Collin Texas Lien-Property refers to a legal claim on a property located in Collin County, Texas. A lien is typically placed on a property to ensure payment for a debt or obligation owed by the property owner. This detailed description will shed light on the different types of Collin Texas Lien-Property and their significance. 1. Mechanic's Lien: A mechanic's lien in Collin County, Texas, is a type of lien that is filed by contractors, subcontractors, or material suppliers who haven't been paid for work done or materials provided for a construction project. This lien provides them with the right to seek payment by forcing the sale of the property. 2. Tax Lien: A tax lien in Collin County, Texas, is placed on a property when the owner fails to pay property taxes. These liens are enforced by the county government and can ultimately lead to the sale of the property if the taxes remain unpaid. Tax lien properties can often be purchased at tax lien auctions. 3. Judgement Lien: A judgement lien in Collin County, Texas, is typically obtained through a court judgement stating that the property owner owes a debt to a creditor. This lien allows the creditor to have a legal claim to the property, and they can seek to satisfy the debt by collecting from the sale proceeds if the property is sold. 4. Homeowners Association (HOA) Lien: Homeowners associations have the authority in Collin County, Texas, to place a lien on a property if the homeowner fails to pay their dues or violates the HOA rules. This lien allows the HOA to take legal action to enforce payment or even initiate foreclosure proceedings. It's important for property owners in Collin County, Texas, to be aware of these different types of liens as they can have serious implications on property ownership and can potentially affect one's ability to sell or refinance the property. Prospective buyers should also thoroughly investigate a property's title history to ensure there are no outstanding liens that could become their responsibility upon purchase. Seeking legal advice or conducting a title search can provide valuable insights regarding any potential liens on a property in Collin County, Texas.

