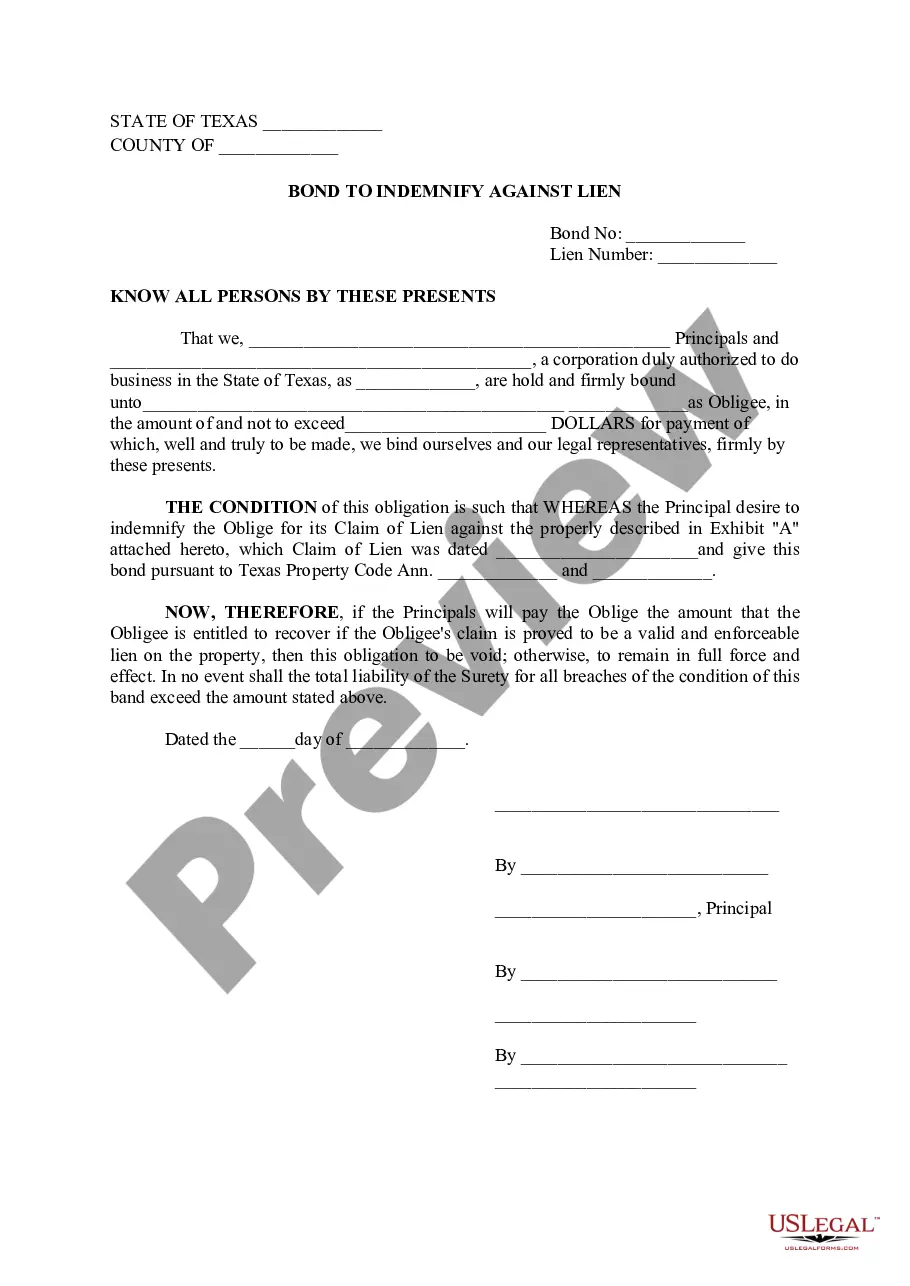

The Fort Worth Texas Bond to Indemnify Against Lien is a type of financial guarantee that is designed to protect property owners or other interested parties from potential liens that may be placed on a property. This bond is commonly used in real estate transactions to provide assurance and security to all parties involved. A Fort Worth Texas Bond to Indemnify Against Lien essentially acts as a safeguard against any unpaid debts or obligations that may arise during the course of a property transaction. It ensures that if a lien is filed against the property for unpaid bills, claims, or other legal matters, the bond issuer will cover the financial obligation up to the agreed amount on the bond. This type of bond is typically required by mortgage lenders or title companies as a condition for granting a loan or issuing a title insurance policy. It provides additional protection to these entities, reducing the risk associated with potential liens and enhancing the overall transactional security. There may be several types of Fort Worth Texas Bond to Indemnify Against Lien, each tailored to meet specific requirements or circumstances. Some common variations include: 1. Mechanics Lien Bond: This bond is specific to construction projects and indemnifies against unpaid bills or claims from subcontractors, suppliers, or laborers. 2. Material man Lien Bond: Similar to a mechanics lien bond, this type of bond covers unpaid materials used in a construction project. 3. Tax Lien Bond: This bond is used to protect against any unpaid property taxes that may result in a tax lien on the property. 4. Association Lien Bond: This bond is often required when purchasing property in a homeowners' association (HOA) community and indemnifies against any unpaid HOA fees or dues. It is essential to understand that the specific requirements for the Fort Worth Texas Bond to Indemnify Against Lien may vary, depending on the type of lien or legal obligation being addressed. Therefore, it is advisable to consult with a reputable bonding agency or legal professional to ensure compliance with all necessary regulations and to determine the most appropriate bond type for a particular situation.

Fort Worth Texas Bond to Indemnify Against Lien

Description

How to fill out Fort Worth Texas Bond To Indemnify Against Lien?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Fort Worth Texas Bond to Indemnify Against Lien gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Fort Worth Texas Bond to Indemnify Against Lien takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

