a consolidated mortgage allows borrowers and lenders to address evolving needs without renegotiating or terminating the entire mortgage agreement. This arrangement brings several advantages, such as: 1. Flexibility: The supplemental indenture allows parties to adjust the terms of the consolidated mortgage to accommodate changes in interest rates, loan terms, payment schedules, or collateral requirements. 2. Accessibility to Capital: Borrowers can leverage the supplemental indenture to secure additional funding or negotiate favorable loan modifications based on changing financial circumstances. 3. Legal Compliance: The supplemental indenture helps ensure compliance with ever-evolving state or federal laws, regulatory frameworks, or zoning regulations that may impact the original mortgage agreement. Types of McKinney Texas Supplemental Indenture to Consolidated Mortgage: Several types of McKinney Texas Supplemental Indenture to Consolidated Mortgage may exist, each addressing unique circumstances or requirements. These types include: 1. Modifications to Interest Rates: The supplemental indenture may be used to adjust the mortgage interest rates, either to account for fluctuations in market rates or to provide favorable terms for specific borrowers. 2. Loan Term Extensions: This type of supplemental indenture allows for an extension of the loan repayment period beyond the initially agreed-upon term, offering borrowers increased flexibility and potential relief during challenging Financial Times. 3. Collateral Amendment: In situations where the collateral value changes significantly or additional assets need to be included as security, a supplemental indenture may be executed to modify the original mortgage agreement. 4. Payment Schedule Revisions: This type of supplemental indenture allows for revisions to the payment schedule, such as adjusting the frequency of payments, extending grace periods, or modifying penalty provisions. Conclusion: Understanding the purpose and types of McKinney Texas Supplemental Indenture to Consolidated Mortgage is essential for both borrowers and lenders involved in the real estate industry. This legal document enables parties to adapt their mortgage agreements, addressing changes in financial circumstances, market conditions, or legal requirements. By utilizing supplemental indentures, stakeholders can ensure their mortgage agreements remain relevant, flexible, and compliant with the dynamic nature of the real estate landscape.

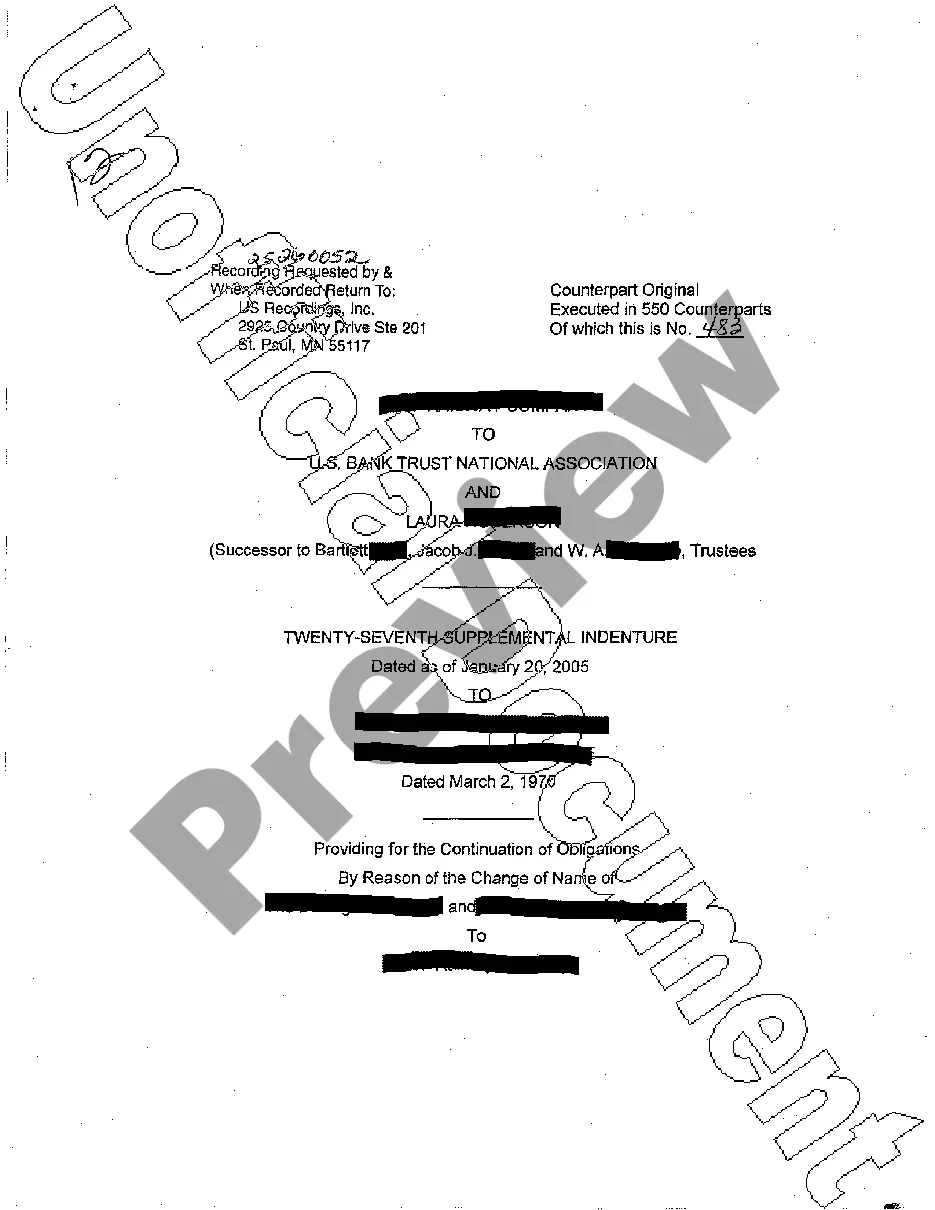

McKinney Texas Supplemental Indenture to Consolidated Mortgage

Description

How to fill out McKinney Texas Supplemental Indenture To Consolidated Mortgage?

