Title: Odessa, Texas Request for Notice of Default or Notice of Sale: A Comprehensive Guide Introduction: In Odessa, Texas, real estate transactions can sometimes lead to situations where a property owner may face foreclosure. When a borrower fails to make mortgage payments, the lender can initiate foreclosure proceedings. This article provides a detailed description of Odessa's Request for Notice of Default or Notice of Sale, outlining their significance in the foreclosure process. 1. Notice of Default (NOD) in Odessa, Texas: The Notice of Default is a crucial document that marks the beginning of the foreclosure process. It is served to the borrower by the lender, notifying them about their default status due to missed payments. Mentioned below are key points related to Odessa's Notice of Default: — Requirements: The NOD must contain essential details such as borrower's name, property details, loan amount, missed payments, and a statement outlining deadlines to cure the default. — Timeframe: In Texas, the lender must provide the borrower with at least 20 days to cure the default before proceeding with further actions. — Legal implications: Receiving an NOD indicates the borrower's urgency to resolve the default to prevent foreclosure. 2. Request for Notice of Default: A Request for Notice of Default is a proactive step taken by interested parties, such as lien holders or investors, to stay informed about foreclosure proceedings. By filing this request with the County Clerk's office in Odessa, they will receive a copy of the Notice of Default whenever it is recorded against a specific property. This allows them to monitor the situation and potentially take necessary actions if needed. 3. Notice of Sale (NOS) in Odessa, Texas: Once the borrower fails to cure the default within the specified timeframe mentioned in the NOD, the lender can proceed with initiating the foreclosure sale. They must serve the borrower with a Notice of Sale. Here's what you need to know about Odessa's Notice of Sale: — Content: The NOS should include the borrower's name, property details, sale date, time, and location. — Publication: The NOS must be published at least 21 days before the scheduled sale date in a newspaper of general circulation in the county where the property is located. — Foreclosure auction: On the scheduled sale date, the property is auctioned to the highest bidder, allowing interested parties to bid on the foreclosed property. In conclusion, in Odessa, Texas, the Request for Notice of Default and Notice of Sale play vital roles in the foreclosure process. Property owners experiencing financial difficulties should be aware of these documents to understand the steps necessary to prevent foreclosure. Conversely, interested parties, including lien holders and investors, can file a Request for Notice of Default to stay informed about potential foreclosure auctions in Odessa.

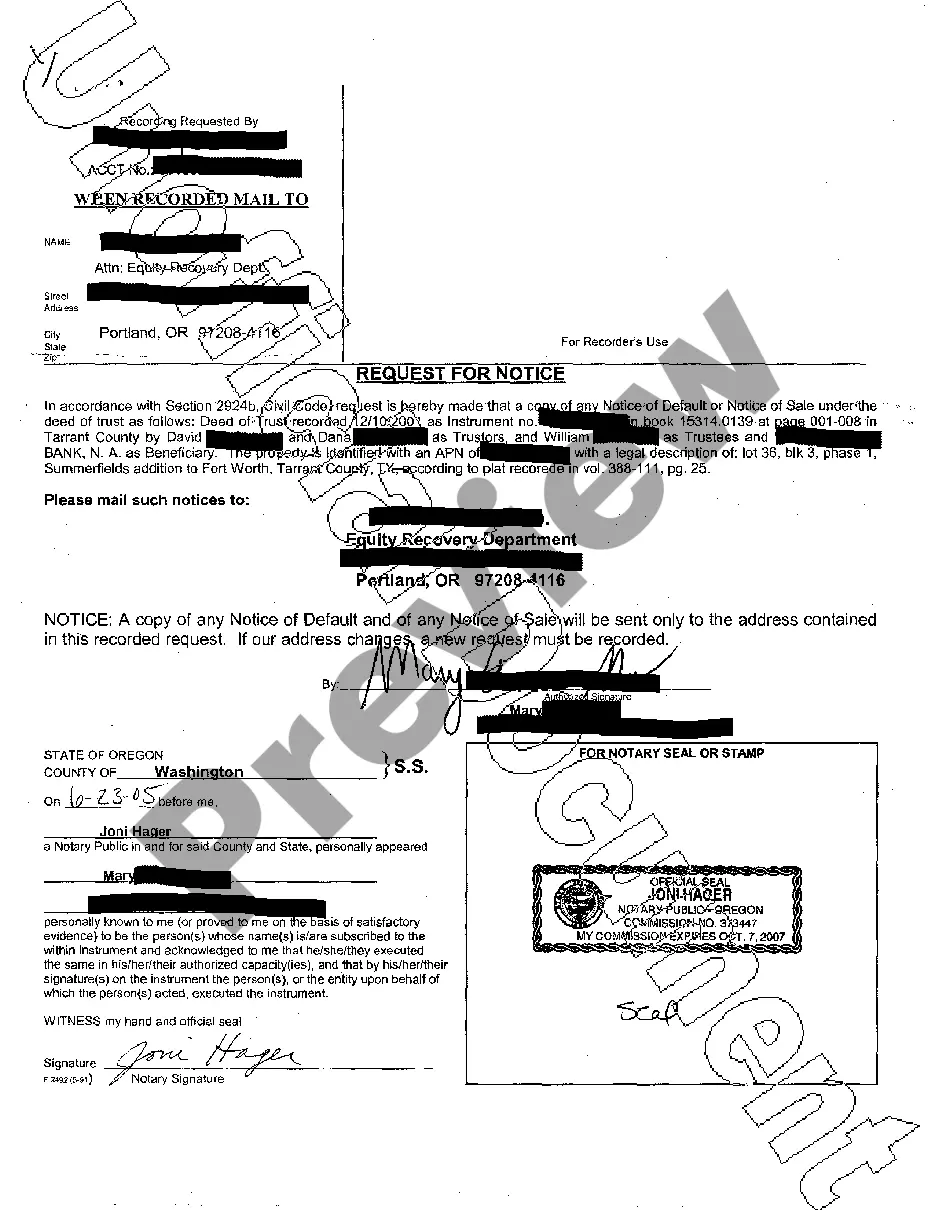

Odessa Texas Request for Notice of Default or Notice of Sale

Description

How to fill out Odessa Texas Request For Notice Of Default Or Notice Of Sale?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Odessa Texas Request for Notice of Default or Notice of Sale or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Odessa Texas Request for Notice of Default or Notice of Sale complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Odessa Texas Request for Notice of Default or Notice of Sale is suitable for you, you can select the subscription option and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!