Amarillo Texas Lien-Property refers to a legal claim or encumbrance on real estate situated in Amarillo, Texas. When a lien is placed on a property, it means that the property owner owes a debt or obligation to another individual or entity, and the lien serves as security or collateral for that debt. In Amarillo, there are several types of liens that can be placed on properties, each with its own implications and consequences. 1. Mechanics Lien: This type of lien is filed by contractors, subcontractors, or suppliers who have not been paid for labor, materials, or services provided for the improvement of a property. A Mechanics Lien allows the filer to seek payment by forcing a sale of the property if the debt remains unpaid. 2. Mortgage Lien: A mortgage lien is a common lien placed on a property by a lender when the property owner borrows money to purchase or refinance the property. The lien gives the lender the right to foreclose on the property if the borrower defaults on the loan payments. 3. Tax Lien: This type of lien is imposed by the government, typically the county or state, when property owners fail to pay their property taxes. The lien allows the government to collect the unpaid taxes by seizing and selling the property. 4. Judgment Lien: A judgment lien is obtained when someone wins a lawsuit against a property owner and fails to collect the awarded judgment. The lien is placed on the property as a means to secure payment of the debt. 5. Homeowners Association (HOA) Lien: In Amarillo, properties located within homeowners associations may be subject to HOA liens. If a homeowner fails to pay their HOA fees, the association can place a lien on the property, which may lead to foreclosure if the debt remains unpaid. It is crucial for property owners in Amarillo, Texas, to be aware of these various liens and understand the potential consequences associated with each. In the event of a lien, property owners should seek legal advice to navigate the process and protect their interests.

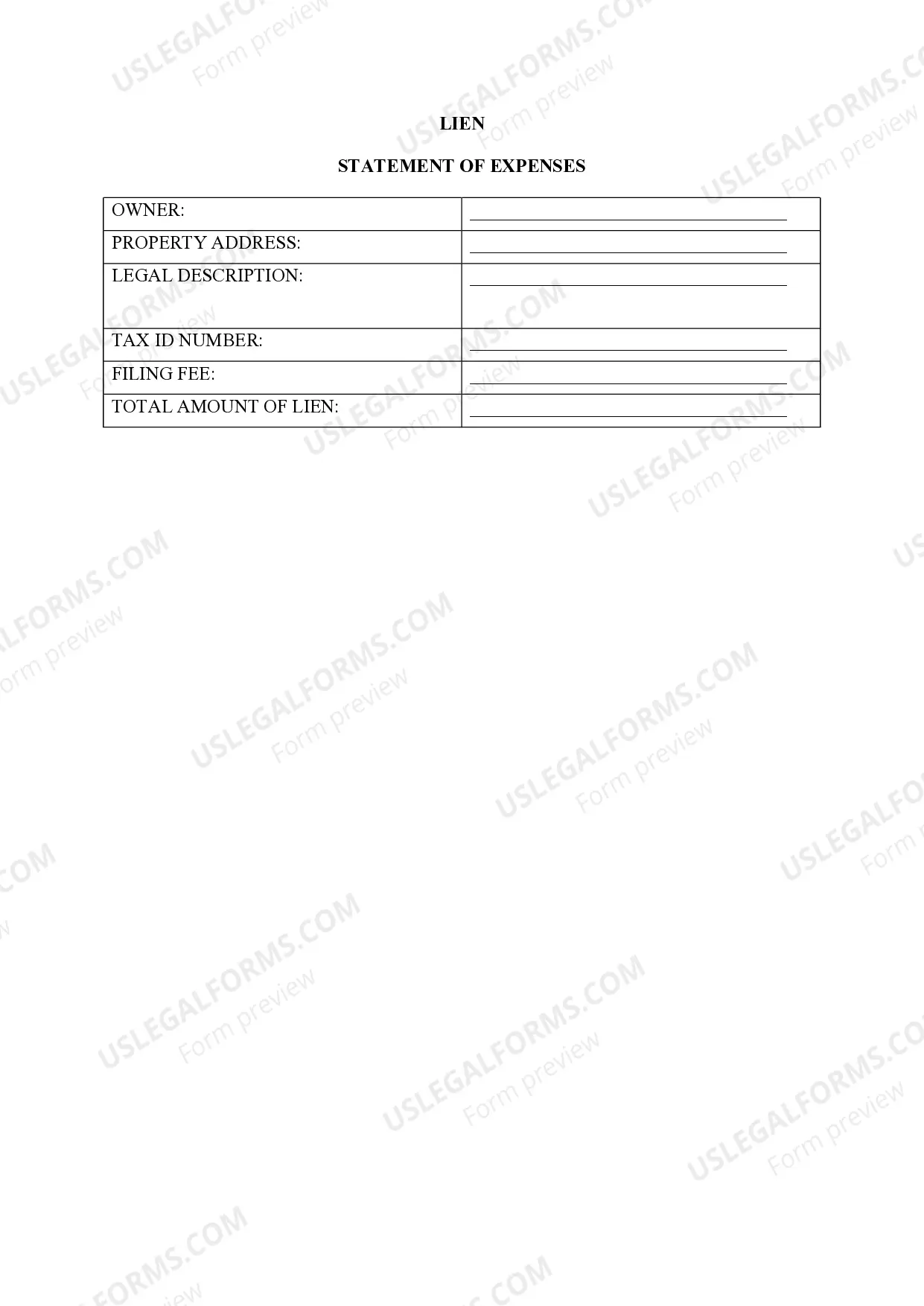

Amarillo Texas Lien -Property

Description

How to fill out Amarillo Texas Lien -Property?

Do you need a reliable and inexpensive legal forms provider to get the Amarillo Texas Lien -Property? US Legal Forms is your go-to option.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked based on the requirements of specific state and county.

To download the form, you need to log in account, find the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Amarillo Texas Lien -Property conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is good for.

- Start the search over in case the form isn’t suitable for your legal scenario.

Now you can create your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Amarillo Texas Lien -Property in any available format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours learning about legal papers online once and for all.