A McKinney Texas Lien-Property refers to a legal claim placed on a property in McKinney, Texas, by a creditor or a government entity in order to secure a debt or protect the interests of the lien holder. This lien serves as a legal mechanism to ensure that the property owner repays a debt or fulfills an obligation. There are different types of McKinney Texas Lien-Property that can arise in various situations. Some common types include: 1. Tax Liens: These are typically placed on a property by the local government when the property owner fails to pay property taxes. A tax lien allows the government to recoup the unpaid taxes by selling the property. 2. Mortgage Liens: When a property owner obtains a mortgage loan, the lender generally places a mortgage lien on the property. This lien serves as a security interest for the lender, allowing them to foreclose on the property in case the borrower defaults on the loan. 3. Mechanics' Liens: Contractors, subcontractors, or suppliers who provide labor, materials, or services for a construction project can place a mechanics' lien on the property if they are not paid for their work. This lien ensures they have a legal right to seek payment by forcing a sale of the property. 4. HOA Liens: Homeowner's Associations (Has) in McKinney, Texas, may place a lien on a property if the homeowner fails to pay their association fees or violates certain rules and regulations. 5. Judgment Liens: If a court awards a monetary judgment against a property owner in a lawsuit, the creditor can place a judgment lien on the property. This lien ensures that the creditor can satisfy the debt by potentially forcing the sale of the property. Understanding the different types of McKinney Texas Lien-Property is crucial for property owners, creditors, and potential buyers to navigate the complex legal terrain involved in property transactions. It is important for property owners to promptly address any liens as they can negatively impact their ability to sell or refinance their property. On the other hand, creditors and lien holders must follow legal procedures to properly enforce and satisfy their liens. Seeking legal advice from a qualified attorney specializing in real estate law can be invaluable in dealing with McKinney Texas Lien-Property issues.

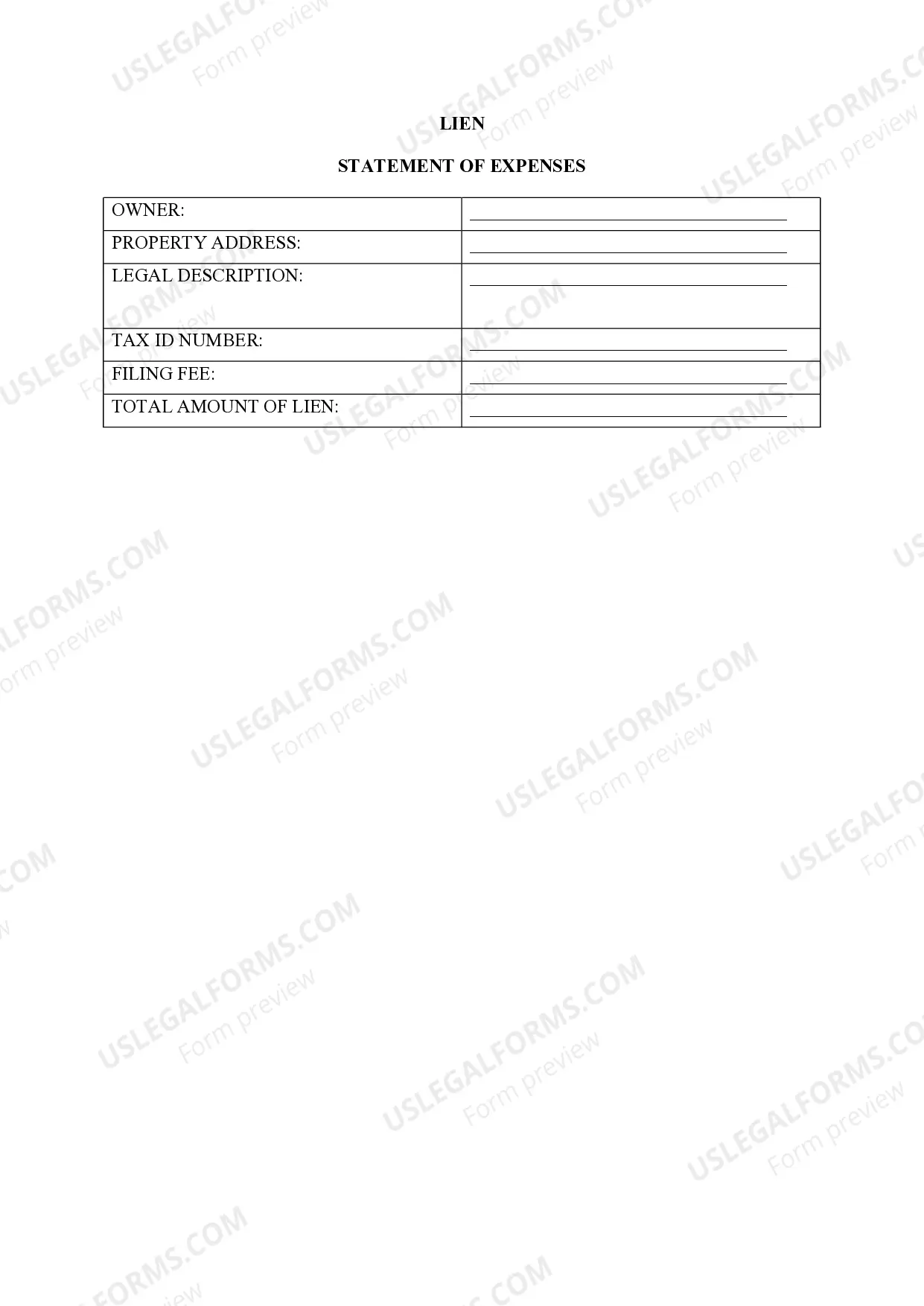

McKinney Texas Lien -Property

Description

How to fill out McKinney Texas Lien -Property?

If you are looking for a relevant form template, it’s difficult to choose a better place than the US Legal Forms website – one of the most comprehensive libraries on the web. Here you can get a huge number of templates for business and personal purposes by categories and states, or key phrases. With our high-quality search feature, getting the latest McKinney Texas Lien -Property is as elementary as 1-2-3. Moreover, the relevance of every file is confirmed by a team of skilled lawyers that on a regular basis check the templates on our platform and revise them according to the newest state and county regulations.

If you already know about our platform and have an account, all you should do to receive the McKinney Texas Lien -Property is to log in to your user profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the form you want. Check its information and utilize the Preview option to check its content. If it doesn’t meet your needs, use the Search field at the top of the screen to find the proper record.

- Affirm your choice. Choose the Buy now option. Following that, choose your preferred subscription plan and provide credentials to register an account.

- Make the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the file format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the acquired McKinney Texas Lien -Property.

Every form you save in your user profile has no expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to have an extra version for modifying or creating a hard copy, feel free to return and save it once more at any moment.

Take advantage of the US Legal Forms professional library to gain access to the McKinney Texas Lien -Property you were looking for and a huge number of other professional and state-specific samples in a single place!