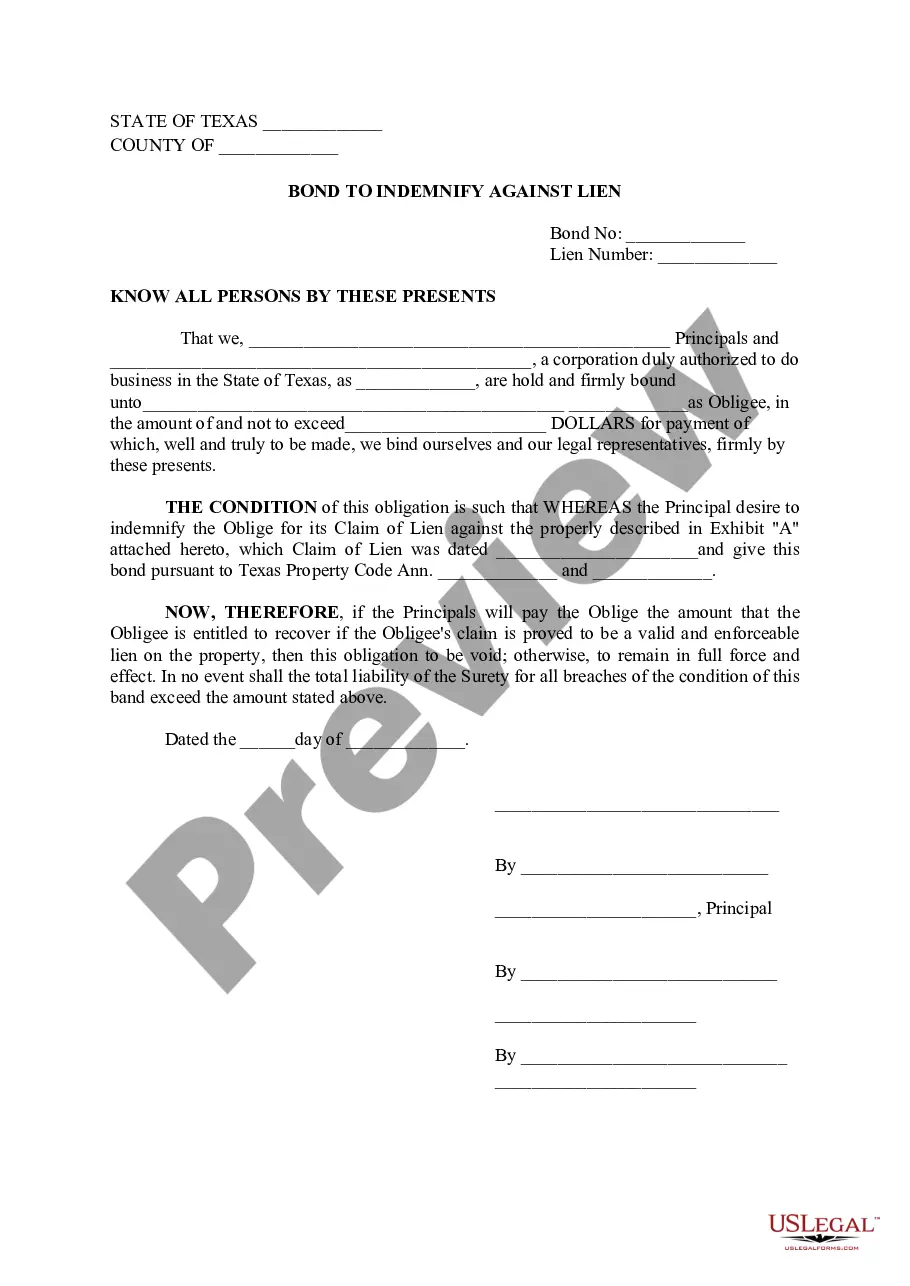

McKinney Texas Bond to Indemnify Against Lien is a type of surety bond that serves as a form of protection against potential liens on property titles in McKinney, Texas. This bond acts as a guarantee that the property owner or the party issuing the bond will address any outstanding liens or claims that may arise during the transfer or sale of the property. The McKinney Texas Bond to Indemnify Against Lien protects the interests of both the buyer and the seller by ensuring that any outstanding debts or obligations associated with the property title are resolved. This bond helps maintain the integrity of property transactions and provides peace of mind to all parties involved in the transaction. There are different types of McKinney Texas Bonds to Indemnify Against Lien, each designed to cater to specific needs and circumstances. Some common types of these bonds include: 1. Residential Property Bond: This type of bond is specific to residential property transactions. It ensures that any outstanding liens or claims related to residential property titles are resolved before the transfer of ownership. 2. Commercial Property Bond: This bond is tailored to commercial property transactions. It guarantees that any outstanding liens or claims related to commercial property titles are addressed and resolved to facilitate a smooth transfer of ownership. 3. Title Insurance Indemnity Bond: This bond is often required by title insurance companies to protect against potential title defects or ownership disputes. It provides assurance that any claims arising from defects in the title will be rectified. 4. Mechanic's Lien Bond: This bond is commonly utilized in construction projects to protect property owners from mechanic's liens placed on the property by contractors or suppliers who have not been paid. It guarantees that outstanding debts owed to contractors or suppliers will be resolved. McKinney Texas Bond to Indemnify Against Lien is a crucial tool in the real estate industry, ensuring that property transactions proceed smoothly and all parties involved are safeguarded against any potential title-related issues. By obtaining the appropriate bond, property owners can have confidence in the validity of their property title and buyers can proceed with their purchase knowing that any existing liens or claims will be resolved.

McKinney Texas Bond to Indemnify Against Lien

Description

How to fill out McKinney Texas Bond To Indemnify Against Lien?

