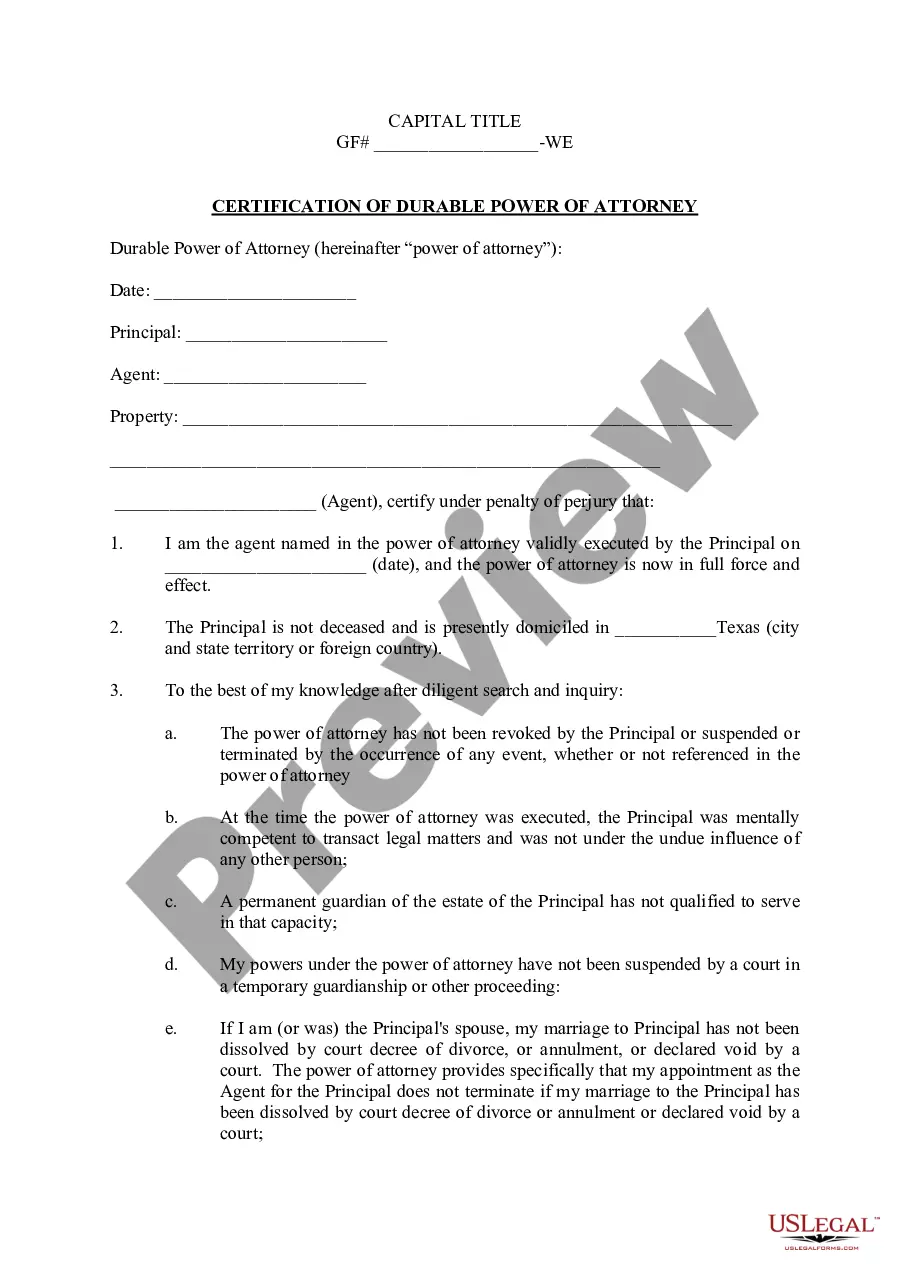

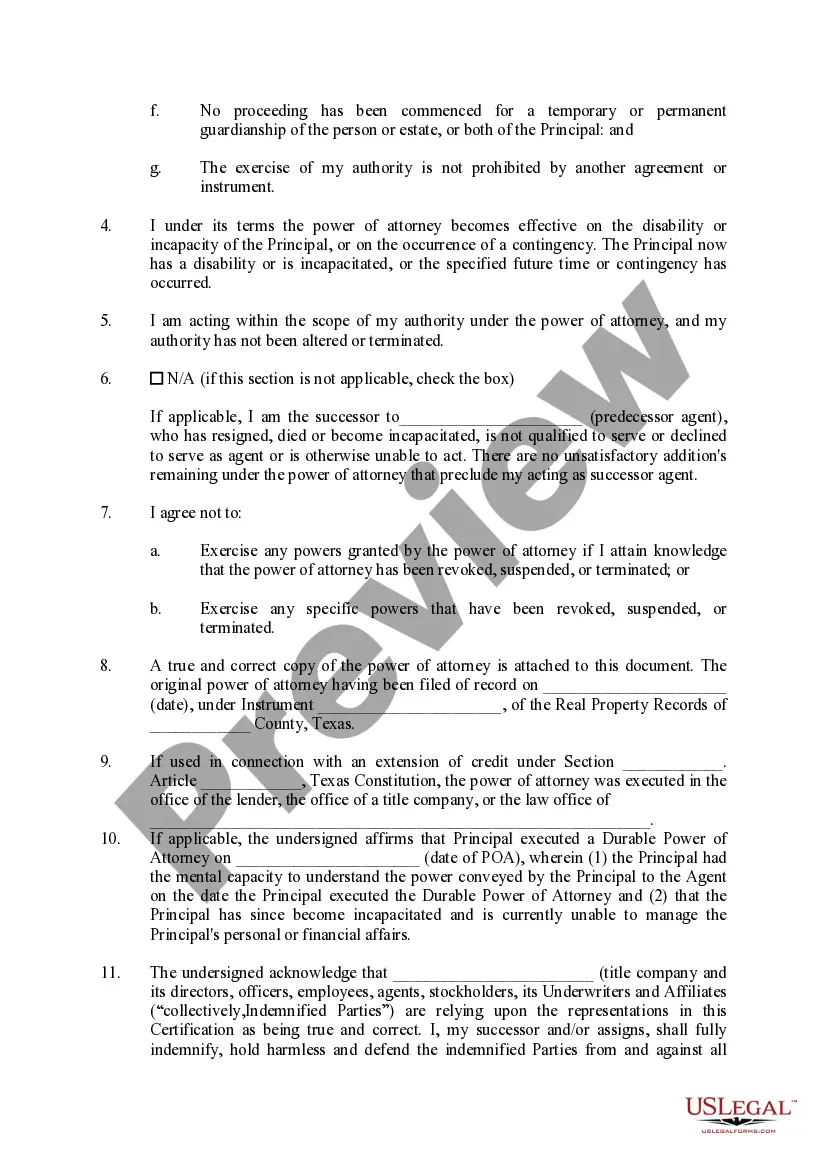

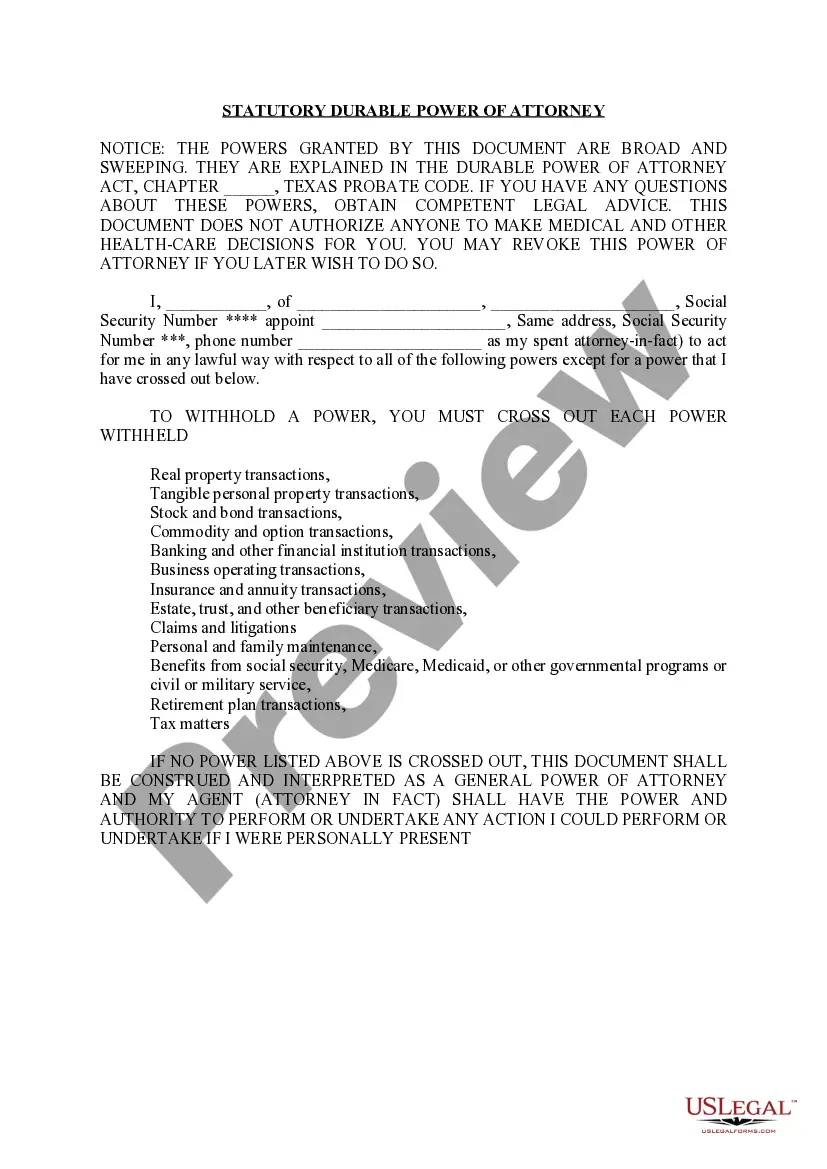

Bexar Texas Certification of Durable Power of Attorney

Description

How to fill out Texas Certification Of Durable Power Of Attorney?

