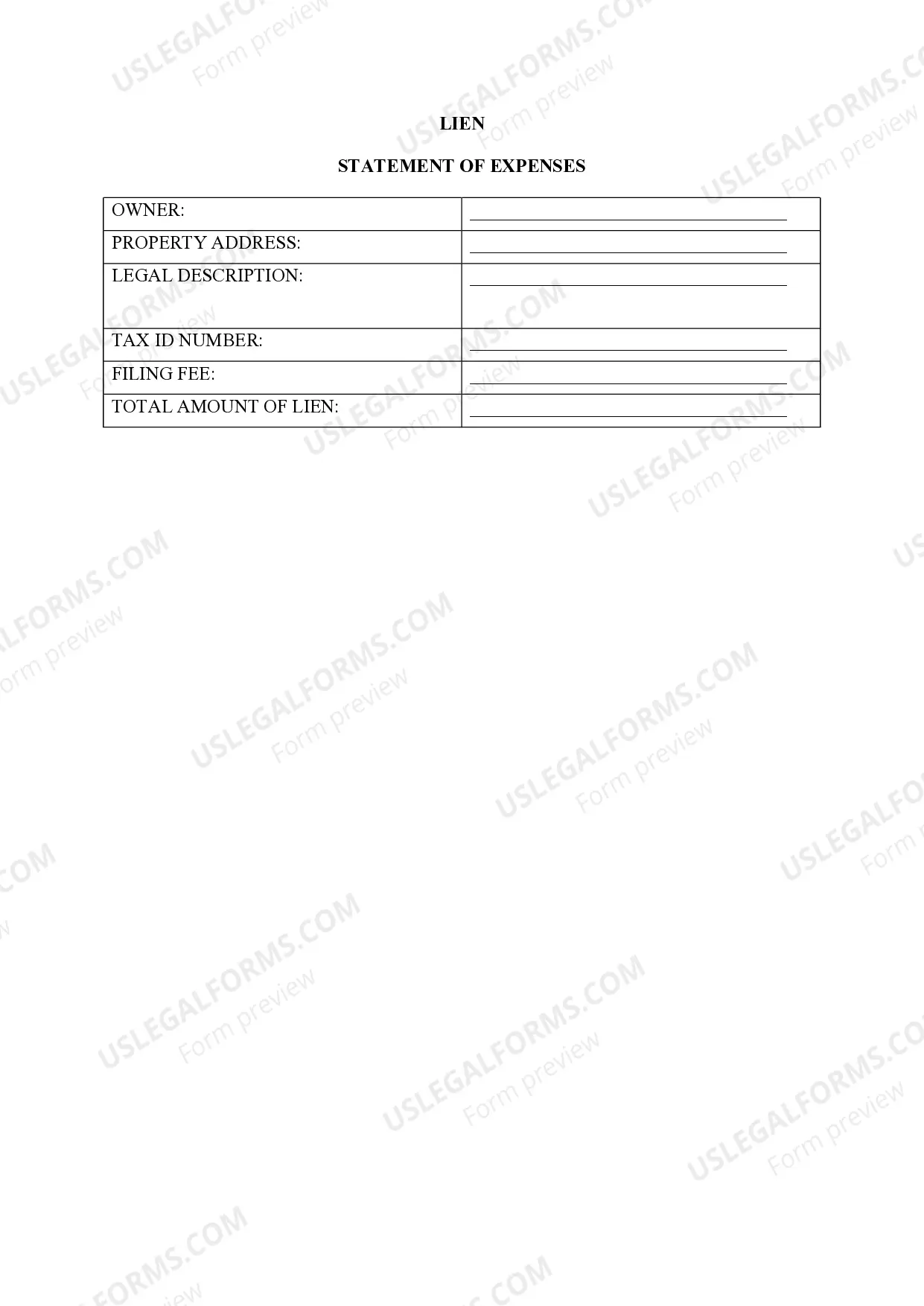

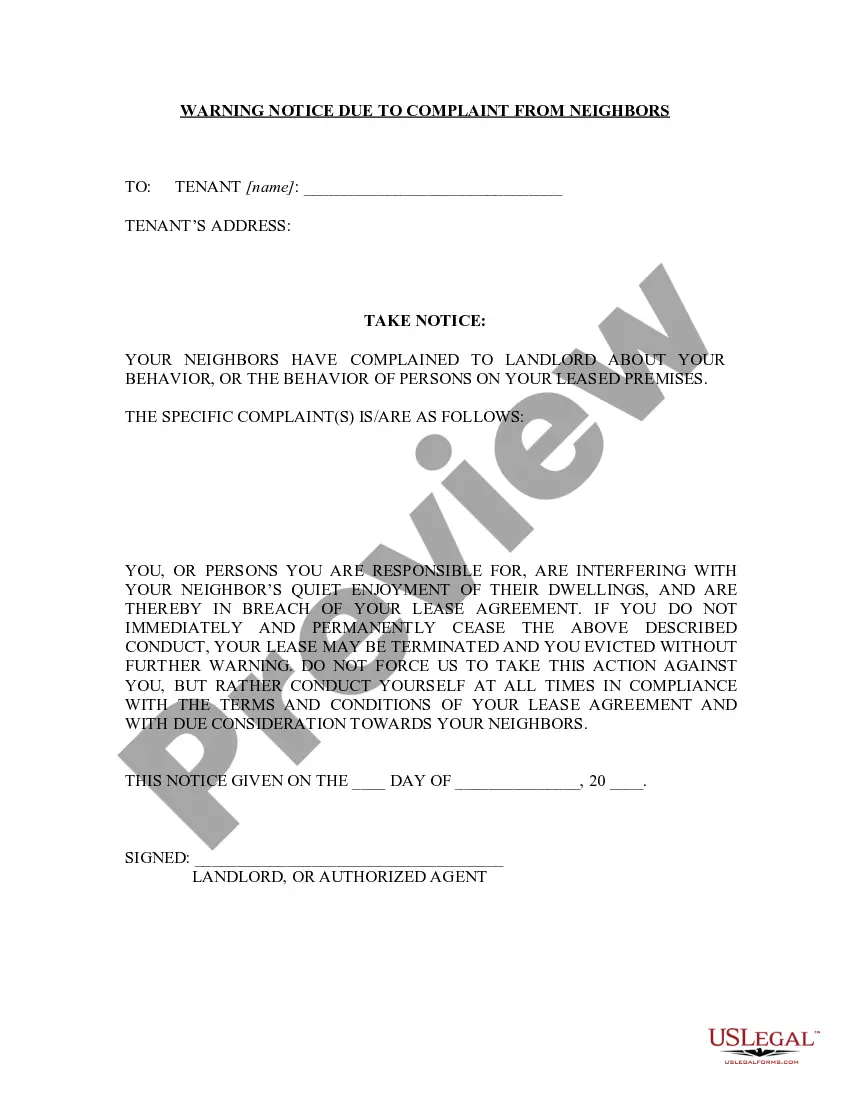

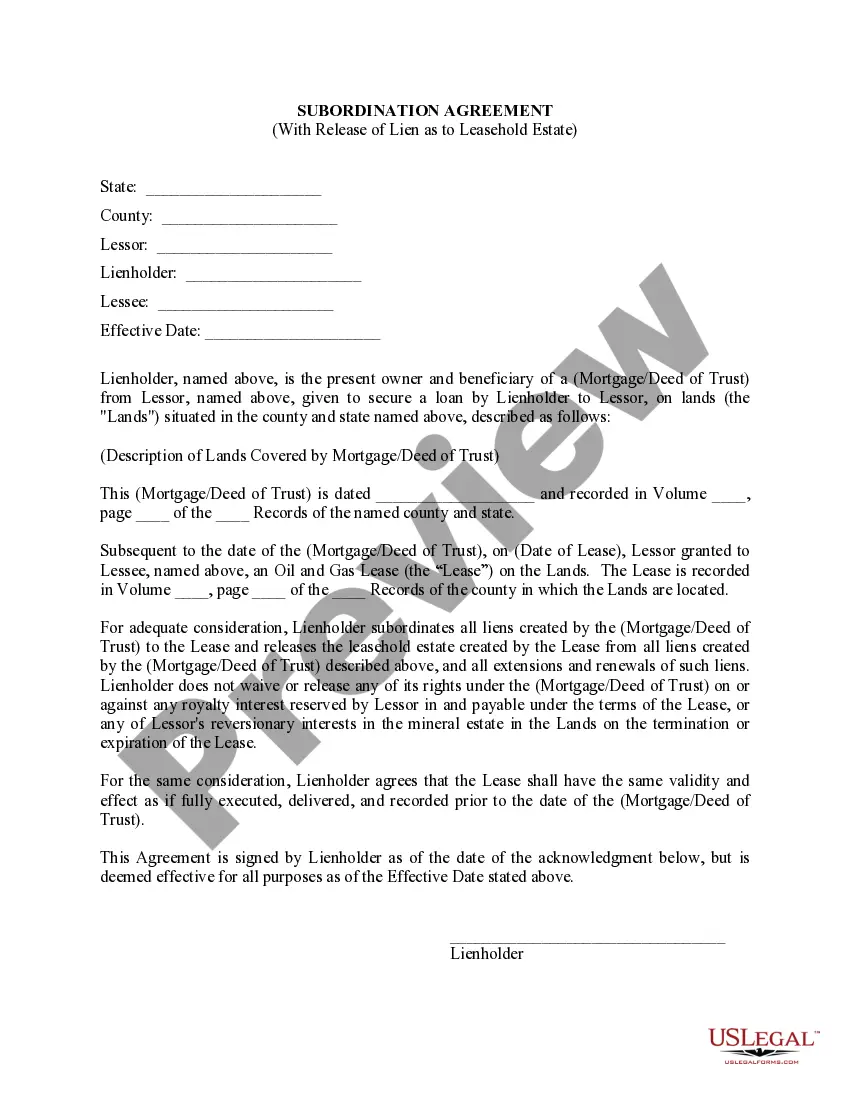

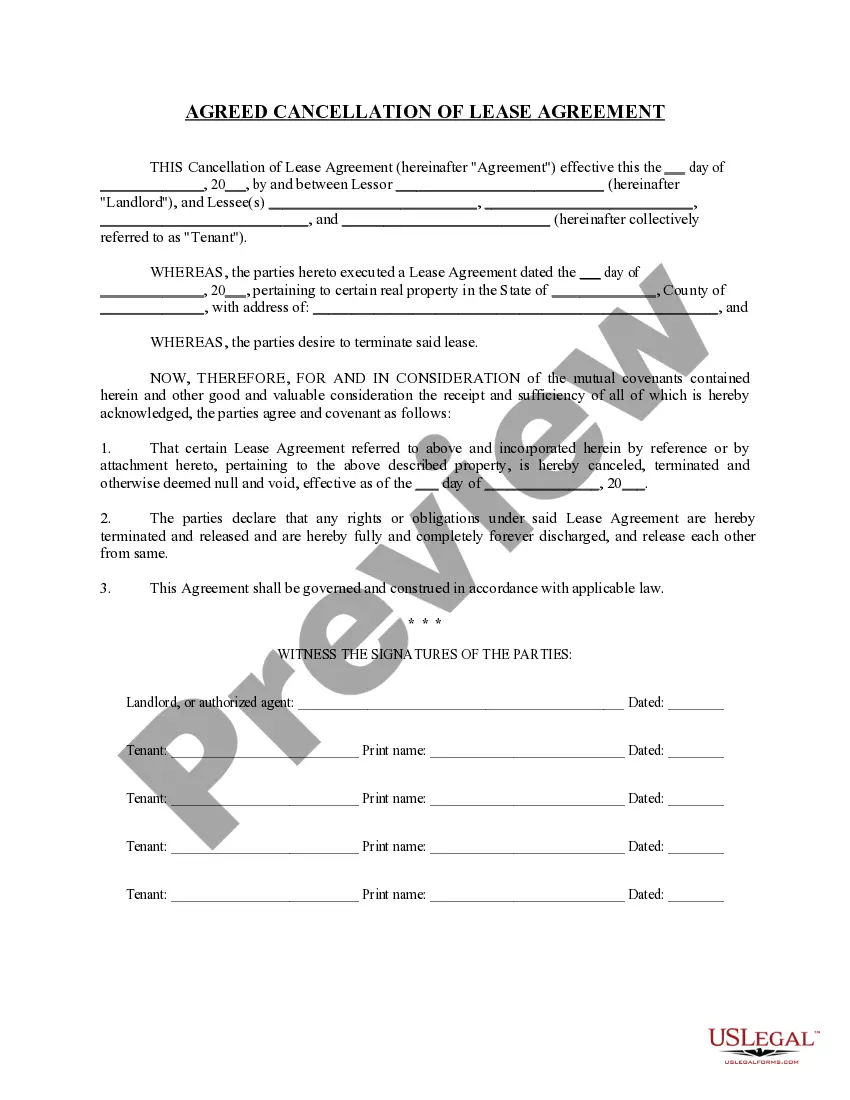

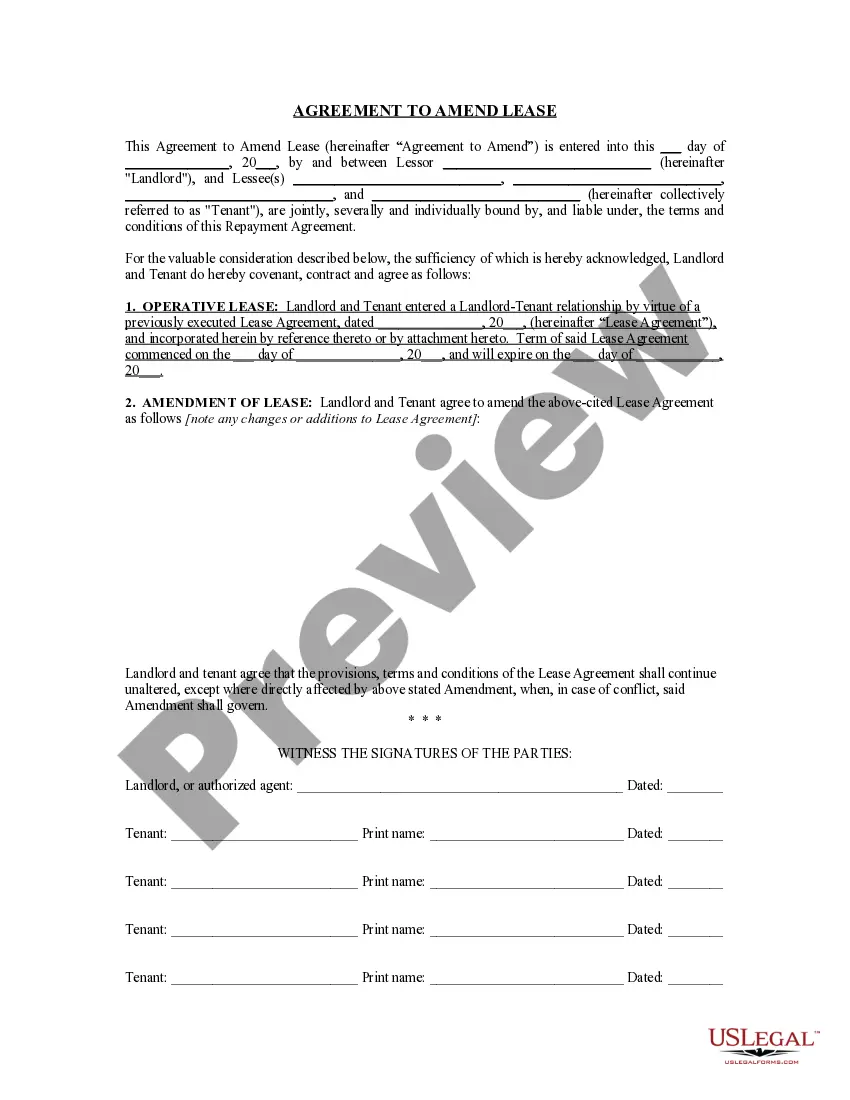

Corpus Christi Texas Lien-Property refers to any legal claim or encumbrance placed on a property in Corpus Christi, Texas, that grants a creditor the right to sell or seize the property as collateral to satisfy a debt. Liens can be filed against both residential and commercial properties in Corpus Christi and are typically associated with unpaid debts, such as unpaid property taxes, mortgages, or contractor work. Here are some types of Corpus Christi Texas Liens-Property: 1. Property Tax Lien: This type of lien is imposed by the local government when property owners fail to pay their property taxes. The government can sell the property to recover the unpaid taxes. 