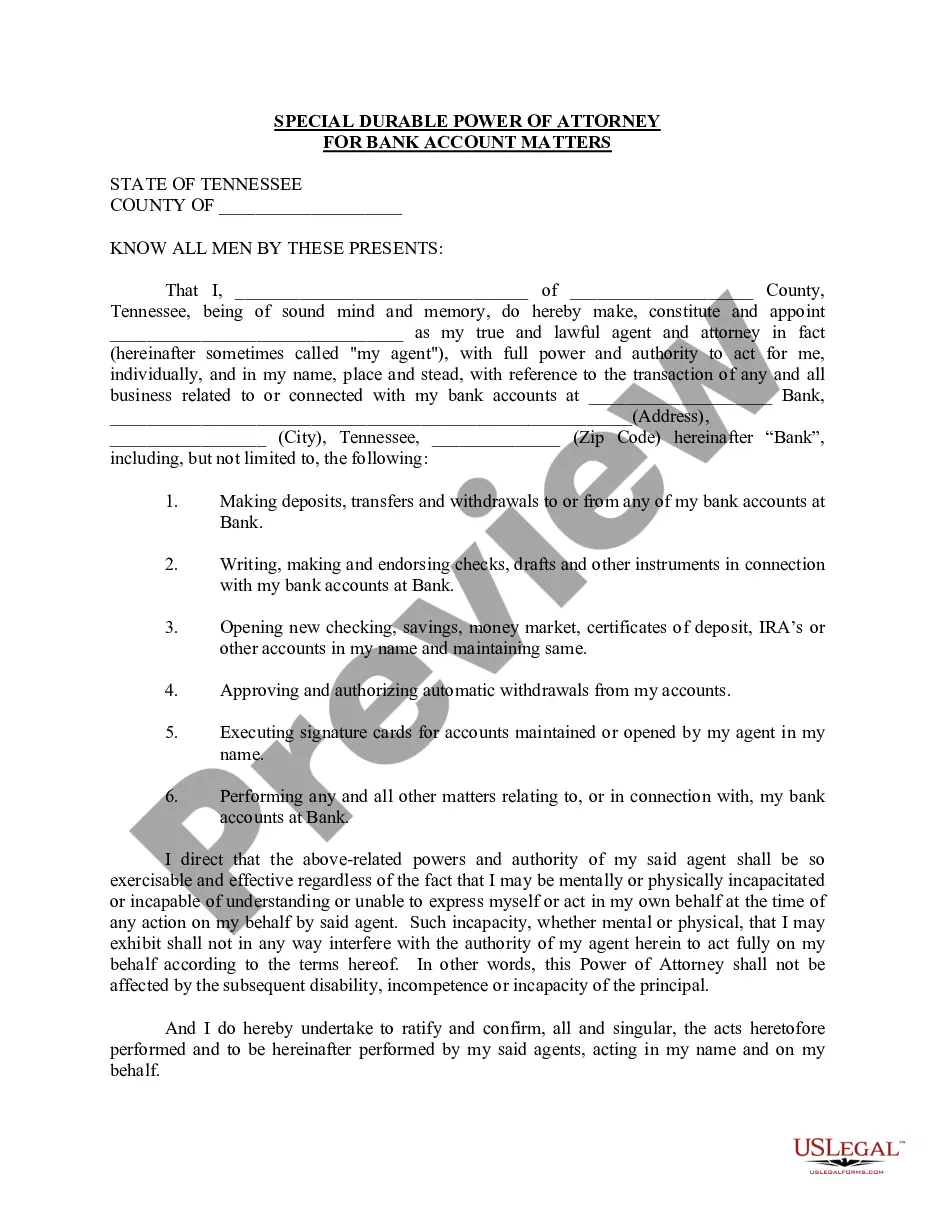

Locating approved templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online collection of over 85,000 legal forms for both personal and business requirements and a variety of real-world situations.

All documents are well-organized by category and jurisdiction, making the search for the McKinney Texas Bond to Indemnify Against Lien as simple as 1-2-3.

Maintaining organized documents that comply with legal standards is crucial. Leverage the US Legal Forms library to always have the necessary document templates readily available!

- Verify the Preview mode and form details.

- Ensure you've selected the correct one that fits your requirements and fully aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to discover the appropriate one. If it meets your needs, proceed to the next step.

- Complete your purchase.

