Corpus Christi, Texas Bond to Indemnify Against Lien: A Comprehensive Overview Introduction: In Corpus Christi, Texas, a Bond to Indemnify Against Lien serves as a crucial financial tool that offers protection against potential liens on a property or construction project. This bond acts as a guarantee that the property owner or contractor will promptly clear all liens that may arise during the course of a project. In this detailed description, we will explore the different types of Corpus Christi Texas Bonds to Indemnify Against Lien, explaining their significance and benefits. Types of Corpus Christi Texas Bonds to Indemnify Against Lien: 1. Construction Lien Indemnification Bonds: Construction projects are prone to unexpected delays, disputes, or non-payment issues, which may lead to subcontractors or suppliers filing liens against the property. A Construction Lien Indemnification Bond provides financial security to the property owner, ensuring that all liens will be cleared and resolved, minimizing potential legal complications and disruptions. 2. Subdivision Completion Lien Indemnification Bonds: Developers in Corpus Christi, Texas, often have to comply with specific local regulations related to public infrastructure development. Subdivision Completion Lien Indemnification Bonds are utilized to safeguard against any potential liens that may arise due to incomplete or non-compliant infrastructure work. With this bond, developers can ensure that all required infrastructure is completed, protecting the project from unresolved liens. 3. Municipal Lien Indemnification Bonds: Municipal Lien Indemnification Bonds are commonly used when acquiring property from a municipality or local government. These bonds provide assurance to the municipality or government that any existing liens on the property will be paid off, enabling a smooth transfer of ownership. They act as a financial protection tool for both the buyer and the municipality. 4. Lien Release Bonds: In cases where a lien is wrongfully filed against a property or project, a Lien Release Bond can be obtained. This bond allows the property owner or contractor to remove the lien temporarily while the legal dispute is being resolved. By posting the bond, the property owner avoids the negative impacts of the lien on the property’s marketability and can continue their project without delays. Benefits of Corpus Christi Texas Bond to Indemnify Against Lien: — Protects property owners, contractors, developers, and buyers from financial liability arising from liens. — Enables property transactions to proceed smoothly by clearing any existing liens on the property. — Minimizes legal disputes and potential disruptions in construction projects. — Increases marketability and value of the property by ensuring a clean title free from unresolved liens. — Offers a reliable solution in cases of wrongful liens, providing temporary relief until legal matters are resolved. Conclusion: Corpus Christi, Texas Bond to Indemnify Against Lien is a critical instrument that plays a vital role in protecting property owners, contractors, developers, and buyers in construction and real estate projects. By obtaining the appropriate bond type for a specific situation, individuals can guard against potential financial risks and legal disputes associated with liens. Whether it is a Construction Lien Indemnification Bond, Subdivision Completion Lien Indemnification Bond, Municipal Lien Indemnification Bond, or Lien Release Bond, the implementation of these bonds ensures smooth operations, mitigates risks, and contributes to the overall success of projects in Corpus Christi, Texas.

Corpus Christi Texas Bond to Indemnify Against Lien

Category:

State:

Texas

City:

Corpus Christi

Control #:

TX-LR018T

Format:

Word;

