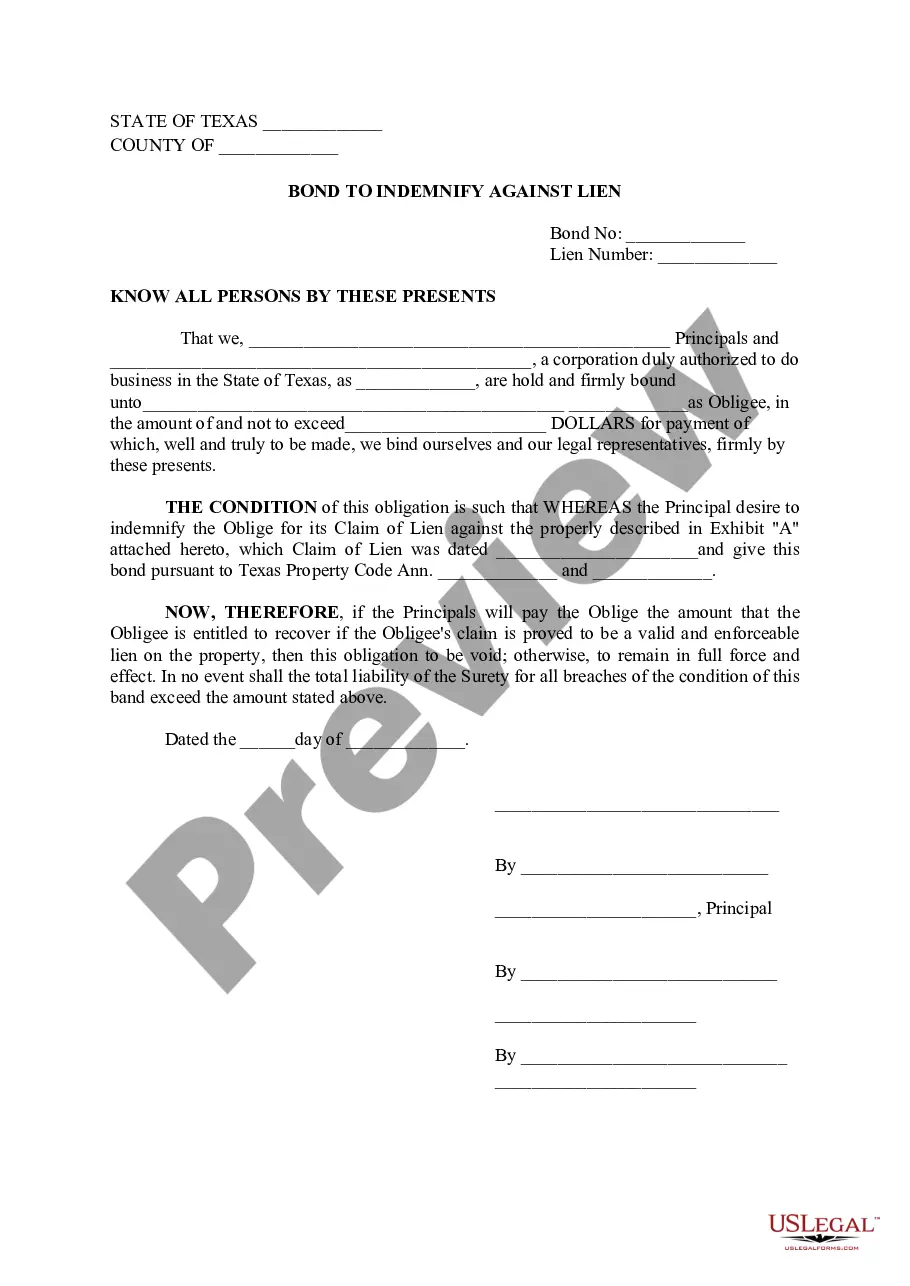

In Houston, Texas, a Bond to Indemnify Against Lien is a legal document that provides financial protection to property owners against potential liens that may arise due to unpaid services, materials, or labor on a construction project. This bond serves as a guarantee that the property owner will be indemnified or compensated for any valid claims of unpaid debts or liens that may be placed on the property. There are two main types of Houston Texas Bonds to Indemnify Against Lien: 1. Subcontractor Bond: This type of bond is obtained by subcontractors or suppliers to demonstrate their ability to pay for services, materials, or labor provided on a construction project. It assures the property owner that the subcontractor or supplier will fulfill their financial obligations and prevent the property from being encumbered by any liens resulting from non-payment. 2. General Contractor Bond: In contrast, the general contractor bond is procured by the primary contractor overseeing a construction project. It is used to guarantee the payment of subcontractors, suppliers, or other parties performing work on the project. This bond safeguards the property owner against potential liens, ensuring that all parties involved are compensated for their contributions to the project. Both types of bonds may be required by the property owner as a condition for initiating a construction project. They serve as an added layer of financial security, mitigating the risk of unpaid debts and potential legal complications arising from lien claims. In summary, the Houston Texas Bond to Indemnify Against Lien is a critical financial instrument that offers protection to property owners in the event of unpaid debts or liens related to construction projects. By requiring such a bond, property owners can safeguard their investment and ensure that all parties involved are fairly compensated for their services, materials, or labor.

Houston Texas Bond to Indemnify Against Lien

Description

How to fill out Houston Texas Bond To Indemnify Against Lien?

Benefit from the US Legal Forms and get immediate access to any form you want. Our helpful platform with a large number of document templates allows you to find and obtain virtually any document sample you will need. You can download, complete, and certify the Houston Texas Bond to Indemnify Against Lien in just a few minutes instead of surfing the Net for hours searching for the right template.

Utilizing our collection is a wonderful way to improve the safety of your record filing. Our experienced attorneys on a regular basis check all the documents to make sure that the templates are relevant for a particular state and compliant with new laws and regulations.

How do you get the Houston Texas Bond to Indemnify Against Lien? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you view. Additionally, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions below:

- Open the page with the template you need. Make certain that it is the form you were hoping to find: check its name and description, and take take advantage of the Preview option when it is available. Otherwise, use the Search field to find the needed one.

- Launch the saving procedure. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Indicate the format to get the Houston Texas Bond to Indemnify Against Lien and change and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable template libraries on the internet. Our company is always ready to assist you in any legal process, even if it is just downloading the Houston Texas Bond to Indemnify Against Lien.

Feel free to benefit from our platform and make your document experience as straightforward as possible!