A League City Texas Bond to Indemnify Against Lien is a type of surety bond that is used in the construction industry to protect property owners against potential liens filed by contractors or suppliers. This bond is a financial guarantee that ensures the property owner will not be responsible for any unpaid bills or outstanding debts related to the construction project. The primary purpose of a League City Texas Bond to Indemnify Against Lien is to provide a means for property owners to mitigate the risk of potential liens. By requiring contractors to obtain this bond, property owners can ensure that any unpaid bills or debts are covered, reducing the likelihood of legal disputes or financial burdens. There are different types of League City Texas Bond to Indemnify Against Lien, each serving a specific purpose. Some common types include: 1. Payment Bond: This type of bond guarantees that contractors and subcontractors will receive payment for their work and materials on a construction project. It provides financial protection to ensure that all parties involved in the project are compensated fairly. 2. Performance Bond: A performance bond guarantees that the contractor will complete the construction project according to the terms and conditions outlined in the contract. It provides assurance to the property owner that the project will be completed as agreed upon. 3. Subdivision Bond: This bond is required for developers who are subdividing land into multiple lots. It guarantees that the developer will complete any necessary infrastructure improvements, such as roads, utilities, or drainage systems, before selling the individual lots. 4. Maintenance Bond: A maintenance bond ensures that the contractor will perform any necessary repairs or maintenance on the completed project within a specified timeframe. It provides additional protection for the property owner in case any defects or issues arise after the construction is completed. Obtaining a League City Texas Bond to Indemnify Against Lien is a crucial step in protecting property owners from potential financial risks involved in construction projects. It provides peace of mind by ensuring that any unpaid bills or outstanding debts will be covered, reducing the chances of legal disputes and financial burdens.

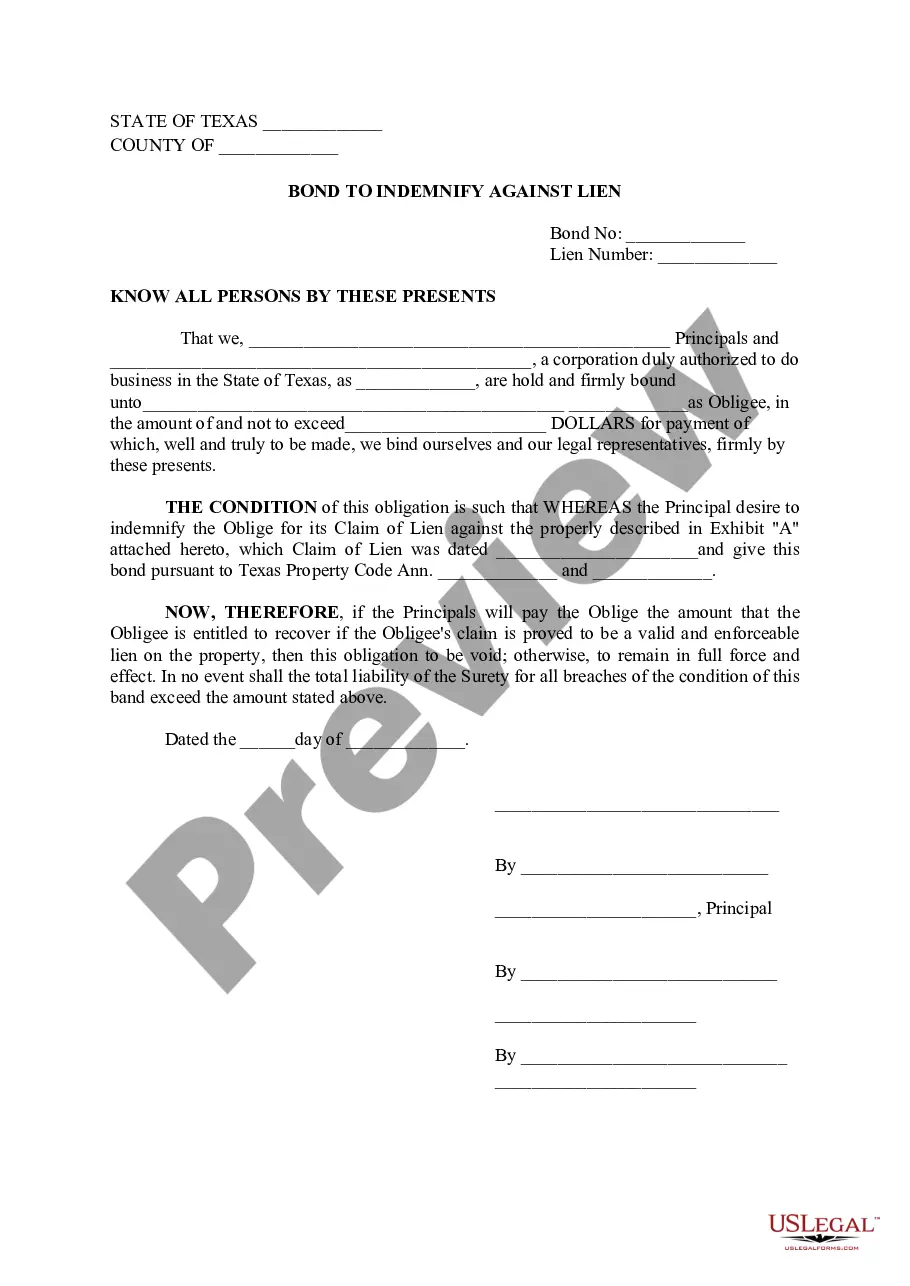

League City Texas Bond to Indemnify Against Lien

Description

How to fill out League City Texas Bond To Indemnify Against Lien?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the League City Texas Bond to Indemnify Against Lien becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the League City Texas Bond to Indemnify Against Lien takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the League City Texas Bond to Indemnify Against Lien. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!