Form popularity

FAQ

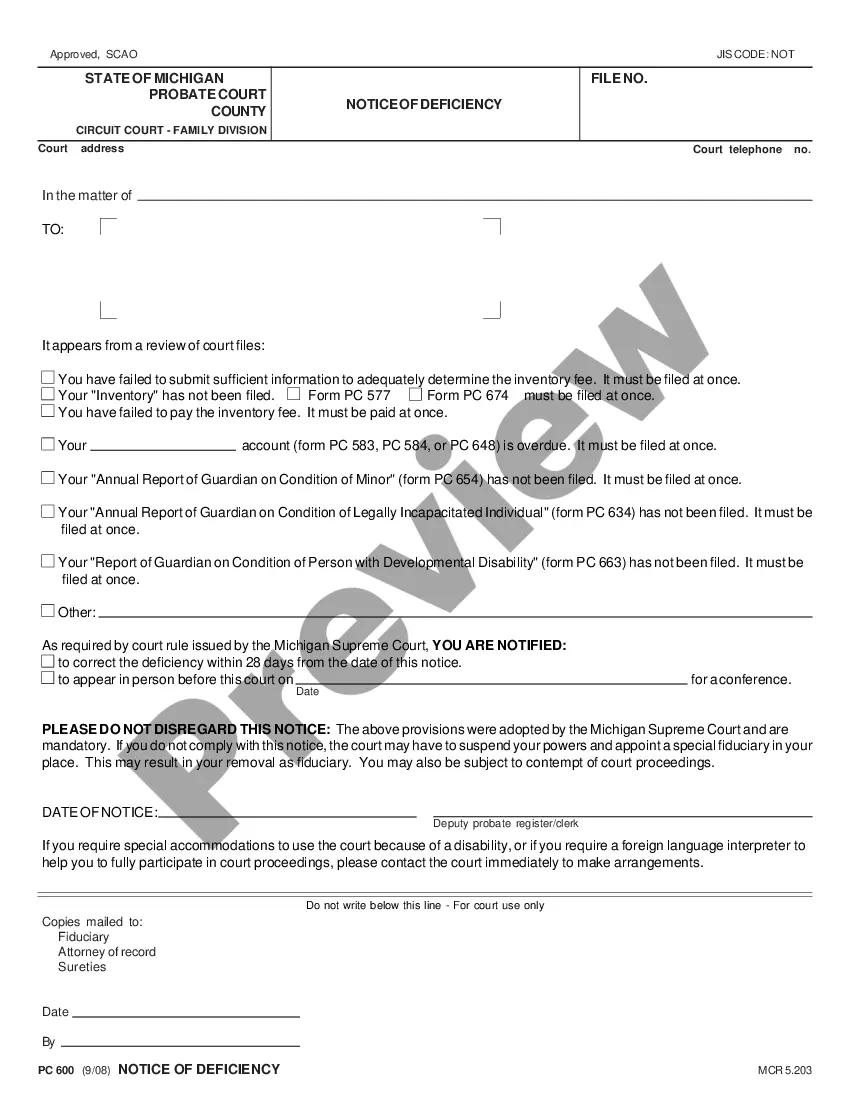

Receiving a letter from the county clerk usually means you have an important notice regarding a legal proceeding or a document filed on your behalf. This letter could relate to actions taken on a McKinney Texas Bond to Indemnify Against Lien, or it might include court dates and deadlines related to your case. It's crucial to read the letter carefully and respond if necessary, as it may affect your legal rights. If you need clarification, consider using platforms like USLegalForms to guide you through the right legal responses.

The judge of the 493rd District Court in Collin County oversees civil and criminal cases within that district. This court may handle issues related to property liens, including disputes where a McKinney Texas Bond to Indemnify Against Lien is applicable. Staying informed about the current judge can help ensure you know whom to consult for specific legal matters. You can find updated information on the Collin County website or through local legal resources.

The county judge for Collin County oversees county administration and serves as the presiding officer of the Commissioners Court. They play a vital role in local governance, including decisions about public funds and community matters. If you need assistance regarding a McKinney Texas Bond to Indemnify Against Lien, the county judge is an essential point of contact for understanding any local legal requirements. Always check current resources to confirm the judge’s identity, as elections can change this office.

In Texas, a court clerk manages court records, files documents, and assists the judge in administering the courtroom. They handle the paperwork related to cases, including the submission of a McKinney Texas Bond to Indemnify Against Lien. The clerk also collects fees, schedules hearings, and ensures that everything follows the legal processes. This support is crucial for maintaining order and efficiency in the judicial system.

