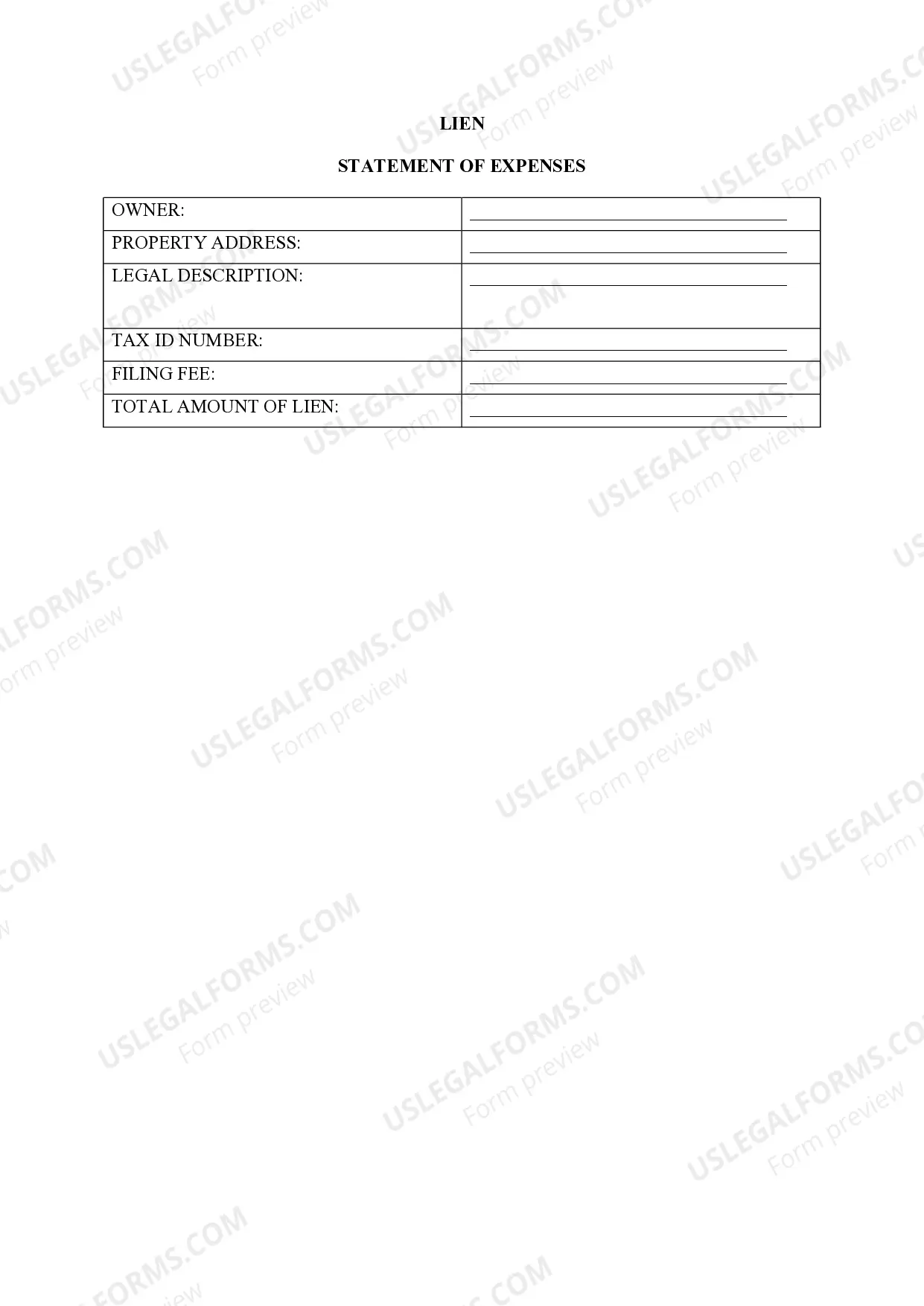

Irving Texas Lien-Property refers to a legal claim or a financial interest placed on a property in Irving, Texas. It is typically enforced by a government entity or a creditor to secure the payment of a debt owed by the property owner. This detailed description will provide a comprehensive overview of the concept and highlight key aspects related to Irving Texas Lien-Property. Keywords: Irving Texas, lien, property, legal claim, financial interest, government entity, creditor, debt. In Irving, Texas, a lien-property is a legal tool used to protect the rights of creditors or government entities in securing outstanding debts. When a property owner fails to fulfill their financial obligations, a lien can be placed on their property as collateral until the debt is settled. There are different types of Irving Texas Lien-Property, including: 1. Property Tax Lien: A property tax lien is imposed by the local government when property taxes remain unpaid. The government can enforce this lien by auctioning off the property to recoup the unpaid taxes. 2. Judgment Lien: A judgment lien is placed on a property when a court order is obtained against the property owner for an outstanding debt or legal judgment. It ensures that the creditor has a legal claim over the property until the debt is satisfied. 3. Mechanic's Lien: When contractors, subcontractors, or suppliers remain unpaid for work or materials provided for property improvements or construction, they can assert a mechanic's lien. This lien allows them to stake a claim against the property and potentially force its sale to recover their unpaid fees or invoices. 4. Homeowners Association (HOA) Lien: In the case of homeowners association fees or assessments going unpaid, the HOA can place a lien on the delinquent property. This lien enables the HOA to recover the outstanding charges by potentially foreclosing on the property. 5. IRS Tax Lien: The Internal Revenue Service (IRS) can impose a tax lien on a property if the property owner fails to pay federal taxes owed. This lien can hinder property sales or transfers until the debt is satisfied. It is important for property owners in Irving, Texas, to be aware of the implications of having a lien on their property. A lien can negatively impact the property's marketability, as it serves as a public record of the owner's outstanding debts. Additionally, failing to address or resolve the liens in a timely manner can lead to legal consequences, potential foreclosures, or forced property sales. Overall, Irving Texas Lien-Property is a legal mechanism used by creditors and government entities in Irving, Texas, to secure outstanding debts. Whether it be property tax liens, judgment liens, mechanic's liens, HOA liens, or IRS tax liens, it is essential for property owners to handle and resolve these liens promptly to avoid further complications.

Irving Texas Lien -Property

Description

How to fill out Irving Texas Lien -Property?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney services that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Irving Texas Lien -Property or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Irving Texas Lien -Property adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Irving Texas Lien -Property is proper for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!