A lien on property in Houston, Texas refers to a legal claim or encumbrance placed on a property as security for the payment of a debt or obligation. It entitles the lien holder to seek satisfaction of the debt by selling or foreclosing the property if the obligation remains unpaid. There are different types of liens on property in Houston, Texas: 1. Tax Liens: When homeowners fail to pay their property taxes, the local government may place a tax lien on the property, giving them the right to collect the owed taxes by selling the property. 2. Mechanics' Liens: Contractors, subcontractors, or suppliers who have provided labor, materials, or services for the improvement of a property but have not been paid may file a mechanics' lien. This gives them the right to force the sale of the property to satisfy their unpaid bills. 3. Homeowners Association (HOA) Liens: If a homeowner fails to pay their HOA dues or violates the association's rules, the HOA can place a lien on the property. This allows them to collect the unpaid fees by selling the property. 4. Judgment Liens: If a court awards a monetary judgment against a property owner, the judgment creditor can place a lien on the property to secure the payment. This lien ensures that the creditor will be able to collect the amount owed from the proceeds of the property's sale. 5. Mortgage Lien: When a homeowner takes out a mortgage loan to purchase a property, the lender places a mortgage lien on the property. This gives the lender the right to foreclose and sell the property to recover their outstanding loan balance if the homeowner defaults on the mortgage payments. These are some common types of liens on property in Houston, Texas. It is important for property owners to be aware of any potential liens on their properties and take appropriate actions to resolve them to avoid potential legal consequences and financial difficulties.

Houston Texas Lien -Property

Category:

State:

Texas

City:

Houston

Control #:

TX-LR036T

Format:

Word;