Bonding around a lien involves obtaining a bond that assures the payment of a claim despite the lien's presence. When you choose a McKinney Texas Bond to Indemnify Against Lien, you essentially remove the lien as a barrier to the completion of your project. This can expedite processes and provide reassurance for both property owners and contractors engaged in business.

An indemnity bond works by ensuring that one party will financially cover the loss incurred by another party based on predefined conditions. With a McKinney Texas Bond to Indemnify Against Lien, if a lien is placed against your property, the bond allows the affected party to recover losses from the bonding company. This provides security and fosters confidence among all parties involved in a transaction.

Being bound to indemnify means that you have entered into a commitment to compensate another party for certain losses or damages. When you obtain a McKinney Texas Bond to Indemnify Against Lien, you accept the responsibility of covering any valid claims that arise from a lien situation. This act reinforces trust among project stakeholders, helping to foster smoother transactions.

A bond to indemnify is a legal agreement that protects one party from potential losses incurred by another party in a particular situation. Specifically, a McKinney Texas Bond to Indemnify Against Lien serves to safeguard property owners and contractors against financial claims related to liens. By securing this bond, you can ensure that your financial interests are protected during a project's life cycle.

Indemnifying a bond means providing a guarantee against any potential financial loss related to that bond. In the context of a McKinney Texas Bond to Indemnify Against Lien, this means that you assure compensation for any claims filed against the bond due to a lien. This protection can be crucial, as it helps protect your assets and maintain peace of mind during legal transactions.

A bond to indemnify against lien in Texas is a legal instrument that protects property owners from the financial impact of a lien. This bond ensures that if a claim arises, the bond provider will cover the damages, safeguarding the property owner's interests. If you are dealing with a potential lien issue, a McKinney Texas Bond to Indemnify Against Lien offers a reliable solution to manage your risks.