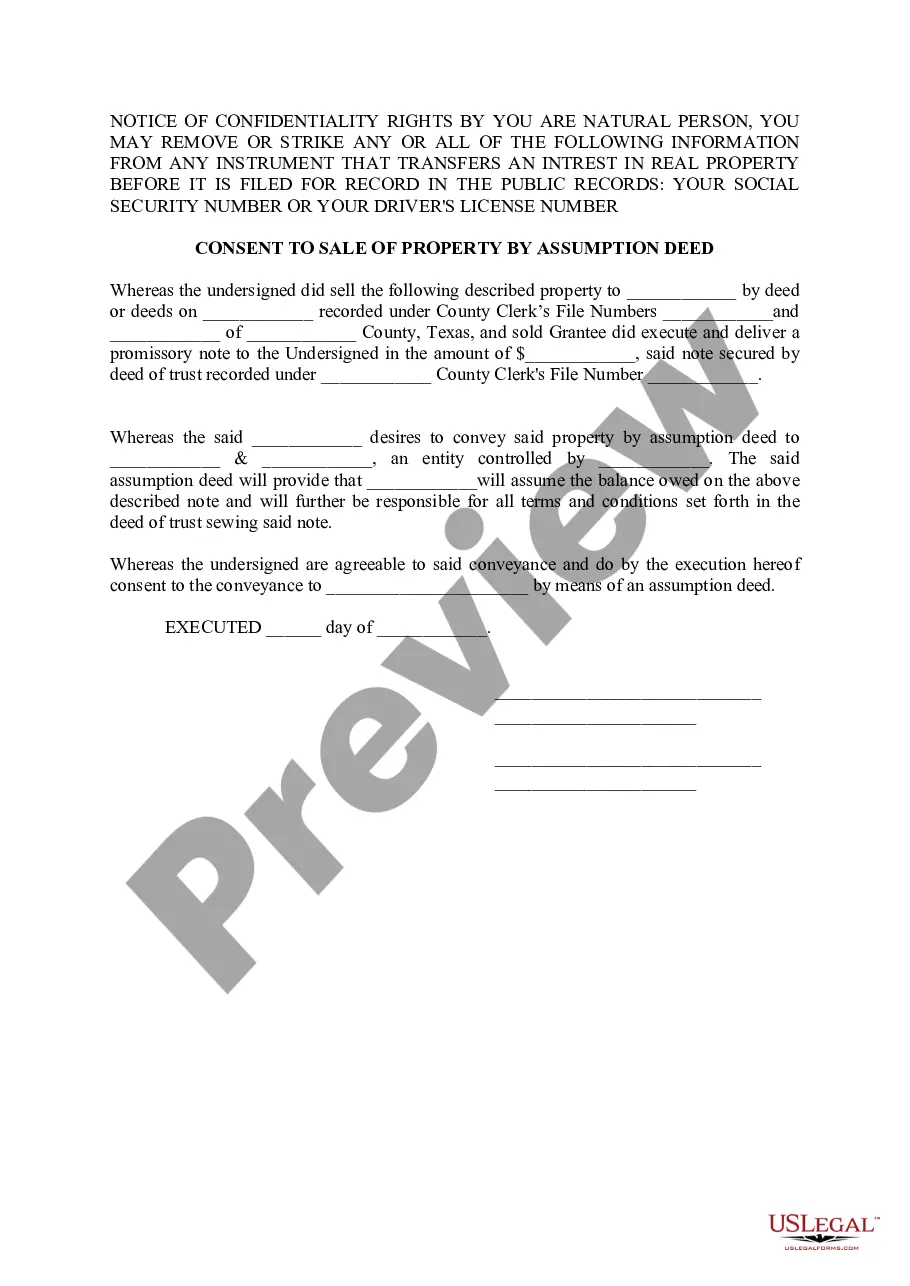

McKinney Texas Consent to Sale of Property By Assumption Deed is a legal document used in real estate transactions where a property owner intends to sell their property while allowing the buyer to assume the existing mortgage. The Consent to Sale of Property By Assumption Deed serves as the agreement between the seller, the buyer, and the mortgage lender, granting permission for the property to be sold subject to the assumption of the existing mortgage. This type of transaction is commonly used when the property has an existing mortgage with favorable terms, and the buyer is willing to take on the responsibility of paying off the loan. The Consent to Sale of Property By Assumption Deed outlines various key details such as the names and contact information of the parties involved, the property's legal description, the mortgage loan details, and the terms and conditions of the assumption. It is crucial to consult with an attorney or real estate professional when drafting or executing this document to ensure compliance with Texas law. Different types of McKinney Texas Consent to Sale of Property By Assumption Deeds may include variations based on the specific terms and conditions agreed upon by the parties involved. Some key variations may pertain to the transfer of title, the assumption of mortgage payments, liabilities and obligations, and any additional contingencies or provisions that may be required by the parties. It is important to note that the McKinney Texas Consent to Sale of Property By Assumption Deed is a legally binding document, and all parties involved should fully understand the implications and responsibilities associated with the assumption of the existing mortgage. Seeking legal advice and conducting thorough due diligence prior to entering into such an agreement is highly recommended protecting the rights and interests of all parties involved. Overall, the McKinney Texas Consent to Sale of Property By Assumption Deed facilitates a smooth and legal transfer of property ownership while allowing the buyer to assume the existing mortgage. This option can be advantageous for both the seller, who can avoid paying off the mortgage, and the buyer, who can take advantage of favorable loan terms.

McKinney Texas Consent to Sale of Property By Assumption Deed Assumption Deed

Description

How to fill out McKinney Texas Consent To Sale Of Property By Assumption Deed Assumption Deed?

Benefit from the US Legal Forms and have immediate access to any form template you want. Our beneficial website with a large number of templates allows you to find and get almost any document sample you require. You are able to save, fill, and sign the McKinney Texas Consent to Sale of Property By Assumption Deed in just a matter of minutes instead of surfing the Net for several hours looking for an appropriate template.

Using our library is a superb way to raise the safety of your form filing. Our experienced lawyers regularly review all the records to make sure that the templates are relevant for a particular region and compliant with new laws and polices.

How can you get the McKinney Texas Consent to Sale of Property By Assumption Deed? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. Furthermore, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the tips listed below:

- Find the form you need. Make sure that it is the template you were hoping to find: check its name and description, and take take advantage of the Preview option when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Download the file. Indicate the format to obtain the McKinney Texas Consent to Sale of Property By Assumption Deed and modify and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable template libraries on the internet. Our company is always happy to help you in any legal case, even if it is just downloading the McKinney Texas Consent to Sale of Property By Assumption Deed.

Feel free to benefit from our service and make your document experience as efficient as possible!