Frisco, Texas Lien — Property: A Comprehensive Overview of Property Liens in Frisco, Texas Introduction: In the world of real estate, property liens play a significant role and understanding them is crucial for both buyers and sellers. This article provides a detailed description of Frisco, Texas lien properties, including their definition, types, and implications. Through the use of relevant keywords, we aim to provide comprehensive information on Frisco, Texas lien properties. Definition: A property lien refers to a legal claim that an individual or entity holds over a property as collateral for a debt or obligation. Liens are typically filed with the county clerk's office and become a part of public records, ensuring transparency for potential buyers and lenders. In Frisco, Texas, lien properties can have various types and implications, each requiring specific attention. Types of Frisco Texas Lien — Property: 1. Mortgage Liens: Mortgage liens are the most common type of lien in Frisco, Texas. When purchasing a home through a mortgage loan, the lender places a lien on the property, which allows them to foreclose and take possession of the property in case of default. Mortgage liens are recorded with the county clerk's office and typically take priority over other types of liens. 2. Tax Liens: Tax liens in Frisco, Texas result from unpaid property taxes. When property owners fail to pay their property taxes, the local taxing authority has the right to place a lien on the property. These liens become a priority lien, taking precedence over all other types of liens. It is essential to address tax liens promptly to avoid potential foreclosure. 3. Judgment Liens: Judgment liens arise from a court ruling in favor of a creditor, usually as a result of unpaid debts or legal judgments. In Frisco, Texas, if an individual or business fails to pay a court-ordered monetary judgment, the creditor may place a judgment lien on the debtor's property, ensuring the creditor's right to collect the debt by seizing the property. 4. Mechanic's and Contractor's Liens: Mechanic's and contractor's liens, also known as construction liens, occur when a property owner fails to pay a contractor or subcontractor for work done on the property. These liens empower contractors, subcontractors, or suppliers to claim the property as collateral to secure payment for services rendered. Construction liens can be particularly complex and may involve strict legal procedures. Implications and Considerations: Frisco, Texas lien properties should be approached with caution as they can impact property transactions and financing. Prospective buyers need to conduct thorough due diligence by inspecting public property records to identify any existing liens. It is essential to work closely with real estate professionals, such as attorneys and title companies, to ensure a smooth and legally sound property transaction. In conclusion, Frisco, Texas lien properties encompass a range of liens, including mortgage, tax, judgment, and mechanic's/contractor's liens. Each lien type carries potential implications that buyers and sellers must consider. By understanding the different types of liens and their associated processes, parties involved in real estate transactions can navigate the complexities of Frisco, Texas lien properties successfully.

Frisco Texas Lien -Property

Category:

State:

Texas

City:

Frisco

Control #:

TX-LR036T

Format:

Word;

