Beaumont Texas Lien-Property: A lien is a legal claim imposed by one party over the property of another as security or payment for a debt or obligation. In Beaumont, Texas, a lien-property refers to the various types of liens that can be placed on real estate within the city limits. These liens, aimed to protect the rights and interests of creditors, can have different applications and implications depending on the circumstances. Here are some of the common types of Beaumont Texas Lien-Property: 1. Mechanics Lien: A mechanics lien, also known as a construction lien, can be filed by contractors, subcontractors, or suppliers who haven't received full payment for labor or materials provided to improve a property. This lien is often placed to ensure timely payment and can be enforced through legal action or foreclosure if necessary. 2. Tax Lien: A tax lien is a claim imposed by a government entity, typically the city or county, against a property due to unpaid property taxes. The lien is intended to secure the government's right to collect the owed taxes and can result in the eventual sale of the property at a tax foreclosure auction if the debt remains unpaid for an extended period. 3. Mortgage Lien: When taking out a mortgage to purchase a property, the lender (usually a financial institution) will place a mortgage lien on the property. This lien serves as a security interest, allowing the lender to foreclose on the property if the borrower defaults on the mortgage payments. 4. Judgment Lien: Should a person obtain a judgment against another party in a court of law for a debt owed, they can place a judgment lien on the debtor's property. This lien ensures that the creditor has a claim on the property and can potentially satisfy the debt through the sale or refinancing of the property. 5. HOA/Condominium Lien: Homeowners' associations (Has) and condominium associations may file a lien on a property when a homeowner fails to pay association fees, assessments, or fines. This lien serves to secure the association's right to collect the outstanding dues and can also lead to foreclosure if the debt remains unresolved. 6. IRS Tax Lien: If an individual or business fails to pay federal taxes, the Internal Revenue Service (IRS) may place a tax lien on their property. These liens are aimed at ensuring the government's ability to collect the unpaid taxes and can significantly impact the individual's ability to sell or refinance the property. In summary, Beaumont Texas lien-property refers to the different types of liens that can be placed on real estate in Beaumont. These liens serve as a legal claim, protecting the rights of creditors and ensuring the payment of debts and obligations related to the property.

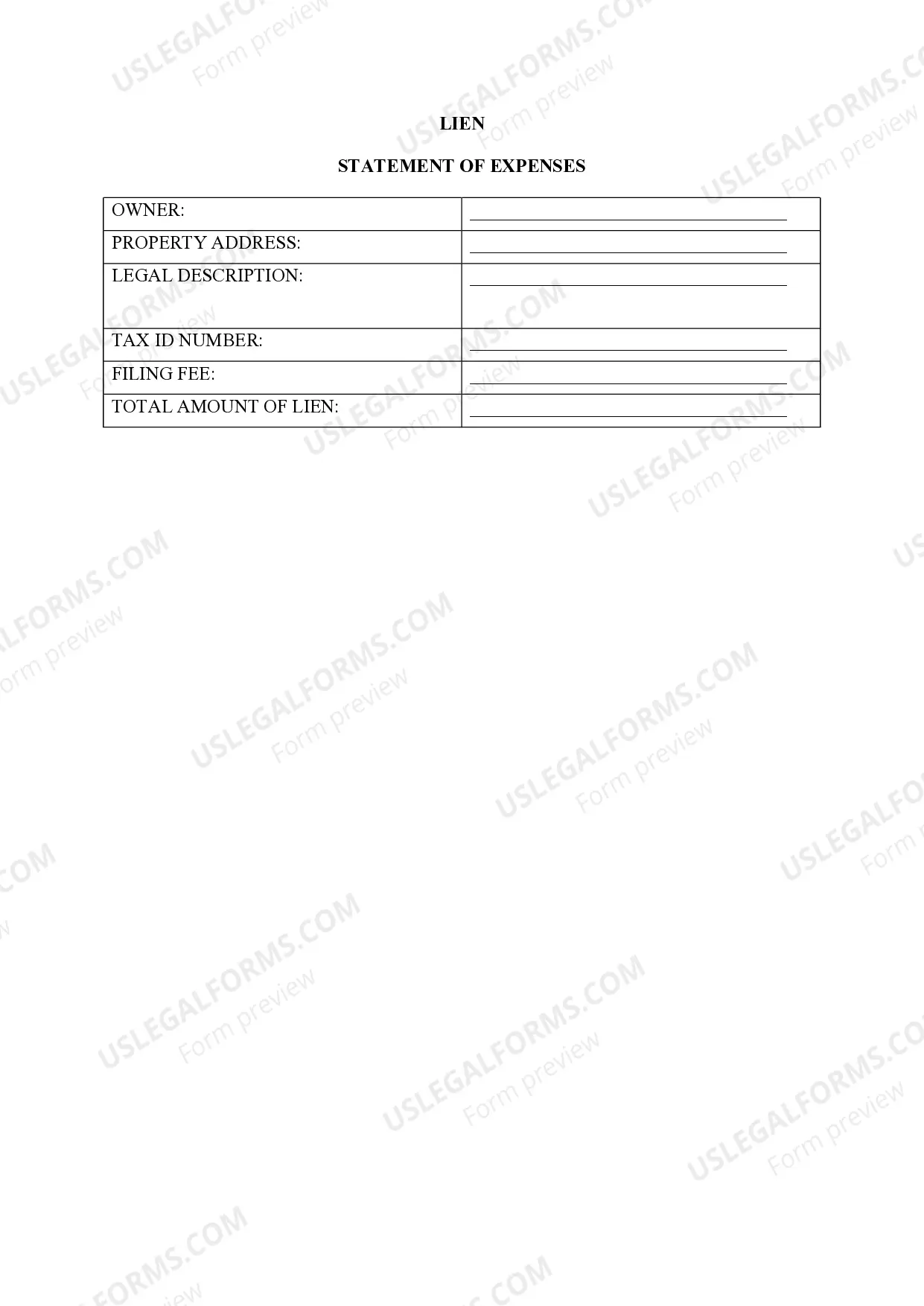

Beaumont Texas Lien -Property

Description

How to fill out Beaumont Texas Lien -Property?

Are you looking for a trustworthy and affordable legal forms provider to get the Beaumont Texas Lien -Property? US Legal Forms is your go-to option.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed based on the requirements of separate state and area.

To download the document, you need to log in account, find the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Beaumont Texas Lien -Property conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the document is intended for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Beaumont Texas Lien -Property in any available format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal paperwork online for good.