2. Mortgage Lien: A mortgage lien is the most common type of lien and is created when a property owner borrows money from a lender to purchase a property. The lender holds a lien on the property until the mortgage is fully repaid. In the event of default, the lender may foreclose on the property. 3. Mechanics' Lien: Contractors, subcontractors, or suppliers who have provided labor, materials, or services to improve a property may file a mechanics' lien if they are not paid for their work. This lien ensures they have a claim on the property, which can be enforced through a foreclosure action. 4. Judgment Lien: If a creditor obtains a judgment against a property owner due to unpaid debts, they can file a judgment lien on the property. This lien allows the creditor to satisfy the debt by forcibly selling the property. 5. Homeowners Association (HOA) Lien: Homeowners who fail to pay their dues or assessments to the homeowners' association may have a lien placed on their property. HOA liens provide the association with the ability to collect outstanding fees or dues through foreclosure. 6. IRS Tax Lien: The Internal Revenue Service (IRS) may file a tax lien against a property owner who owes outstanding federal taxes. This lien ensures that the government has a claim on the property until the tax debt is paid. It is important for property owners in Corpus Christi, Texas, to be aware of these various types of liens, as they can have significant implications on property ownership and potential foreclosure. It is advisable to seek legal advice and promptly address any outstanding debts to avoid the complications and potential loss of property through liens.

Corpus Christi Texas Lien -Property

Description

How to fill out Corpus Christi Texas Lien -Property?

We always want to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we apply for legal services that, as a rule, are very expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of a lawyer. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Corpus Christi Texas Lien -Property or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Corpus Christi Texas Lien -Property complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Corpus Christi Texas Lien -Property would work for your case, you can select the subscription option and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!