Rich Text

Instant download

Description

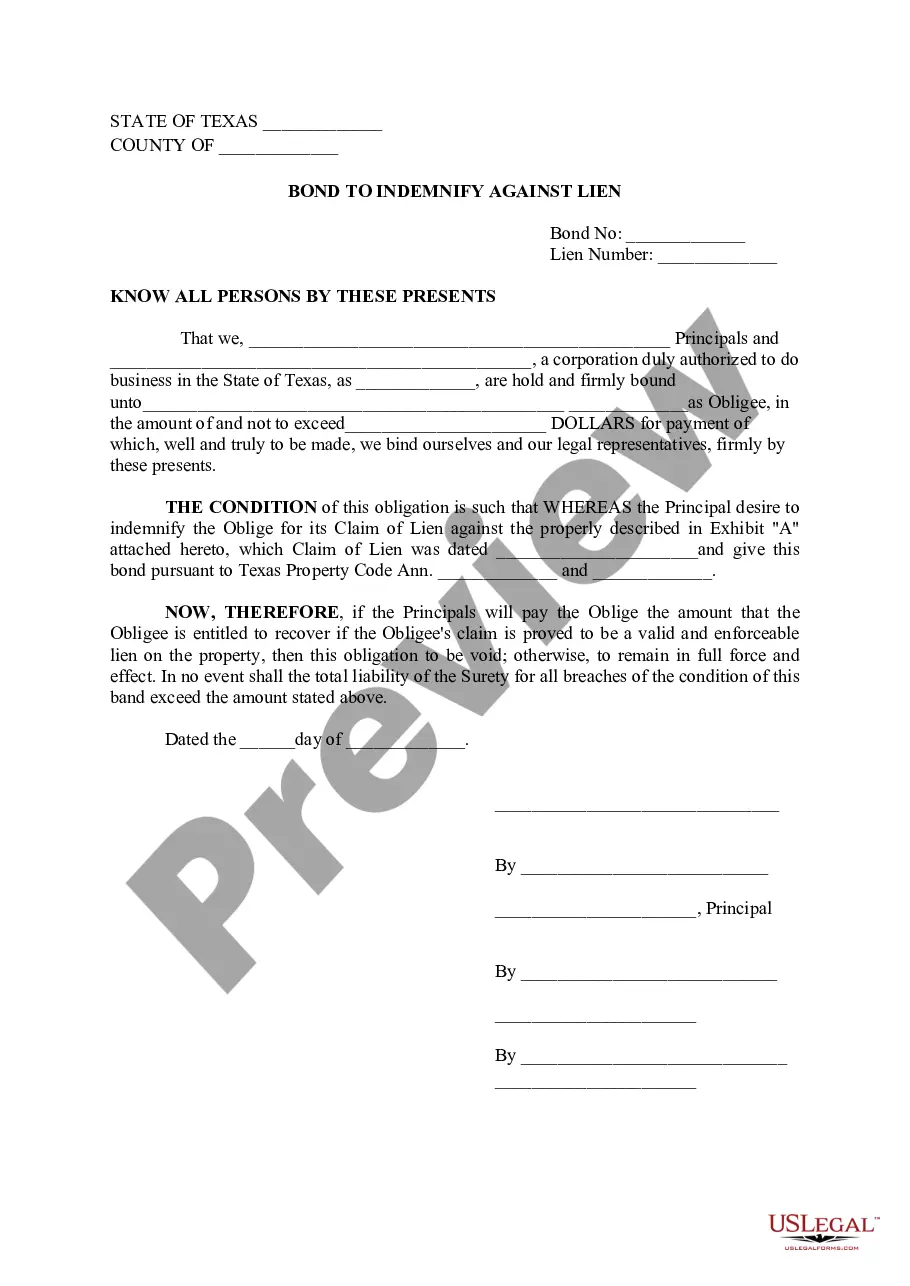

This Bond is where Principal is willing to pay for a valid claim to release lien on property.

Corpus Christi, Texas Bond to Indemnify Against Lien: A Comprehensive Overview Introduction: In Corpus Christi, Texas, a Bond to Indemnify Against Lien serves as a crucial financial tool that offers protection against potential liens on a property or construction project. This bond acts as a guarantee that the property owner or contractor will promptly clear all liens that may arise during the course of a project. In this detailed description, we will explore the different types of Corpus Christi Texas Bonds to Indemnify Against Lien, explaining their significance and benefits. Types of Corpus Christi Texas Bonds to Indemnify Against Lien: 1. Construction Lien Indemnification Bonds: Construction projects are prone to unexpected delays, disputes, or non-payment issues, which may lead to subcontractors or suppliers filing liens against the property. A Construction Lien Indemnification Bond provides financial security to the property owner, ensuring that all liens will be cleared and resolved, minimizing potential legal complications and disruptions. 2. Subdivision Completion Lien Indemnification Bonds: Developers in Corpus Christi, Texas, often have to comply with specific local regulations related to public infrastructure development. Subdivision Completion Lien Indemnification Bonds are utilized to safeguard against any potential liens that may arise due to incomplete or non-compliant infrastructure work. With this bond, developers can ensure that all required infrastructure is completed, protecting the project from unresolved liens. 3. Municipal Lien Indemnification Bonds: Municipal Lien Indemnification Bonds are commonly used when acquiring property from a municipality or local government. These bonds provide assurance to the municipality or government that any existing liens on the property will be paid off, enabling a smooth transfer of ownership. They act as a financial protection tool for both the buyer and the municipality. 4. Lien Release Bonds: In cases where a lien is wrongfully filed against a property or project, a Lien Release Bond can be obtained. This bond allows the property owner or contractor to remove the lien temporarily while the legal dispute is being resolved. By posting the bond, the property owner avoids the negative impacts of the lien on the property’s marketability and can continue their project without delays. Benefits of Corpus Christi Texas Bond to Indemnify Against Lien: — Protects property owners, contractors, developers, and buyers from financial liability arising from liens. — Enables property transactions to proceed smoothly by clearing any existing liens on the property. — Minimizes legal disputes and potential disruptions in construction projects. — Increases marketability and value of the property by ensuring a clean title free from unresolved liens. — Offers a reliable solution in cases of wrongful liens, providing temporary relief until legal matters are resolved. Conclusion: Corpus Christi, Texas Bond to Indemnify Against Lien is a critical instrument that plays a vital role in protecting property owners, contractors, developers, and buyers in construction and real estate projects. By obtaining the appropriate bond type for a specific situation, individuals can guard against potential financial risks and legal disputes associated with liens. Whether it is a Construction Lien Indemnification Bond, Subdivision Completion Lien Indemnification Bond, Municipal Lien Indemnification Bond, or Lien Release Bond, the implementation of these bonds ensures smooth operations, mitigates risks, and contributes to the overall success of projects in Corpus Christi, Texas.

Free preview

How to fill out Corpus Christi Texas Bond To Indemnify Against Lien?

If you’ve already utilized our service before, log in to your account and download the Corpus Christi Texas Bond to Indemnify Against Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Corpus Christi Texas Bond to Indemnify Against Lien. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!