McAllen, Texas Lien-Property: A Comprehensive Overview In the context of real estate and property ownership, a lien refers to a legal claim or encumbrance placed on a property by a creditor as a security interest for an outstanding debt or obligation. McAllen, Texas, being a vibrant city known for its flourishing real estate market, is no exception when it comes to various types of property liens. Here, we delve into the details of McAllen, Texas Lien-Property, exploring its definition, significance, and the different types of property liens prevalent in the region. Definition of McAllen Texas Lien-Property: A McAllen Texas Lien-Property is a legally imposed claim on a property that arises due to the property owner's unpaid debts or obligations. The lien identifies a creditor's right to satisfy the outstanding debt by selling the property in question. Liens create a cloud on the property's title and can impact the owner's ability to sell or refinance the property until the lien is resolved. Types of McAllen Texas Lien-Property: 1. Mortgage Lien: This is the most common type of lien in McAllen, Texas, where a lender holds a lien against a property until the mortgage loan is fully repaid. If the property owner defaults on the loan, the mortgage lender has the right to initiate foreclosure proceedings to recover their investment. 2. Tax Lien: When property taxes are left unpaid, municipal or county governments may place a tax lien on the property. These liens take precedence over other liens and can result in the government selling the property at a tax lien auction if the debt remains unresolved. 3. Mechanic's Lien: Contractors, subcontractors, or suppliers in the construction industry may file a mechanic's lien if they haven't been paid for their services or materials. This lien ensures that these parties have a legal claim on the property until they are compensated for their work. 4. Judgement Lien: If a property owner loses a lawsuit and is ordered to pay a financial judgement, a judgement lien may be placed on the property. This lien allows the plaintiff to claim the awarded amount from the property's sale proceeds. 5. HOA or Condo Association Lien: Homeowners or condo associations can place a lien on a property if the owner fails to pay monthly fees or special assessments. These liens are typically enforced to recover the owed dues. 6. Child Support Lien: In cases where a parent owes unpaid child support, the state's child support enforcement agencies can establish a lien on the delinquent parent's property. The lien ensures that the parent's property is encumbered until the child support debt is satisfied. Understanding the different types of liens that can be associated with McAllen Texas Lien-Property is crucial for both property owners and potential buyers. If you are purchasing a property in McAllen, it is advisable to conduct a thorough title search to identify any existing liens to prevent any future complications. For property owners, resolving outstanding liens promptly is essential to maintain their property's marketability and protect their investment. In conclusion, McAllen Texas Lien-Property encompasses various types of liens, including mortgage, tax, mechanic's, judgement, HOA or condo association, and child support liens. Understanding how these liens work and their impact on property ownership is vital for individuals involved in real estate transactions in the McAllen, Texas area.

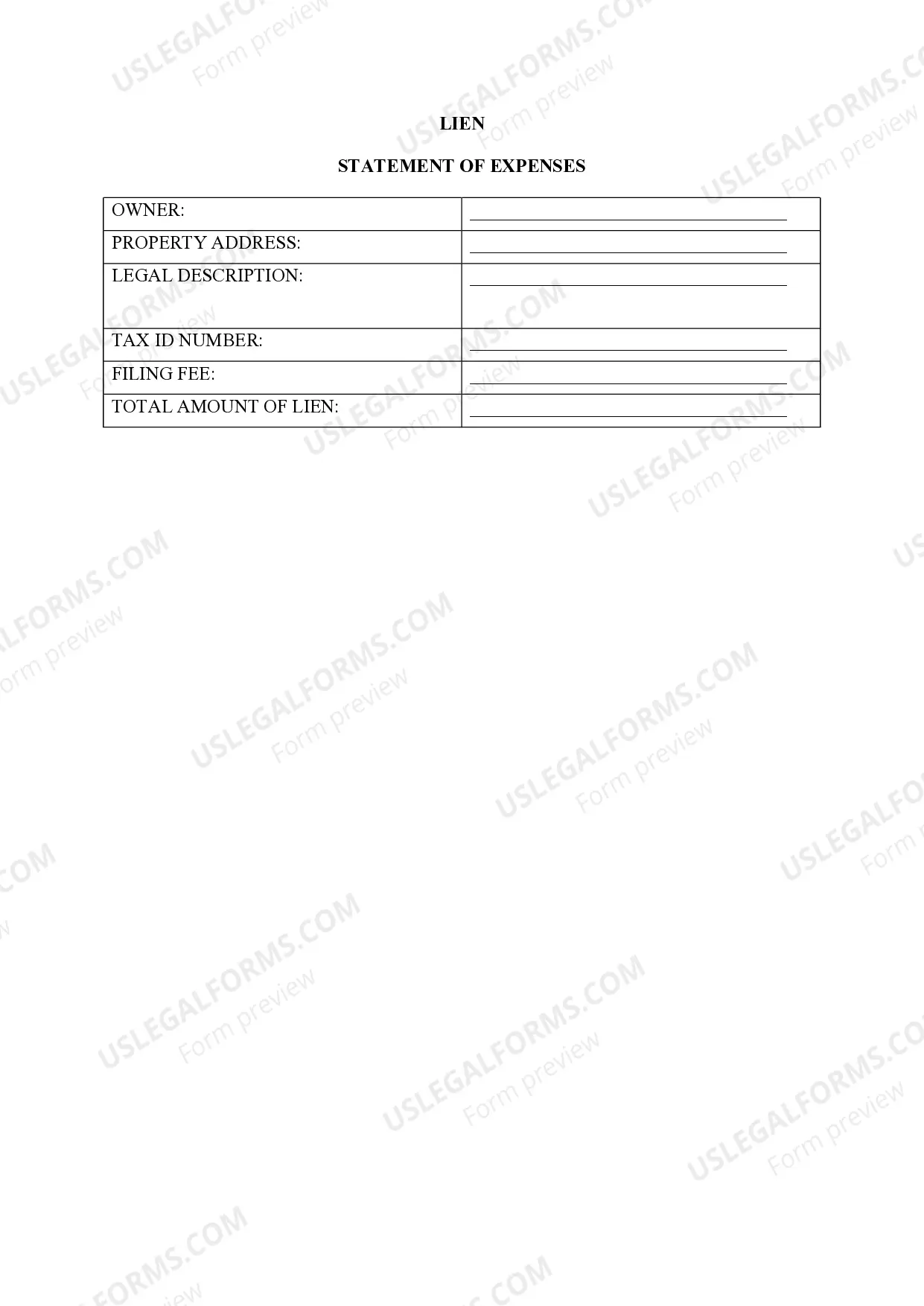

McAllen Texas Lien -Property

Description

How to fill out McAllen Texas Lien -Property?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney services that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the McAllen Texas Lien -Property or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the McAllen Texas Lien -Property complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the McAllen Texas Lien -Property is suitable for your case, you can choose the subscription option and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!