Rich Text

Instant download

Description

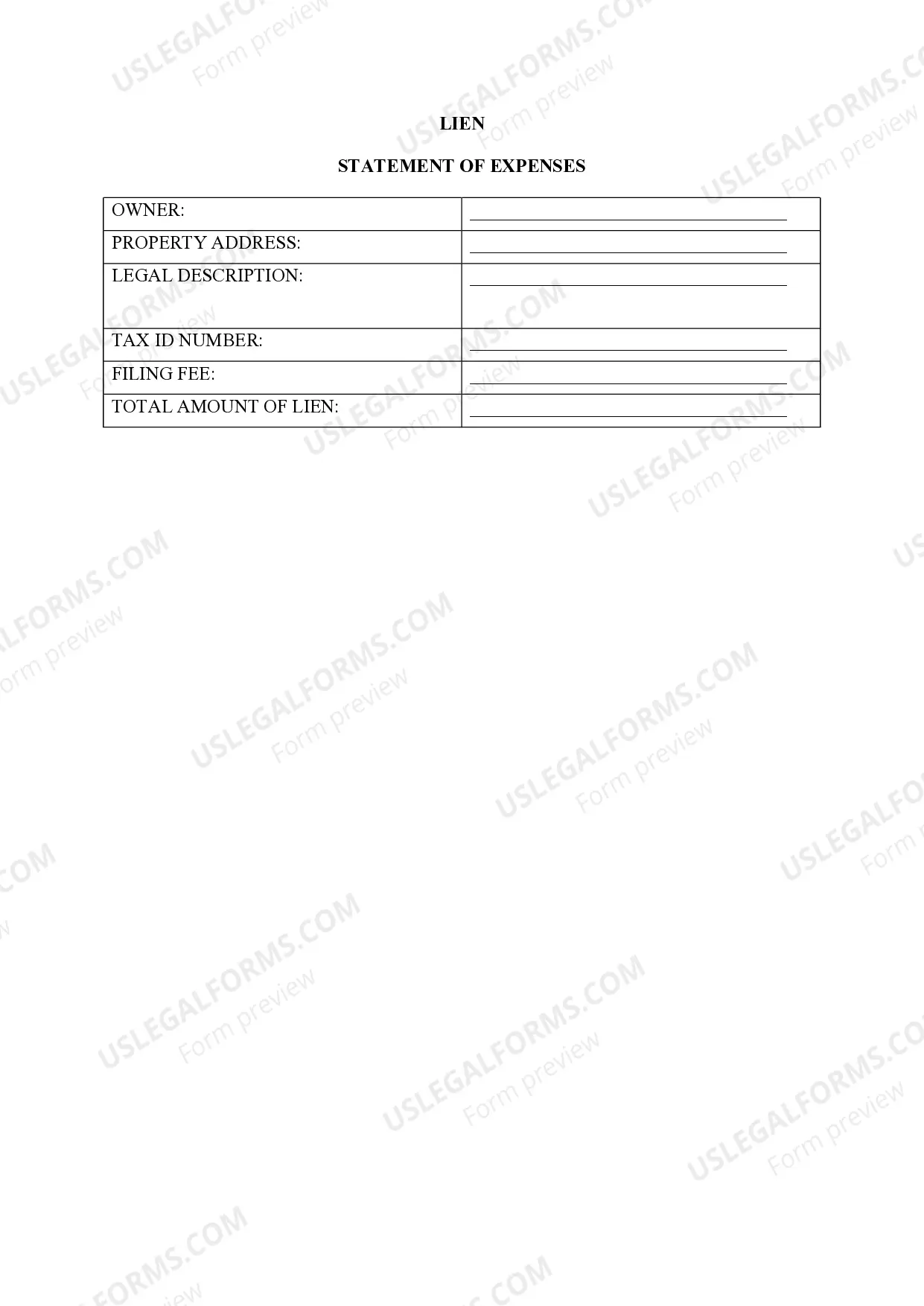

This form is used to show lien affidavit attached to property from the City for cost of cleanup.

A lien on property in Houston, Texas refers to a legal claim or encumbrance placed on a property as security for the payment of a debt or obligation. It entitles the lien holder to seek satisfaction of the debt by selling or foreclosing the property if the obligation remains unpaid. There are different types of liens on property in Houston, Texas: 1. Tax Liens: When homeowners fail to pay their property taxes, the local government may place a tax lien on the property, giving them the right to collect the owed taxes by selling the property. 2. Mechanics' Liens: Contractors, subcontractors, or suppliers who have provided labor, materials, or services for the improvement of a property but have not been paid may file a mechanics' lien. This gives them the right to force the sale of the property to satisfy their unpaid bills. 3. Homeowners Association (HOA) Liens: If a homeowner fails to pay their HOA dues or violates the association's rules, the HOA can place a lien on the property. This allows them to collect the unpaid fees by selling the property. 4. Judgment Liens: If a court awards a monetary judgment against a property owner, the judgment creditor can place a lien on the property to secure the payment. This lien ensures that the creditor will be able to collect the amount owed from the proceeds of the property's sale. 5. Mortgage Lien: When a homeowner takes out a mortgage loan to purchase a property, the lender places a mortgage lien on the property. This gives the lender the right to foreclose and sell the property to recover their outstanding loan balance if the homeowner defaults on the mortgage payments. These are some common types of liens on property in Houston, Texas. It is important for property owners to be aware of any potential liens on their properties and take appropriate actions to resolve them to avoid potential legal consequences and financial difficulties.

