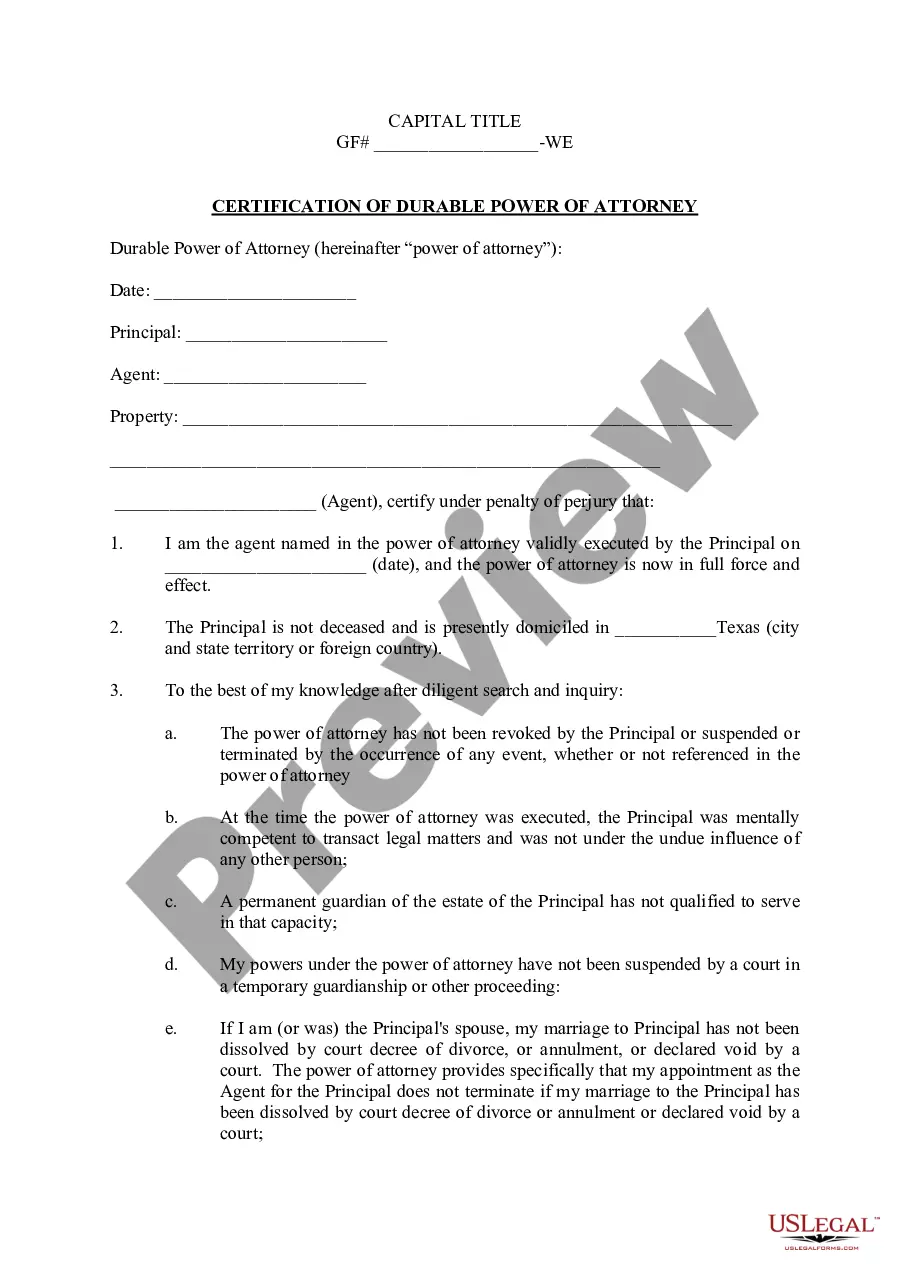

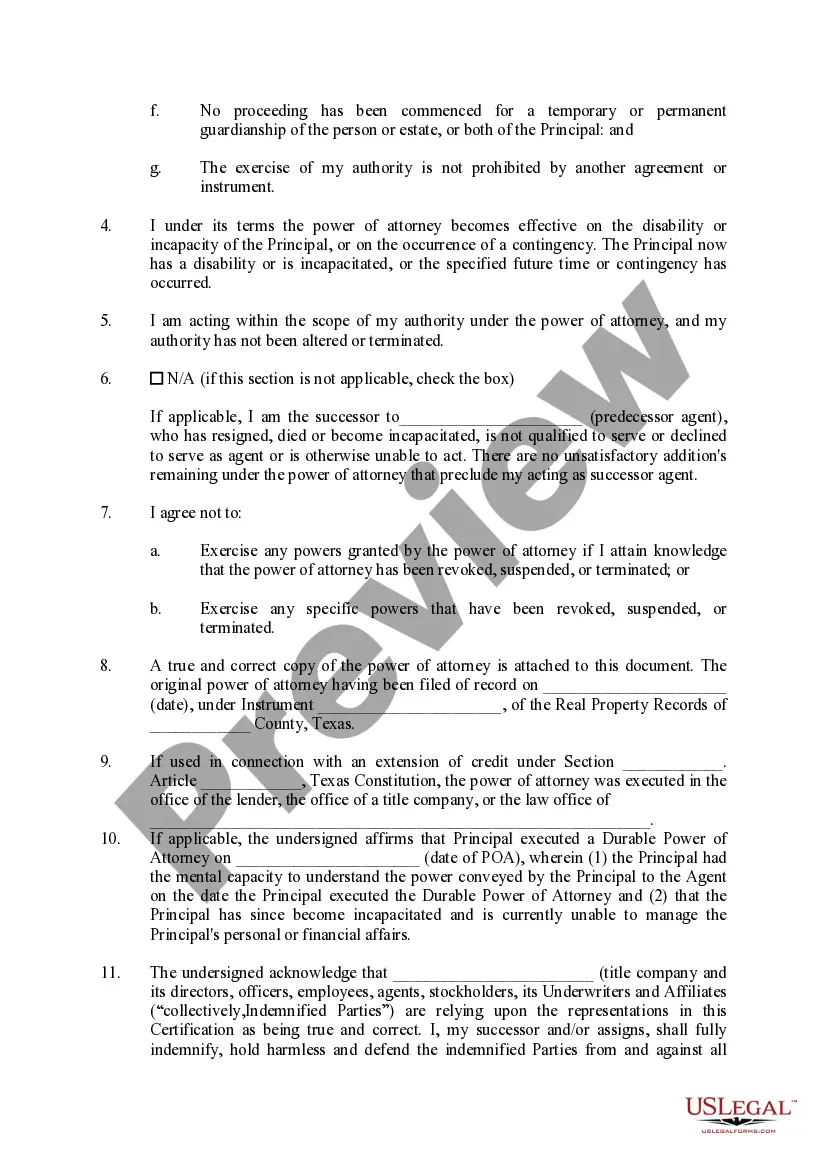

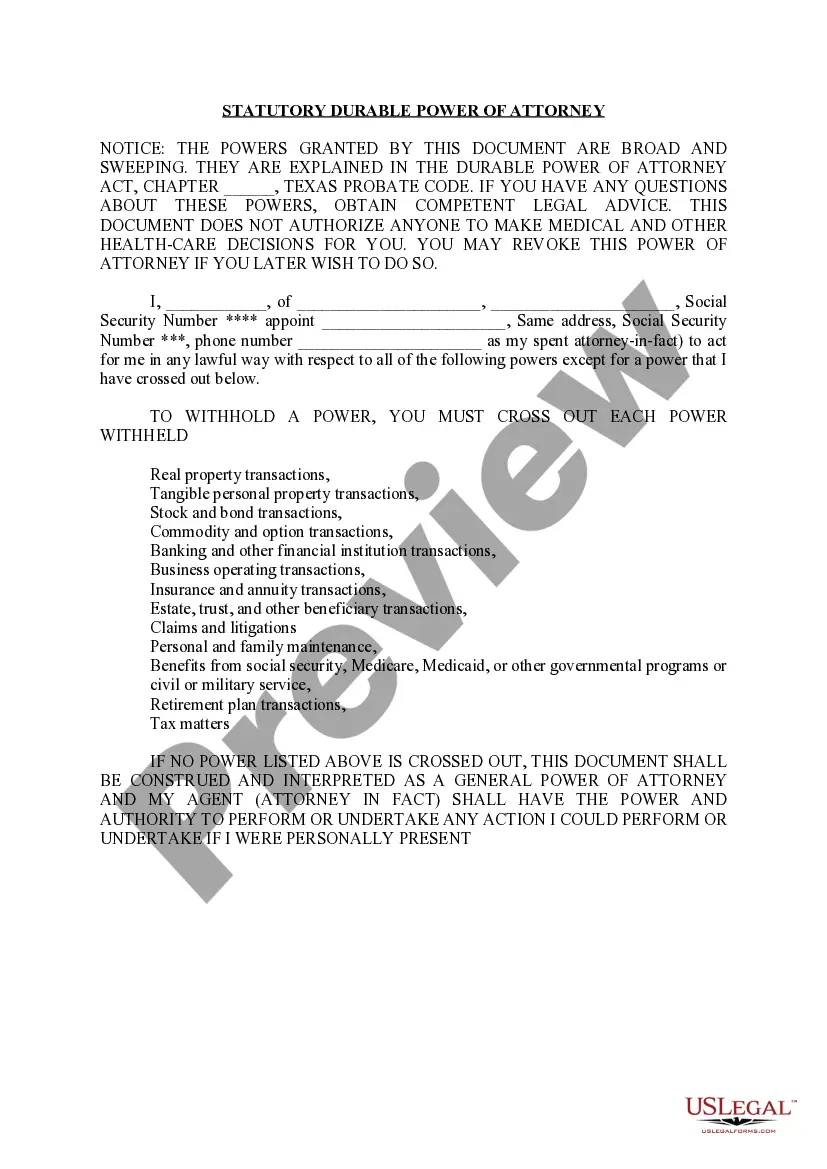

The Houston Texas Certification of Durable Power of Attorney (CPA) is a legal document that grants authority to an individual, known as the agent or attorney-in-fact, to make important financial and business decisions on behalf of another person, known as the principal. This document remains effective even if the principal becomes incapacitated or unable to make decisions for themselves. The CPA is governed by the Texas Estates Code, specifically the Title 2, Chapter XIII. It serves as a safeguard for individuals who want to ensure their affairs are handled appropriately in the event they are unable to do so themselves. This certification is important because it provides a legally recognized power of attorney that allows agents to act on behalf of the principal with the full authority to manage their financial, real estate, and personal business matters. There are different types of Houston Texas Certification of Durable Power of Attorney that can be established, depending on the specific needs and preferences of the principal: 1. General CPA: This type of durable power of attorney grants broad authority to the agent, allowing them to make financial and business decisions on behalf of the principal, as specified in the document. 2. Limited CPA: In this case, the durable power of attorney grants the agent specific powers and limits their authority to a particular area or transaction. For example, it may authorize the agent to handle real estate transactions but not healthcare decisions. 3. Springing CPA: This type of durable power of attorney only becomes effective upon the occurrence of a specified event, typically the incapacity or disability of the principal. Until that event occurs, the agent does not have any authority to act on behalf of the principal. Regardless of the type, the CPA