Title: Exploring the Process of Wichita Falls Texas Request for Notice of Default or Notice of Sale Introduction: Understanding the intricacies of a Wichita Falls, Texas request for notice of default or notice of sale is essential for homeowners, real estate professionals, and investors involved in mortgage-related transactions. In this article, we will delve into the significance of these notices, outlining their key features, purpose, and relevance. We will also discuss any potential variations that exist within the realm of Wichita Falls' request for notice of default or notice of sale. 1. Notice of Default: A Notice of Default (NOD) is a legal document sent by a lender to the borrower when mortgage payments become overdue. Serving as a warning, the notice officially initiates the foreclosure process. Essential keywords include "Notice of Default Wichita Falls," "Wichita Falls foreclosure process," "nonpayment consequences." 2. Notice of Sale: A Notice of Sale (NOS) is a crucial step in the foreclosure process and is typically sent after the Notice of Default. This formal document notifies the borrower that their property will be auctioned to recover the outstanding mortgage debt. Providing pertinent details such as the auction date, time, and location, the NOS emphasizes the urgency to address the situation. Prominent keywords include "Wichita Falls Notice of Sale," "foreclosure auction in Wichita Falls," "mortgage debt recovery." Types of Wichita Falls Texas Request for Notice of Default or Notice of Sale: a. Residential Property Foreclosure Notice: This notice specifically pertains to residential properties within Wichita Falls, Texas. It highlights the steps required for homeowners to take to prevent foreclosure and provides critical information, deadlines, and options for resolving the default, such as loan modification or repayment plans. Key phrases include "Wichita Falls residential property foreclosure," "default resolution options," "homeowner assistance programs." b. Commercial Property Foreclosure Notice: In situations involving commercial real estate in Wichita Falls, Texas, lenders issue a specific notice tailored to the unique requirements and regulations governing such properties. The notice outlines the consequences and possible resolution strategies for defaulting on commercial mortgages, ultimately ending with a notice of sale if necessary. Relevant keywords involve "Wichita Falls commercial property foreclosure," "commercial mortgage default consequences," "loan workout solutions." Conclusion: The request for notice of default (NOD) and notice of sale (NOS) are vital components in the foreclosure process within Wichita Falls, Texas. Being well-versed in the implications, requirements, and available resolutions provided in these notices is crucial for homeowners, real estate professionals, and investors. By understanding the distinct variations between residential and commercial foreclosure notices, stakeholders can navigate the challenging landscape of mortgage-related transactions more effectively.

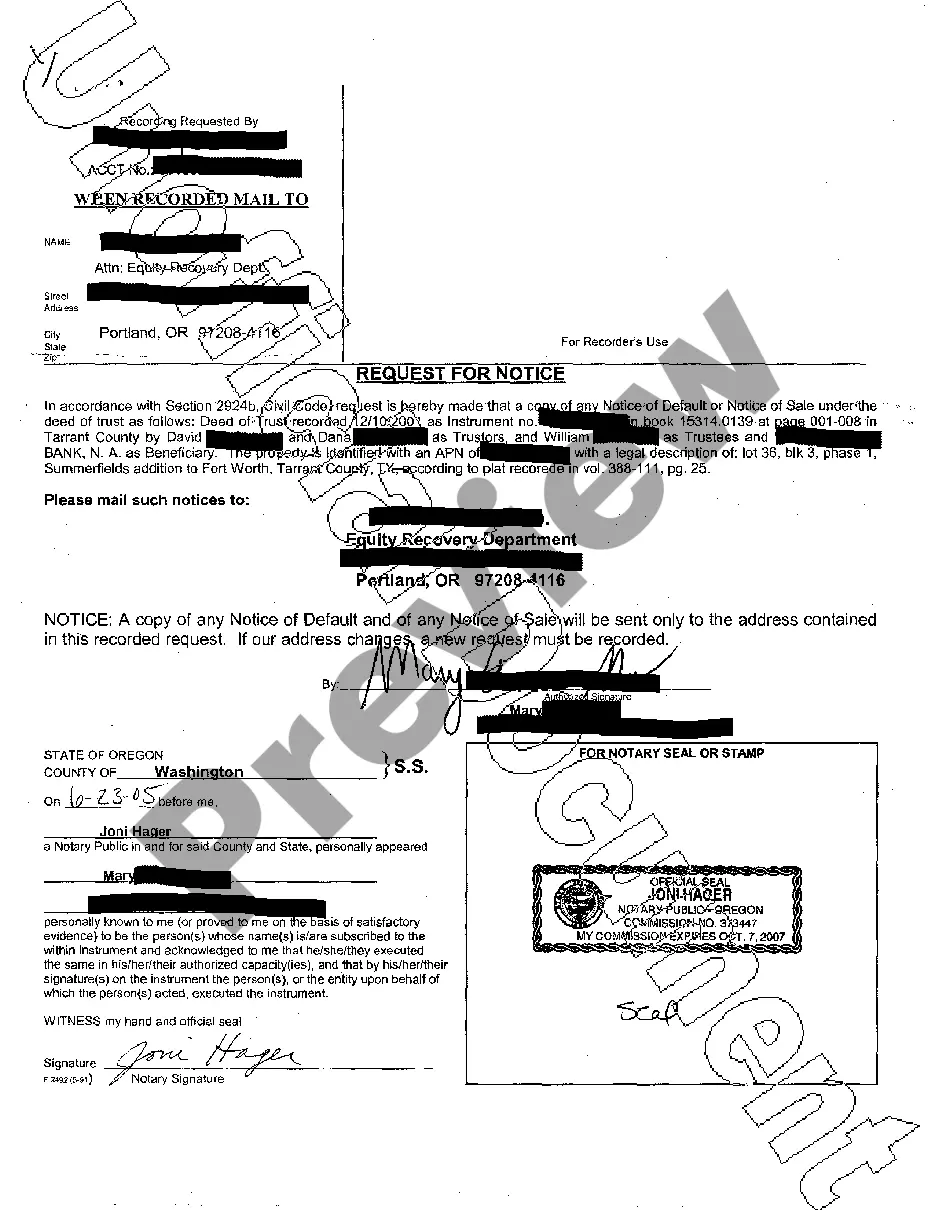

Wichita Falls Texas Request for Notice of Default or Notice of Sale

Description

How to fill out Wichita Falls Texas Request For Notice Of Default Or Notice Of Sale?

Do you need a trustworthy and affordable legal forms supplier to get the Wichita Falls Texas Request for Notice of Default or Notice of Sale? US Legal Forms is your go-to solution.

Whether you require a basic agreement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and county.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Wichita Falls Texas Request for Notice of Default or Notice of Sale conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the document is good for.

- Restart the search if the form isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Wichita Falls Texas Request for Notice of Default or Notice of Sale in any available format. You can get back to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal papers online for good.