Rich Text

Instant download

Description

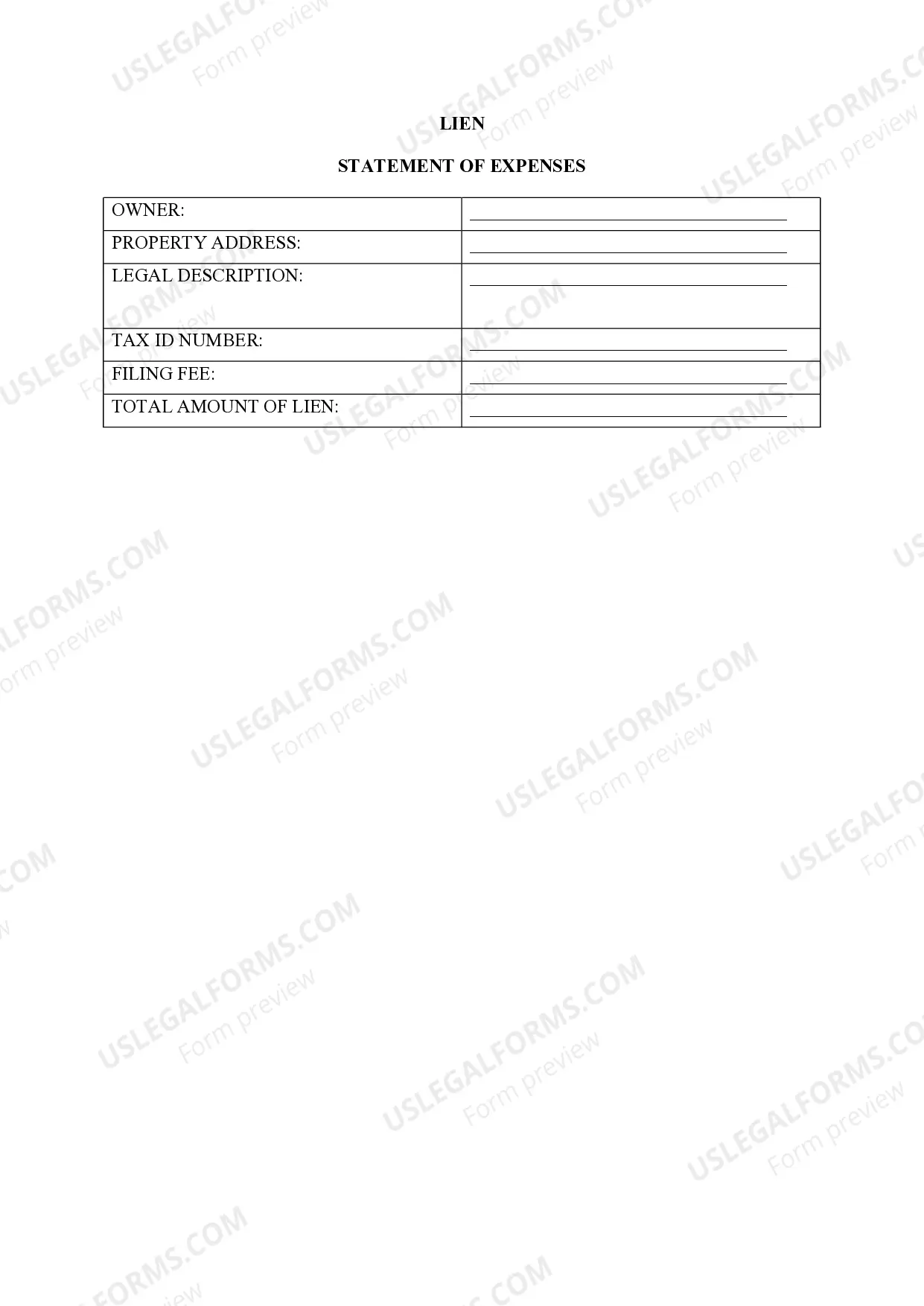

This form is used to show lien affidavit attached to property from the City for cost of cleanup.

Frisco, Texas Lien — Property: A Comprehensive Overview of Property Liens in Frisco, Texas Introduction: In the world of real estate, property liens play a significant role and understanding them is crucial for both buyers and sellers. This article provides a detailed description of Frisco, Texas lien properties, including their definition, types, and implications. Through the use of relevant keywords, we aim to provide comprehensive information on Frisco, Texas lien properties. Definition: A property lien refers to a legal claim that an individual or entity holds over a property as collateral for a debt or obligation. Liens are typically filed with the county clerk's office and become a part of public records, ensuring transparency for potential buyers and lenders. In Frisco, Texas, lien properties can have various types and implications, each requiring specific attention. Types of Frisco Texas Lien — Property: 1. Mortgage Liens: Mortgage liens are the most common type of lien in Frisco, Texas. When purchasing a home through a mortgage loan, the lender places a lien on the property, which allows them to foreclose and take possession of the property in case of default. Mortgage liens are recorded with the county clerk's office and typically take priority over other types of liens. 2. Tax Liens: Tax liens in Frisco, Texas result from unpaid property taxes. When property owners fail to pay their property taxes, the local taxing authority has the right to place a lien on the property. These liens become a priority lien, taking precedence over all other types of liens. It is essential to address tax liens promptly to avoid potential foreclosure. 3. Judgment Liens: Judgment liens arise from a court ruling in favor of a creditor, usually as a result of unpaid debts or legal judgments. In Frisco, Texas, if an individual or business fails to pay a court-ordered monetary judgment, the creditor may place a judgment lien on the debtor's property, ensuring the creditor's right to collect the debt by seizing the property. 4. Mechanic's and Contractor's Liens: Mechanic's and contractor's liens, also known as construction liens, occur when a property owner fails to pay a contractor or subcontractor for work done on the property. These liens empower contractors, subcontractors, or suppliers to claim the property as collateral to secure payment for services rendered. Construction liens can be particularly complex and may involve strict legal procedures. Implications and Considerations: Frisco, Texas lien properties should be approached with caution as they can impact property transactions and financing. Prospective buyers need to conduct thorough due diligence by inspecting public property records to identify any existing liens. It is essential to work closely with real estate professionals, such as attorneys and title companies, to ensure a smooth and legally sound property transaction. In conclusion, Frisco, Texas lien properties encompass a range of liens, including mortgage, tax, judgment, and mechanic's/contractor's liens. Each lien type carries potential implications that buyers and sellers must consider. By understanding the different types of liens and their associated processes, parties involved in real estate transactions can navigate the complexities of Frisco, Texas lien properties successfully.

Free preview

How to fill out Frisco Texas Lien -Property?

If you’ve already utilized our service before, log in to your account and download the Frisco Texas Lien -Property on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Frisco Texas Lien -Property. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!