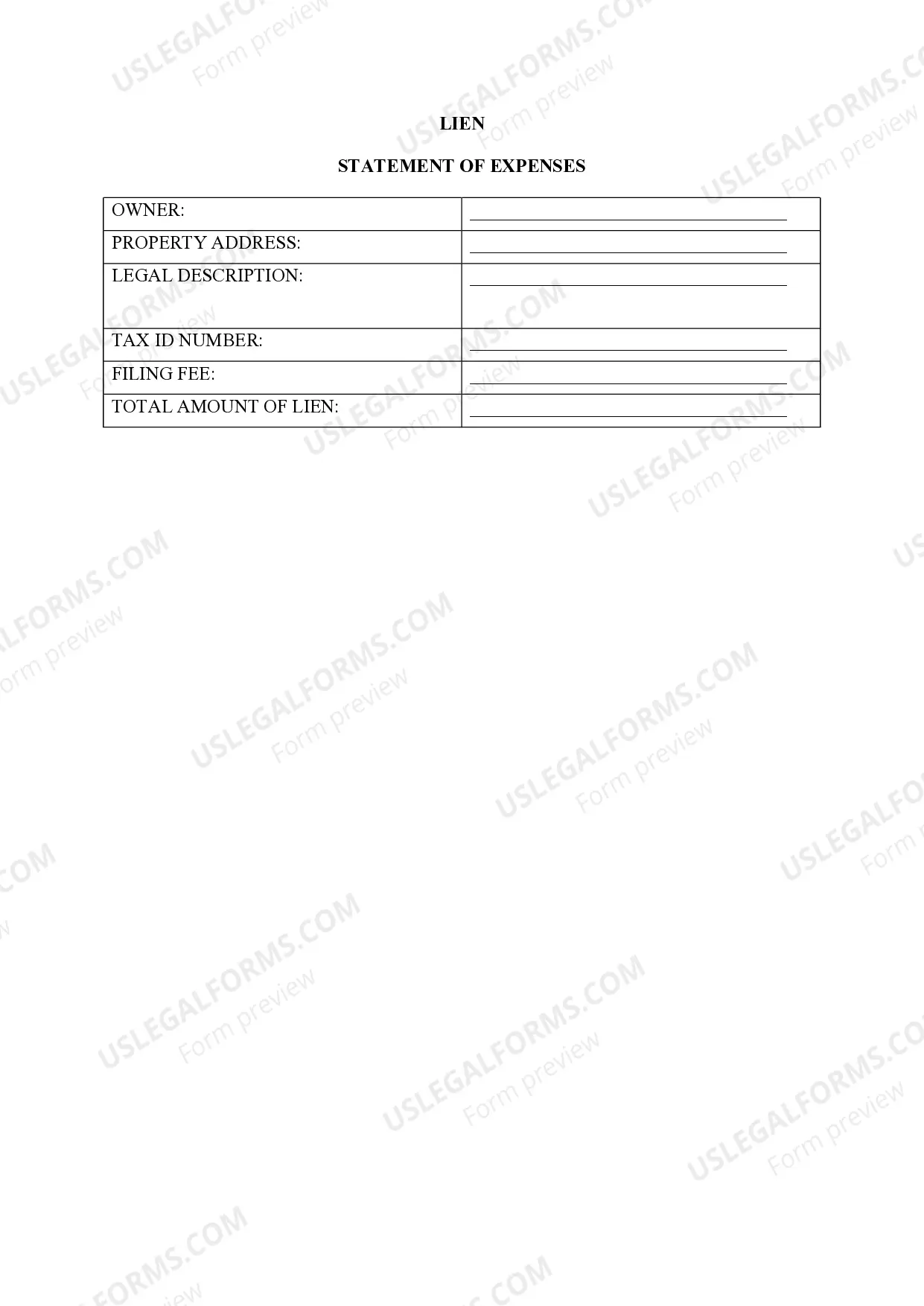

Collin Texas Lien -Property

Description

How to fill out Collin Texas Lien -Property?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone with no legal education to create such paperwork cfrom the ground up, mostly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our service provides a huge catalog with over 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you want the Collin Texas Lien -Property or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Collin Texas Lien -Property in minutes employing our trusted service. In case you are already a subscriber, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are new to our library, ensure that you follow these steps prior to downloading the Collin Texas Lien -Property:

- Ensure the template you have found is suitable for your area since the rules of one state or area do not work for another state or area.

- Preview the form and read a brief outline (if provided) of scenarios the paper can be used for.

- In case the form you picked doesn’t suit your needs, you can start again and look for the needed form.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your login information or create one from scratch.

- Pick the payment method and proceed to download the Collin Texas Lien -Property as soon as the payment is completed.

You’re good to go! Now you can go on and print out the form or fill it out online. In case you have any problems getting your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: PREFERRED METHOD If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317). The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

Visit the nearest TxDMV regional service center. Complete the Application for a Certified Copy of Title (Form VTR-34). NOTE: All recorded owners must sign the form and provide photo ID (or a copy) at time of application.

While some states require the signatures to be notarized, Texas doesn't. You can have your signatures notarized if you wish, but this isn't a required step to legally transfer a title in your state.

State governments issue car titles, typically through their department of motor vehicles or a similar agency. If you need a replacement car title, you can get one online, in person, or by mail, depending on the state.

The electronic title is created and held by TxDMV in the state motor vehicle database....Participation in ELT Complete the ELT intake form. Sign our Service Level Agreement (SLA) Meet TxDMV's Technical Specifications. Complete technical certification testing. Submit forms via email to VTRe-Titles@txdmv.gov.

To get your Texas license plates and registration sticker, visit your local county tax-assessor collector office. You will need your insurance card, the Vehicle Inspection Report issued by the inspection station, and proof that you own the vehicle such as the registration or title from your previous state.

To transfer a Texas titled vehicle, bring in or mail the following to our offices: Texas title, signed and dated by the seller(s) and buyer(s).VTR-130U (Application for Texas title), signed and dated by the seller(s) and buyer(s).Proof of insurance in the buyer's name. Acceptable form of ID. Proof of inspection. Fees.

How do I get a copy of my Texas title? If your Texas title is lost or never received, a replacement title can be obtained in person or by mail through a Texas Department of Motor Vehicles Regional Service Center. A replacement is referred to as a Certified Copy of Title.

The title fee is $33, plus motor-vehicle sales tax (6.25 percent). There is also a $2.50 transfer of a current registration fee. If the license is not current, there may be a registration fee.