in Houston, Texas requires certain specific elements to be valid. It should be in writing, signed by the principal, and witnessed by two or more competent individuals who are at least 18 years old. The principal must also be of sound mind at the time of signing the CPA. It is crucial to consult with an attorney experienced in estate planning when creating a Houston Texas Certification of Durable Power of Attorney to ensure it complies with all legal requirements and meets the specific needs and goals of the principal. As laws may vary and change over time, obtaining professional advice ensures that the document is properly drafted and executed in accordance with applicable regulations.

Houston Texas Certification of Durable Power of Attorney

State:

Texas

City:

Houston

Control #:

TX-LR021T

Format:

Word;

Rich Text

Instant download

Description

This Power of Attorney stays in effect if you become incapacitated and unable to handle matters on your own.

The Houston Texas Certification of Durable Power of Attorney (CPA) is a legal document that grants authority to an individual, known as the agent or attorney-in-fact, to make important financial and business decisions on behalf of another person, known as the principal. This document remains effective even if the principal becomes incapacitated or unable to make decisions for themselves. The CPA is governed by the Texas Estates Code, specifically the Title 2, Chapter XIII. It serves as a safeguard for individuals who want to ensure their affairs are handled appropriately in the event they are unable to do so themselves. This certification is important because it provides a legally recognized power of attorney that allows agents to act on behalf of the principal with the full authority to manage their financial, real estate, and personal business matters. There are different types of Houston Texas Certification of Durable Power of Attorney that can be established, depending on the specific needs and preferences of the principal: 1. General CPA: This type of durable power of attorney grants broad authority to the agent, allowing them to make financial and business decisions on behalf of the principal, as specified in the document. 2. Limited CPA: In this case, the durable power of attorney grants the agent specific powers and limits their authority to a particular area or transaction. For example, it may authorize the agent to handle real estate transactions but not healthcare decisions. 3. Springing CPA: This type of durable power of attorney only becomes effective upon the occurrence of a specified event, typically the incapacity or disability of the principal. Until that event occurs, the agent does not have any authority to act on behalf of the principal. Regardless of the type, the CPA in Houston, Texas requires certain specific elements to be valid. It should be in writing, signed by the principal, and witnessed by two or more competent individuals who are at least 18 years old. The principal must also be of sound mind at the time of signing the CPA. It is crucial to consult with an attorney experienced in estate planning when creating a Houston Texas Certification of Durable Power of Attorney to ensure it complies with all legal requirements and meets the specific needs and goals of the principal. As laws may vary and change over time, obtaining professional advice ensures that the document is properly drafted and executed in accordance with applicable regulations.

Free preview

How to fill out Houston Texas Certification Of Durable Power Of Attorney?

If you’ve already utilized our service before, log in to your account and download the Houston Texas Certification of Durable Power of Attorney on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Houston Texas Certification of Durable Power of Attorney. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!