Abilene Texas Lien-Property refers to the legal claim imposed on a property owner's assets, typically as a result of unpaid debts or obligations. It provides the creditor with the right to seize and sell the property to recover the outstanding debt. There are several types of liens commonly seen in Abilene, Texas, each serving different purposes and originating from different sources. Understanding these various types of liens can be crucial for property owners and potential buyers alike. Here are some of the types of Abilene Texas Lien-Property: 1. Tax Lien: A tax lien is imposed by the government authorities when property owners fail to pay their property taxes. These liens are typically prioritized over other types of liens and may result in foreclosure if left unpaid for an extended period. 2. Mechanic's Lien: Also known as a construction lien, this type of lien is filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services to improve a property but haven't received payment. Mechanic's liens ensure that these contractors have a claim on the property to ensure their compensation. 3. Mortgage Lien: A mortgage lien is created when a property is used as collateral for a loan, usually a mortgage. The lender (mortgage holder) has a legal claim to the property until the mortgage is paid off. Failure to repay the loan may lead to foreclosure. 4. Judgment Lien: A judgment lien is placed on a property when the property owner loses a lawsuit, and the court orders them to pay a particular amount to the victorious party (judgment creditor). To secure payment, the creditor may place a lien on the debtor's property. 5. HOA Lien: Homeowners Association (HOA) liens are filed against properties when the owner fails to pay their HOA fees or violates certain provisions outlined by the association. These liens can result in foreclosure if the debt remains unresolved. 6. State or Federal Tax Lien: These liens are imposed by state or federal government agencies when an individual or business owes unpaid taxes to the respective government entities. They are similar to tax liens but arise from different tax obligations. 7. Child Support Lien: A child support lien is initiated when a parent falls behind on their child support payments. The lien is placed on their property as a means to enforce payment. It's important for property owners in Abilene, Texas, to address any liens promptly to avoid further legal complications and potential foreclosure. Buyers should also conduct thorough title searches to uncover any existing liens before purchasing a property to mitigate potential liabilities.

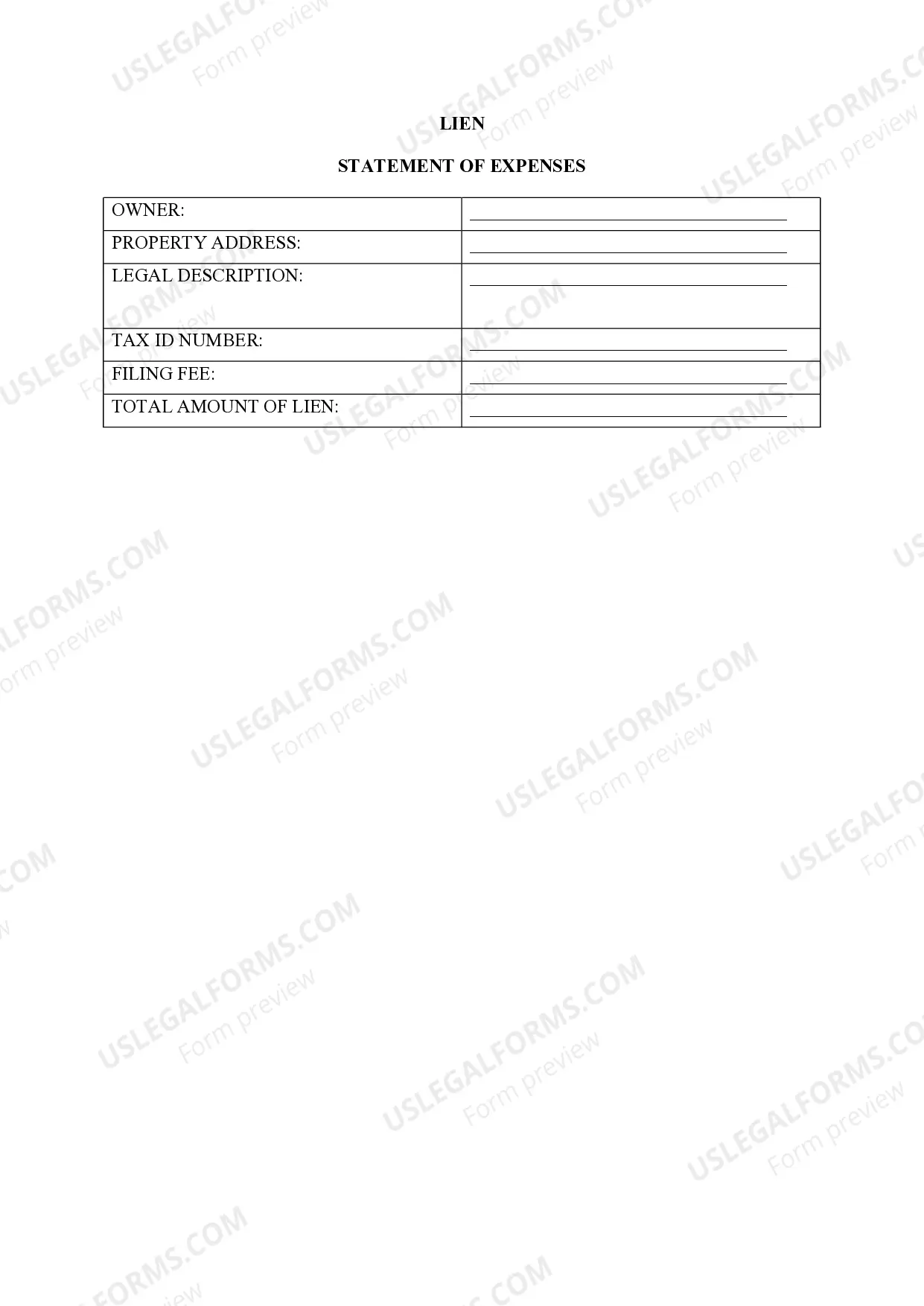

Abilene Texas Lien -Property

Description

How to fill out Abilene Texas Lien -Property?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, as a rule, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Abilene Texas Lien -Property or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Abilene Texas Lien -Property complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Abilene Texas Lien -Property would work for you, you can select the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!