Utilize the US Legal Forms and have instant access to any form sample you desire. Our beneficial site with countless document templates simplifies the process of locating and acquiring virtually any document sample you need.

You can download, fill out, and validate the McKinney Texas Supplemental Indenture to Consolidated Mortgage in just a few minutes rather than spending hours searching the internet for an appropriate template.

Employing our catalog is an excellent method to enhance the security of your form submissions. Our knowledgeable legal experts consistently review all the records to ensure that the templates are suitable for a specific state and comply with current laws and regulations.

How can you access the McKinney Texas Supplemental Indenture to Consolidated Mortgage? If you already possess an account, simply sign in to your profile. The Download option will be available for all the documents you examine. Additionally, you can retrieve all previously saved documents from the My documents menu.

US Legal Forms is one of the most extensive and trustworthy form libraries on the internet. We are always prepared to assist you in nearly any legal procedure, even if it is merely downloading the McKinney Texas Supplemental Indenture to Consolidated Mortgage.

Feel free to utilize our form catalog and streamline your document experience as much as possible!

- Access the page with the form you need. Ensure that it is the template you were searching for: check its title and description, and take advantage of the Preview feature if it is provided. Otherwise, utilize the Search box to find the required one.

- Initiate the saving process. Click Buy Now and select the pricing option you prefer. Then, register for an account and pay for your purchase using a credit card or PayPal.

- Download the document. Choose the format to obtain the McKinney Texas Supplemental Indenture to Consolidated Mortgage and modify and complete it, or sign it according to your needs.

Form popularity

FAQ

No, a bond indenture is not the same as a trust indenture, though they share similarities. A bond indenture delineates the specifics of a bond issuance, while a trust indenture creates a fiduciary relationship with a trustee who acts on behalf of the bondholders. Both are crucial in protecting the interests of investors, especially when examining a McKinney Texas Supplemental Indenture to Consolidated Mortgage, as understanding these differences can guide investment strategies.

A bond indenture and a trust indenture serve similar functions, but they differ in certain aspects. A bond indenture focuses on the terms of a specific bond or bond series, while a trust indenture establishes a relationship between the issuer and a trustee who oversees the bondholders' interests. In the case of a McKinney Texas Supplemental Indenture to Consolidated Mortgage, both types of indentures play a role in ensuring investor protection and compliance with existing agreements.

A bond indenture is a contract that specifies the terms of a bond, including the interest rate, maturity date, and repayment schedule. This document ensures that both the issuer and the bondholders understand their obligations. Moreover, it may include various protective provisions for bondholders. If you’re considering a McKinney Texas Supplemental Indenture to Consolidated Mortgage, having a solid grasp of what a bond indenture entails is vital for making informed investment decisions.

A bond indenture is a legal document that outlines the specifics of a bond, while a bond certificate serves as proof of ownership. The indenture includes critical terms such as payment schedules, covenants, and obligations, whereas the bond certificate states the amount invested and the issuer’s promise to repay. When dealing with a McKinney Texas Supplemental Indenture to Consolidated Mortgage, recognizing this difference helps investors comprehend their rights and responsibilities.

The primary purpose of a bond indenture is to establish the terms and conditions associated with a bond issue. It serves as a formal agreement between issuers and bondholders, outlining the rights of the parties involved. Additionally, it can include details on payment schedules, interest rates, and any covenants or promises by the borrower. In the context of a McKinney Texas Supplemental Indenture to Consolidated Mortgage, understanding these terms ensures transparency and security for investors.

An indenture and a trust deed are both legal instruments associated with property loans, but they serve different purposes. An indenture is more focused on outlining the terms of the mortgage itself, while a trust deed serves as a security agreement between the borrower and lender. In the context of the McKinney Texas Supplemental Indenture to Consolidated Mortgage, understanding the nuances between these two can help borrowers make better-informed decisions.

An indenture on a mortgage refers to the binding agreement that governs the mortgage transaction, detailing responsibilities such as payment terms and default conditions. This document is essential for both lenders and borrowers as it lays the foundation of the relationship and protects their rights. The McKinney Texas Supplemental Indenture to Consolidated Mortgage specifically provides further clarity on these terms, making it an important resource for all parties involved.

An indenture supplement is an official addition or modification to an existing indenture, detailing changes or new terms agreed upon by the involved parties. This supplement is particularly useful when circumstances shift and require adjustments to the original mortgage agreement. By utilizing the McKinney Texas Supplemental Indenture to Consolidated Mortgage, stakeholders can ensure modifications are legally sound and clearly documented.

A supplemental indenture is a legal document that modifies or supplements the terms of an existing mortgage agreement. In the context of a McKinney Texas Supplemental Indenture to Consolidated Mortgage, this document plays a crucial role in outlining the rights and responsibilities of both parties involved. It ensures that all modifications are clearly stated, helping to prevent misunderstandings in future dealings. If you need assistance drafting a supplemental indenture or understanding its implications, consider using the US Legal Forms platform, which provides reliable resources and templates.