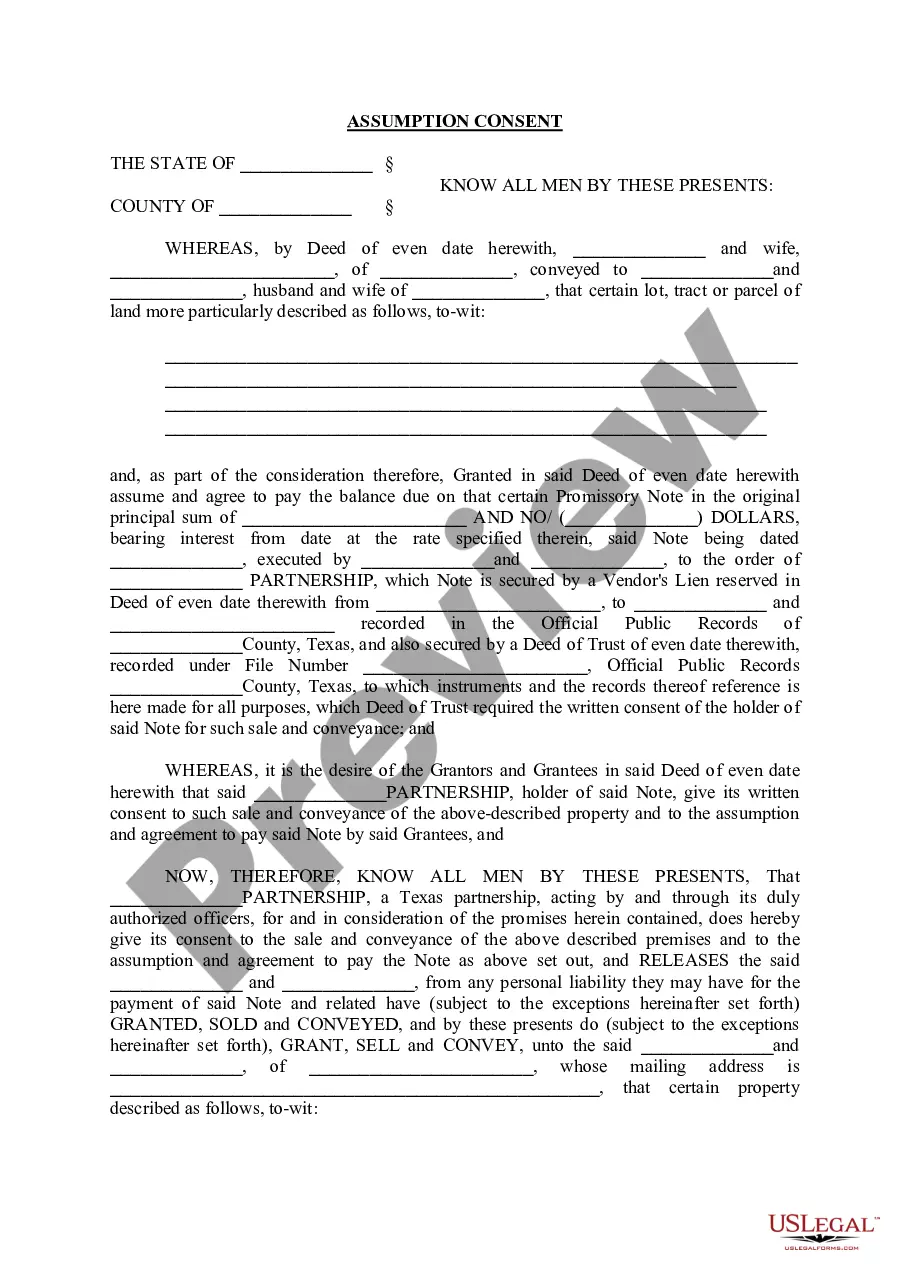

McKinney Texas Assumption Consent refers to the legal process in McKinney, Texas, where one party assumes the responsibility or liability for a debt or obligation that was initially owed by another party. This voluntary agreement takes place between the original debtor and the party who agrees to assume the debt, relieving the original debtor from further obligations. There are several types of McKinney Texas Assumption Consent, with each type serving a specific purpose. These include: 1. Mortgage Assumption Consent: This type of assumption consent occurs when a party assumes the mortgage of the original borrower. The assuming party takes over the mortgage payments and becomes fully responsible for the debt. It often requires the approval of the original lender and may involve a transfer of property ownership. 2. Business Debt Assumption Consent: In the case of businesses, assumption consent allows a new owner or partner to assume the existing debts or obligations of the previous owner or partner. This agreement outlines the terms and conditions of the assumption, ensuring a smooth transition of responsibilities and liabilities. 3. Lease Assumption Consent: Lease assumption consent refers to a situation where a new tenant takes over the rights and responsibilities of a lease agreement from the original leaseholder. This consent requires the approval of the landlord and typically involves a thorough evaluation of the new tenant's financial status and ability to fulfill the lease terms. 4. Loan Assumption Consent: Loan assumption consent occurs when a party takes over an existing loan from the original borrower, becoming solely responsible for repayment. This often requires the involvement of the lender and the completion of necessary paperwork to transfer the loan to the assuming party. The McKinney Texas Assumption Consent process provides a legal framework for the transfer of debts or obligations from one party to another. It ensures that all parties involved are aware of their rights, responsibilities, and liabilities, thereby protecting their interests and facilitating a smooth transition of financial obligations.

McKinney Texas Assumption Consent

Description

How to fill out McKinney Texas Assumption Consent?

Make use of the US Legal Forms and have instant access to any form template you require. Our beneficial website with a huge number of documents simplifies the way to find and get almost any document sample you require. You are able to export, complete, and sign the McKinney Texas Assumption Consent in just a couple of minutes instead of browsing the web for hours trying to find an appropriate template.

Using our library is a superb way to improve the safety of your form filing. Our experienced lawyers on a regular basis review all the documents to make sure that the templates are relevant for a particular state and compliant with new laws and polices.

How can you get the McKinney Texas Assumption Consent? If you have a subscription, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the instructions listed below:

- Open the page with the template you require. Make sure that it is the template you were hoping to find: check its headline and description, and utilize the Preview function if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Export the file. Select the format to get the McKinney Texas Assumption Consent and modify and complete, or sign it for your needs.

US Legal Forms is probably the most extensive and reliable form libraries on the web. Our company is always happy to assist you in any legal process, even if it is just downloading the McKinney Texas Assumption Consent.

Feel free to take advantage of our service and make your document experience as efficient as possible!