Are you seeking a trustworthy and economical supplier of legal forms to obtain the Bexar Texas Certification of Durable Power of Attorney? US Legal Forms is your prime selection.

Whether you need a fundamental agreement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce process in court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business needs. All templates we provide access to are not generic but structured in compliance with the requirements of specific states and counties.

To retrieve the document, you must Log In to your account, locate the desired form, and press the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time in the My documents section.

Are you new to our service? No problem. You can easily create an account, but make sure to do the following first.

Now you can sign up for your account. Then select the subscription option and continue to payment. Once the payment is completed, download the Bexar Texas Certification of Durable Power of Attorney in any available file format. You can revisit the website whenever necessary and redownload the document at no additional cost.

Finding current legal forms has never been simpler. Try US Legal Forms now, and eliminate the hassle of spending hours searching for legal documents online once and for all.

- Verify that the Bexar Texas Certification of Durable Power of Attorney aligns with the laws of your state and locality.

- Review the details of the form (if available) to understand who and what the document is meant for.

- Restart your search if the form is unsuitable for your legal situation.

Form popularity

FAQ

In Texas, a durable power of attorney requires notarization to be legally effective. This requirement ensures the document meets state standards and provides necessary safeguards. If you want to ensure a smooth process for your Bexar Texas Certification of Durable Power of Attorney, working with a qualified platform like US Legal Forms can be beneficial. They provide templates and guidance to help you meet all legal requirements efficiently.

In Texas, you do not necessarily need a lawyer to create a durable power of attorney, such as the Bexar Texas Certification of Durable Power of Attorney. Many individuals choose to use online platforms like USLegalForms, which offer templates and guidance to help you prepare the necessary documents yourself. However, consulting a lawyer can provide extra assurance that your document meets all legal requirements and reflects your intentions accurately. Ultimately, the choice depends on your comfort level and complexity of your specific situation.

In Texas, you typically do not file a power of attorney, including a durable power of attorney, with the court. Instead, you retain the document in a secure location and present it when necessary. If your Bexar Texas Certification of Durable Power of Attorney involves real estate matters, you may want to record it in the county clerk’s office. Legal experts can clarify filing options based on your specific needs.

To file a durable power of attorney in Texas, you generally do not need to file it with the court. Ensuring that the document is properly signed, dated, and notarized is sufficient for its validity. For those with a Bexar Texas Certification of Durable Power of Attorney, make sure to keep the document in a safe place. Consult legal resources or professionals if you have questions.

No, a durable power of attorney does not need to be filed with the court in Texas. The document remains valid as long as it is properly signed and notarized. For individuals pursuing a Bexar Texas Certification of Durable Power of Attorney, understanding this process can ease your concerns. It's beneficial to seek advice if you're unsure about filing.

A durable power of attorney does not need to be recorded in Texas to remain effective; however, recording may be recommended in specific circumstances. If the durable power of attorney involves real estate, recording it can protect the agent’s authority. Hence, for those managing a Bexar Texas Certification of Durable Power of Attorney, considering recording is wise. Legal assistance can guide you on this process.

In Texas, a power of attorney (POA) does not have to be filed with the court to be effective. However, certain legal situations may call for documentation to be presented in court. If you are obtaining a Bexar Texas Certification of Durable Power of Attorney, understanding when and how to file can be beneficial. Consulting with a legal professional can provide clarity.

A legal power of attorney cannot make decisions regarding the principal’s personal care, end-of-life decisions, or any decision that the principal explicitly excludes in the document. This limitation helps ensure that the principal’s wishes are respected. When drafting a Bexar Texas Certification of Durable Power of Attorney, clarity about these boundaries is crucial. Always consider legal advice to cover all bases.

In Texas, a power of attorney does not need to be recorded to be valid. However, if the power of attorney involves real estate transactions, it is advisable to record it. For those creating a Bexar Texas Certification of Durable Power of Attorney, recording can strengthen its legality in certain situations. Always consult a legal expert for personalized guidance.

In Texas, a Power of Attorney does not typically need to be recorded with the county clerk. However, if you intend to use the POA for real estate transactions, recording it can provide additional protection. When preparing your Bexar Texas Certification of Durable Power of Attorney, consider your specific needs and whether recording is beneficial for your situation. For comprehensive guidance, the USLegalForms platform can assist you in preparing the necessary documents.