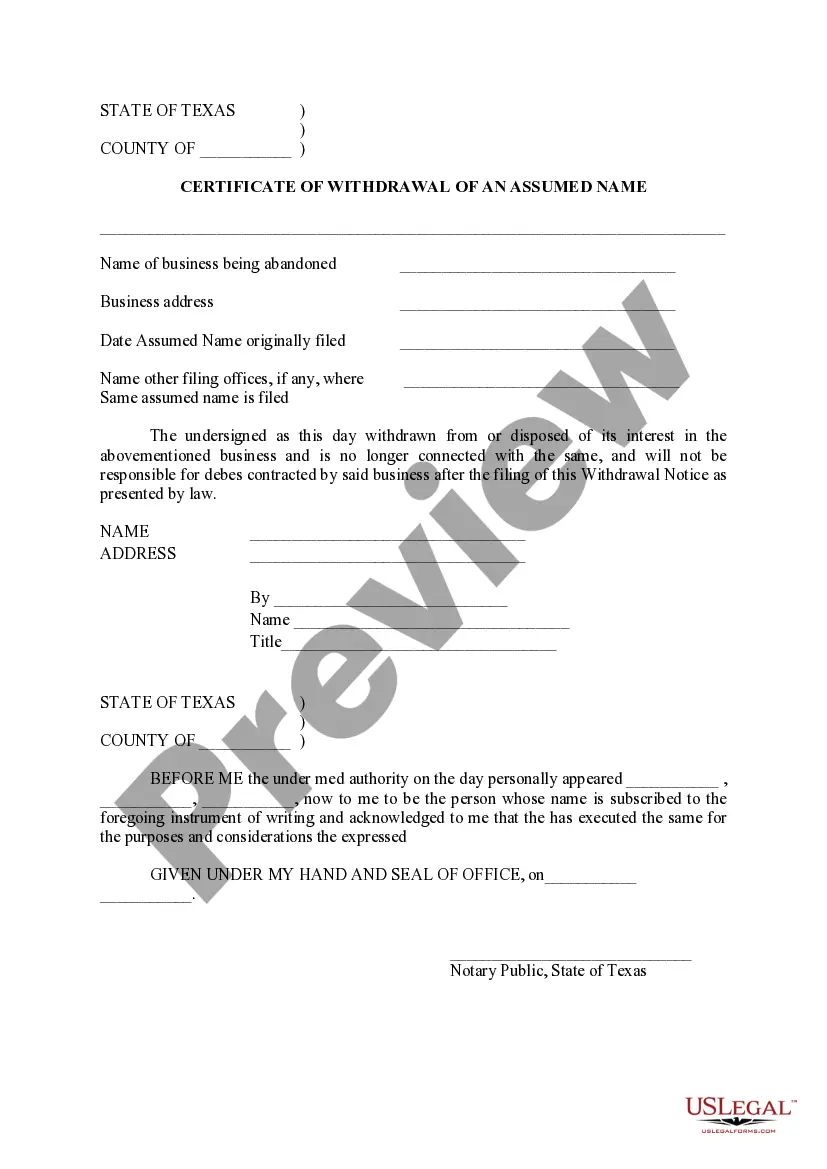

Harris Texas Certificate of Withdrawal of An Assumed Name

Description

Connected and no longer responsible for debts by

Previous business after the filing of this Withdrawal.

How to fill out Texas Certificate Of Withdrawal Of An Assumed Name?

If you have previously availed yourself of our service, sign in to your account and download the Harris Texas Certificate of Withdrawal of An Assumed Name onto your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment scheme.

If this is your inaugural encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to use it again. Utilize the US Legal Forms service to swiftly locate and download any template for your personal or professional needs!

- Ensure you’ve identified the correct document. Review the description and utilize the Preview option, if available, to verify if it suits your requirements. If it doesn’t match, leverage the Search tab above to find the appropriate one.

- Procure the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and complete a transaction. Employ your credit card information or the PayPal method to finalize the purchase.

- Receive your Harris Texas Certificate of Withdrawal of An Assumed Name. Choose the file format for your document and store it onto your device.

- Finalizing your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

To file a DBA, or 'doing business as,' in Texas, visit your local county clerk’s office. It is essential to check the specific requirements and forms needed for your county. Ensuring that you file the Harris Texas Certificate of Withdrawal of An Assumed Name properly will keep your business compliant. Consider using US Legal Forms for comprehensive resources and templates that simplify this process.

To abandon an assumed name in Texas, you must file a certificate of withdrawal. This certificate should be submitted to the same office where you initially filed your assumed name. Completing the Harris Texas Certificate of Withdrawal of An Assumed Name effectively cancels your business name and helps maintain your business records accurately. Tools like US Legal Forms can guide you through the required steps for a smooth withdrawal.

To file an assumed name certificate in Texas, start by completing the certificate form available on the Texas Secretary of State's website. You then need to submit the form to the appropriate county office where your business operates. Efficiently managing your filing ensures that your Harris Texas Certificate of Withdrawal of An Assumed Name is processed without delays. Utilizing US Legal Forms can streamline this process and help you avoid common pitfalls.

Yes, you can file an assumed name online for Texas. The Texas Secretary of State provides a straightforward online application process. This process allows you to submit your Harris Texas Certificate of Withdrawal of An Assumed Name efficiently. Accessing the online portal makes it convenient for you to ensure your filing is done correctly and swiftly.

The terms DBA (Doing Business As) and assumed name refer to the same concept. A DBA is a name under which a business operates that is not its legal name. This allows businesses to create a brand without forming a new legal entity. It’s vital to file the Harris Texas Certificate of Withdrawal of An Assumed Name if you decide to discontinue using a DBA. For easier navigation through the filing process, consider using USLegalForms.

Yes, a DBA can have different owners depending on the nature of the business structure. For example, if partnerships or LLCs hold the DBA, ownership can be shared among multiple parties. However, any changes to ownership must be properly documented, potentially requiring the filing of the Harris Texas Certificate of Withdrawal of An Assumed Name for the previous owner. Utilizing services like USLegalForms helps ensure that all ownership changes comply with Texas regulations.

Filing form 503 in Texas involves completing the form with the necessary business information and submitting it to the Secretary of State. This form serves to establish or renew your assumed name and can be filed online or via mail. Don’t forget, if you're withdrawing an existing name, you should also complete the Harris Texas Certificate of Withdrawal of An Assumed Name. USLegalForms offers user-friendly templates and guidance to assist you in this filing.

To transfer ownership of a DBA in Texas, you need to submit a new Assumed Name Certificate with the updated owner's information. This process includes filling out the Harris Texas Certificate of Withdrawal of An Assumed Name if you're replacing an existing DBA. Ensure you file the form with the appropriate county clerk's office where the DBA was originally registered. Using platforms like USLegalForms can simplify this process and ensure accuracy.

An assumed name certificate is valid for ten years in Texas. After this period, you will need to renew your certificate if you wish to continue using the name. If you decide to stop using the name, ensure that you file a Harris Texas Certificate of Withdrawal of An Assumed Name. Staying informed about these timeframes can help you maintain compliance with Texas law.

To abandon an assumed name in Texas, you must file a Harris Texas Certificate of Withdrawal of An Assumed Name with the appropriate county office. This process officially removes your business's assumed name from public records. It's essential to complete this step to prevent confusion or potential legal issues. Utilizing platforms like USLegalForms can simplify the form-filing process for you.