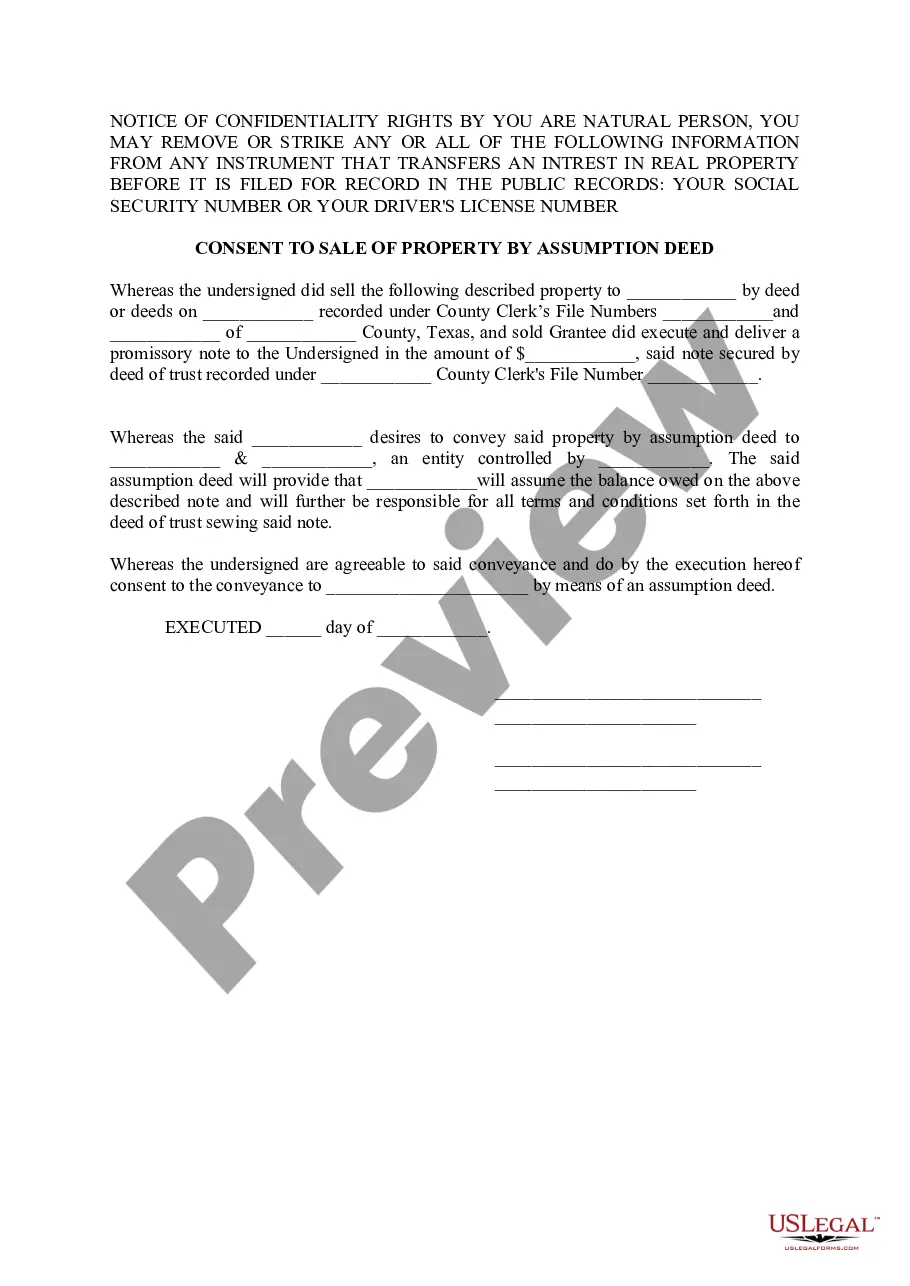

Harris Texas Consent to Sale of Property By Assumption Deed refers to a legal document that grants permission for the sale of a property by assuming existing debts and liabilities. This means that the buyer is taking over the responsibility for any outstanding mortgage, loans, or other obligations associated with the property. The Harris Texas Consent to Sale of Property By Assumption Deed is a crucial document required in property transactions where the buyer intends to assume the existing debt(s) tied to the property. It ensures that all parties involved are aware of and agree to the terms and conditions of the assumption. This document protects the interests of both the buyer and the seller by clarifying their respective rights and responsibilities. There may be different types of Harris Texas Consent to Sale of Property By Assumption Deed, depending on specific circumstances and requirements. Some variations or additional terms commonly seen include: 1. Residential Property Consent to Sale of Property By Assumption Deed: This type is used for residential properties, such as single-family homes, townhouses, or condominiums. 2. Commercial Property Consent to Sale of Property By Assumption Deed: This variant applies to commercial properties, including office buildings, retail spaces, industrial properties, and more. 3. Land/Real Estate Consent to Sale of Property By Assumption Deed: This type is specific to the transfer of ownership for undeveloped land or real estate. 4. Mortgage-assumption Consent to Sale of Property By Assumption Deed: This version focuses solely on assuming the mortgage taken out on the property. Key elements found in a Harris Texas Consent to Sale of Property By Assumption Deed typically include: 1. Identification of Parties: Names, addresses, and contact information of the buyer(s) and seller(s) involved in the transaction. 2. Property Details: A detailed description of the property being sold, including address, legal description, and any pertinent identifying information. 3. Assumption Terms: Clear indication that the buyer intends to assume the existing debts, liabilities, or mortgage associated with the property. 4. Release of Liability: A provision absolving the seller from any future responsibility for the assumed debts or liabilities after the sale. 5. Purchase Price: The agreed-upon purchase price for the property, which may or may not include the assumed debts. 6. Payment Terms: Details regarding the payment method, installment plans, or any other payment arrangements agreed upon by both parties. 7. Signatures and Notarization: Both the buyer and the seller must sign the Consent to Sale of Property By Assumption Deed in the presence of a notary public to authenticate the document's legality. It is essential to consult with legal professionals or real estate agents familiar with Texas property laws to ensure compliance with the specific requirements of a Harris Texas Consent to Sale of Property By Assumption Deed.

Harris Texas Consent to Sale of Property By Assumption Deed Assumption Deed

Description

How to fill out Harris Texas Consent To Sale Of Property By Assumption Deed Assumption Deed?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney services that, as a rule, are very expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Harris Texas Consent to Sale of Property By Assumption Deed or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Harris Texas Consent to Sale of Property By Assumption Deed complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Harris Texas Consent to Sale of Property By Assumption Deed would work for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!