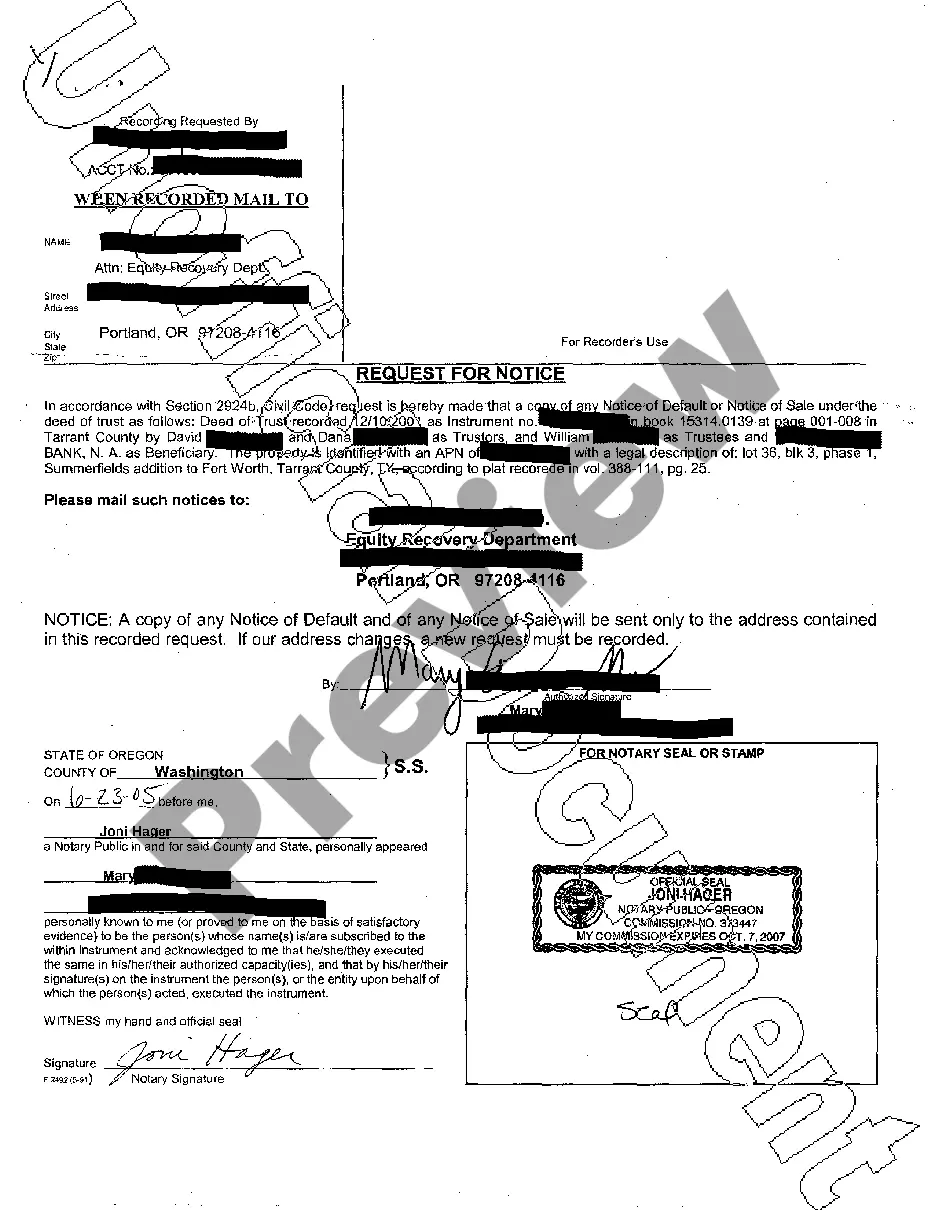

Collin Texas Request for Notice of Default or Notice of Sale is a legal process initiated by lenders or lien holders when a borrower defaults on their mortgage or fails to meet their loan obligations in Collin County, Texas. This process allows the lender to foreclose on the property in order to recover the unpaid loan amount. The Notice of Default is typically the first step in the foreclosure process. It is a formal written notice sent to the borrower, informing them that they have defaulted on their loan and have a certain period of time to remedy the default. The notice outlines the specific details of the default, including the outstanding loan amount, any penalties or fees accrued, and the consequences if the default is not resolved. In Collin County, Texas, there are two main types of Request for Notice of Default or Notice of Sale: 1. Request for Notice of Default: This is a formal request made by a party with an interest in the property, such as a junior lien holder or a second mortgage holder. By filing this request, the party seeks to be notified in case the borrower defaults on their loan. This allows the party to stay informed about the foreclosure proceedings and potentially take action to protect their own interests. 2. Notice of Sale: Once the borrower fails to rectify the default within the given timeframe, the lender can proceed with the foreclosure process. The lender is required to publicly announce and advertise the pending foreclosure sale in Collin County, Texas. The Notice of Sale provides specific details about the scheduled foreclosure auction, including the date, time, and location. It also allows interested parties, including the borrower and other lien holders, to participate in the auction and potentially bid on the property. Both the Request for Notice of Default and the Notice of Sale are crucial steps in the foreclosure process in Collin County, Texas. They ensure that all parties involved are aware of the impending foreclosure and have an opportunity to protect their rights and interests. It is important for borrowers to understand their options and seek legal advice to explore possible alternatives to foreclosure. Likewise, other lien holders should stay vigilant and file a Request for Notice of Default to safeguard their position in case of a borrower's default.

Collin Texas Request for Notice of Default or Notice of Sale

Description

How to fill out Collin Texas Request For Notice Of Default Or Notice Of Sale?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, usually, are extremely costly. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Collin Texas Request for Notice of Default or Notice of Sale or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Collin Texas Request for Notice of Default or Notice of Sale adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Collin Texas Request for Notice of Default or Notice of Sale would work for your case, you can select the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!