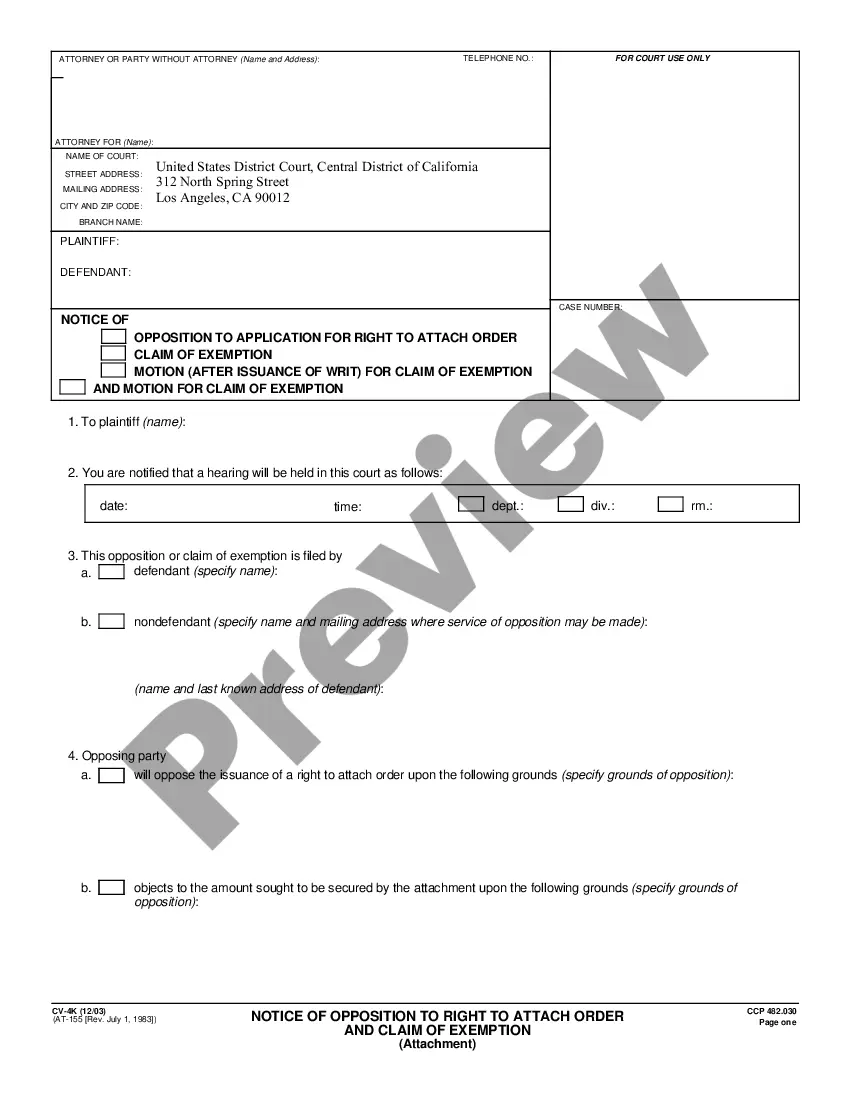

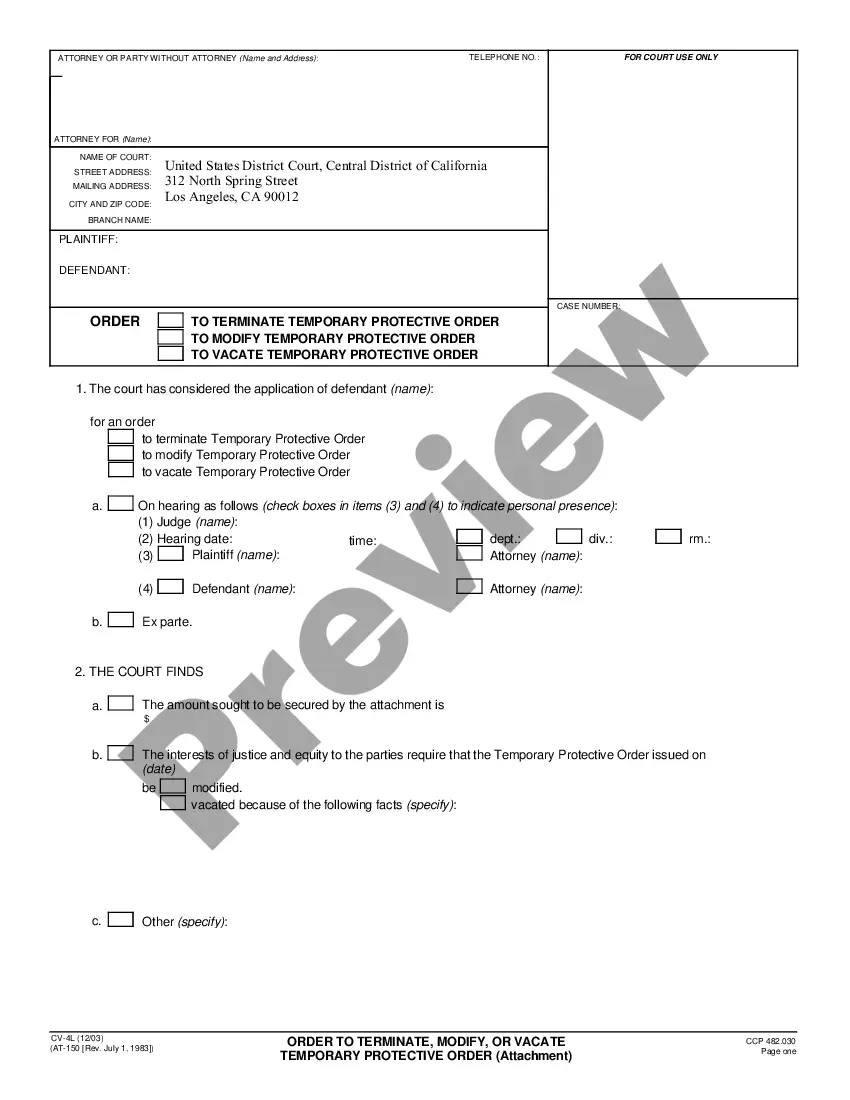

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Fort Worth Texas Bond to Indemnify Against Lien. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!