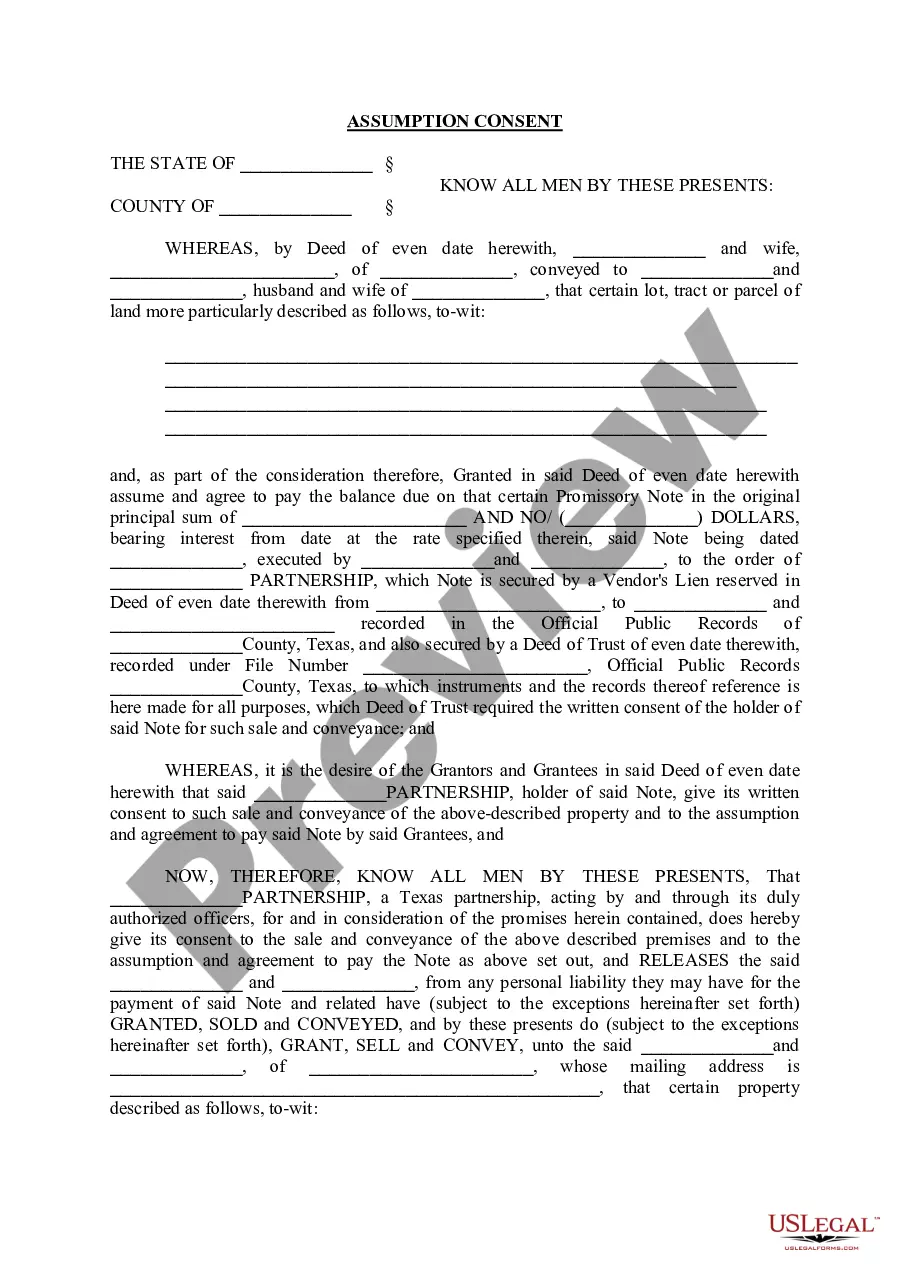

Tarrant Texas Assumption Consent is a legal document that authorizes the transfer of the responsibility for a loan or mortgage from one party to another. This consent is typically required when a property is being sold or transferred to a new owner and the new owner agrees to assume the existing loan or mortgage. The Tarrant Texas Assumption Consent ensures that both parties involved in the transfer are fully aware of the terms and conditions of the loan and agree to the transfer of responsibility. It acts as a formal agreement between the lender, the original borrower, and the new borrower. By signing the Tarrant Texas Assumption Consent, the new borrower agrees to take on all the obligations and liabilities associated with the loan or mortgage. This includes making timely monthly payments, adhering to the terms and conditions stated in the loan agreement, and assuming any potential penalties or default risks. Different types of Tarrant Texas Assumption Consent may exist depending on the specific circumstances of the loan transfer. For instance, there may be a Tarrant Texas Assumption Consent for a residential property, commercial property, or even for a specific type of loan like a fixed-rate mortgage or an adjustable-rate mortgage. In each case, the Tarrant Texas Assumption Consent will outline the terms of the loan, including the outstanding principal balance, the interest rate, the repayment schedule, and any other relevant details specific to the loan or mortgage. It will also specify the responsibilities and rights of the new borrower, ensuring a clear understanding and agreement between all parties involved. Overall, Tarrant Texas Assumption Consent is a vital legal document that facilitates the transfer of an existing loan or mortgage from one party to another. It helps protect the rights and interests of all parties involved while ensuring the smooth continuation of loan payments and obligations under new ownership.

Tarrant Texas Assumption Consent

Description

How to fill out Tarrant Texas Assumption Consent?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any legal background to create such paperwork from scratch, mainly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our platform provides a huge library with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you require the Tarrant Texas Assumption Consent or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Tarrant Texas Assumption Consent quickly using our trustworthy platform. If you are already an existing customer, you can proceed to log in to your account to get the appropriate form.

However, if you are a novice to our library, ensure that you follow these steps prior to downloading the Tarrant Texas Assumption Consent:

- Ensure the template you have found is good for your location because the regulations of one state or county do not work for another state or county.

- Preview the form and read a quick description (if provided) of cases the document can be used for.

- In case the one you chosen doesn’t suit your needs, you can start again and look for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- with your login information or create one from scratch.

- Pick the payment method and proceed to download the Tarrant Texas Assumption Consent as soon as the payment is through.

You’re all set! Now you can proceed to print the form or fill it out online. Should you have any problems getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.