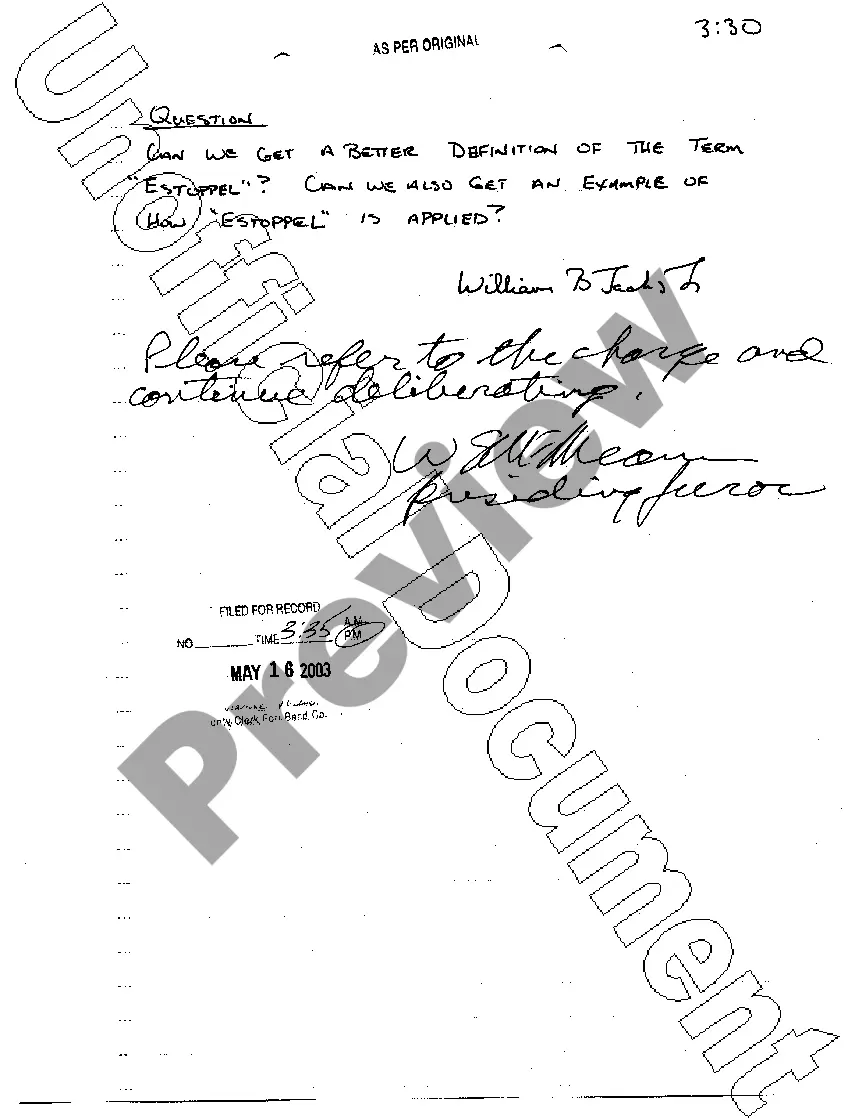

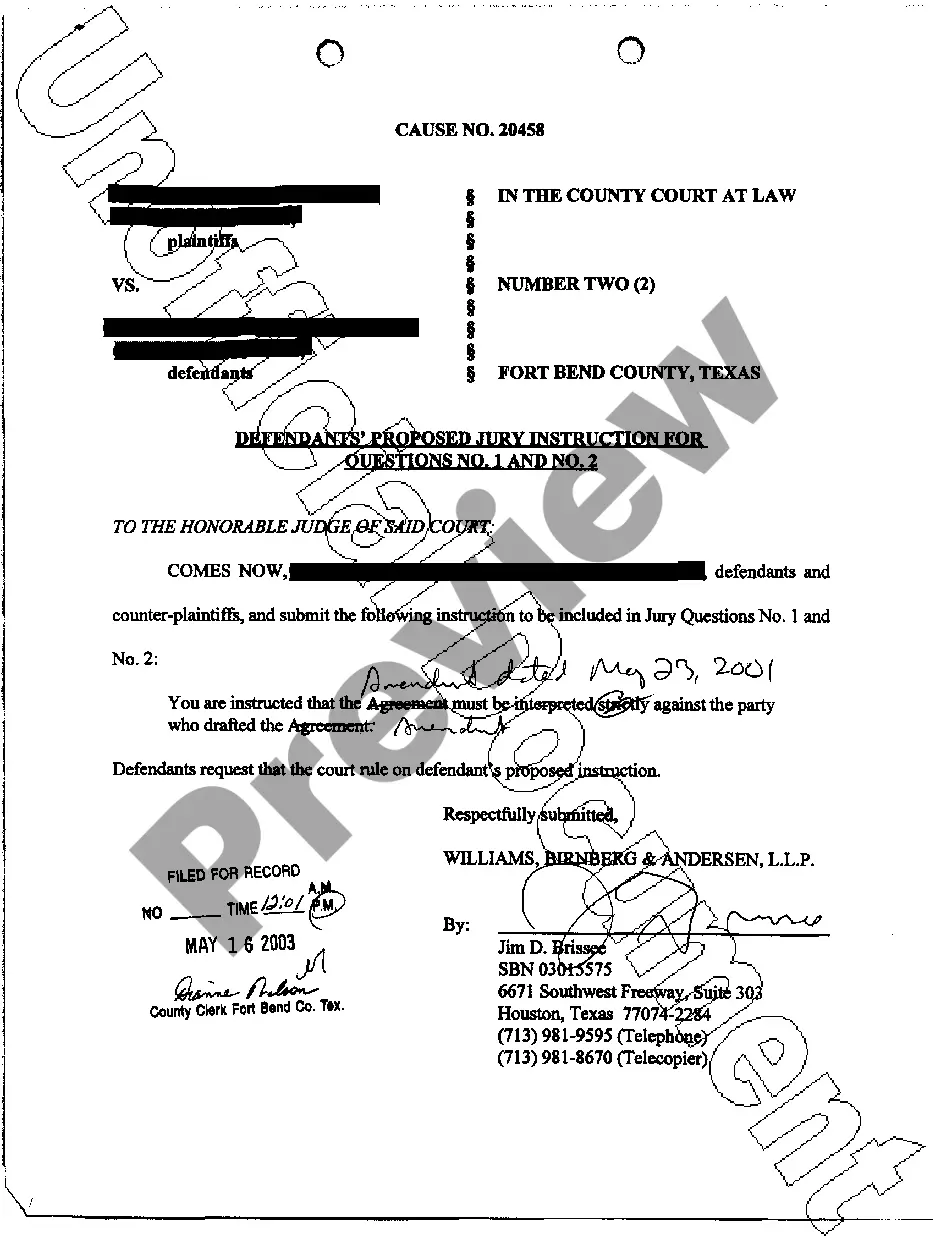

Free preview

How to fill out Houston Texas Lien -Property?

If you’ve already utilized our service before, log in to your account and save the Houston Texas Lien -Property on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Houston Texas Lien -Property. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!