Pearland Texas Lien -Property

Description

How to fill out Texas Lien -Property?

Finding validated templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms library.

It is a digital repository of over 85,000 legal documents for both personal and business purposes and various real-world scenarios.

All the forms are adequately categorized by area of application and jurisdiction, making the search for the Pearland Texas Lien - Property as straightforward and swift as 123.

Retaining organized documents that comply with legal standards is crucial. Take advantage of the US Legal Forms library to always have the necessary document templates readily available for any needs!

- Examine the Preview mode and document description.

- Ensure you have selected the right one that fulfills your needs and completely aligns with your local jurisdiction requirements.

- Search for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct one. If it meets your criteria, proceed to the next step.

- Purchase the document.

- Click the Buy Now button and select your desired subscription plan. You will need to create an account to access the library's resources.

Form popularity

FAQ

Pearland, TX is known for its diverse community, vibrant economy, and welcoming atmosphere. The city hosts numerous events that reflect its rich cultural heritage and offers access to great shopping and dining experiences. It's also recognized for its top-notch educational institutions, making it attractive for families. As you delve into the world of property investment, understanding aspects like Pearland Texas Lien -Property will provide valuable insights to guide your decisions.

Many people consider Pearland TX an excellent place to live due to its family-friendly environment and strong community spirit. The area offers a wide range of amenities, such as parks, recreational programs, and quality schools. Moreover, access to nearby Houston adds to its appeal, as residents enjoy the benefits of city living while retaining a suburban feel. If you're contemplating property ownership, be sure to investigate any Pearland Texas Lien -Property that might impact your decision.

Pearland has experienced significant growth in both population and wealth over recent years. The area benefits from a diverse economy, housing various businesses and industries that support higher-than-average income levels. As you explore the potential of Pearland Texas Lien -Property, you'll find that the economic stability here enhances property investment opportunities. This environment presents both challenges and prospects for new homeowners and investors alike.

To search for a lien on a property in Texas, you can visit the county clerk's office or use their official website for online access. This process typically involves searching property records using the owner’s name or property address. If you find a lien, understanding its implications is vital, particularly for any Pearland Texas Lien -Property you are interested in. Using platforms like uslegalforms can simplify accessing the necessary documents.

Pearland offers a fascinating blend of suburban charm and urban convenience. Located near Houston, it boasts a rich cultural scene, excellent schools, and a strong sense of community. Residents often appreciate the parks, shopping centers, and local eateries that add to Pearland's distinctive character. If you are considering property investment, understanding the local landscape is crucial, especially regarding Pearland Texas Lien -Property.

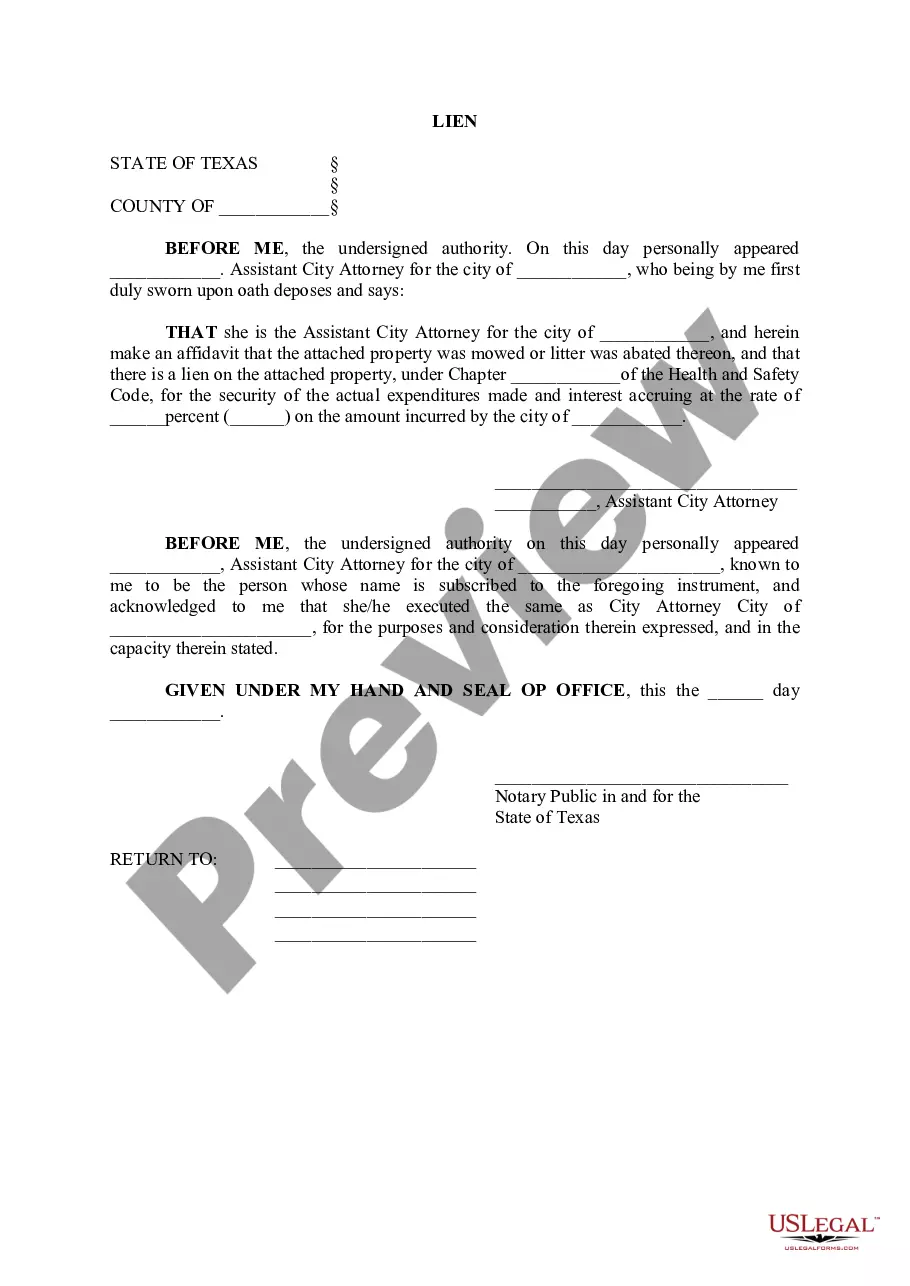

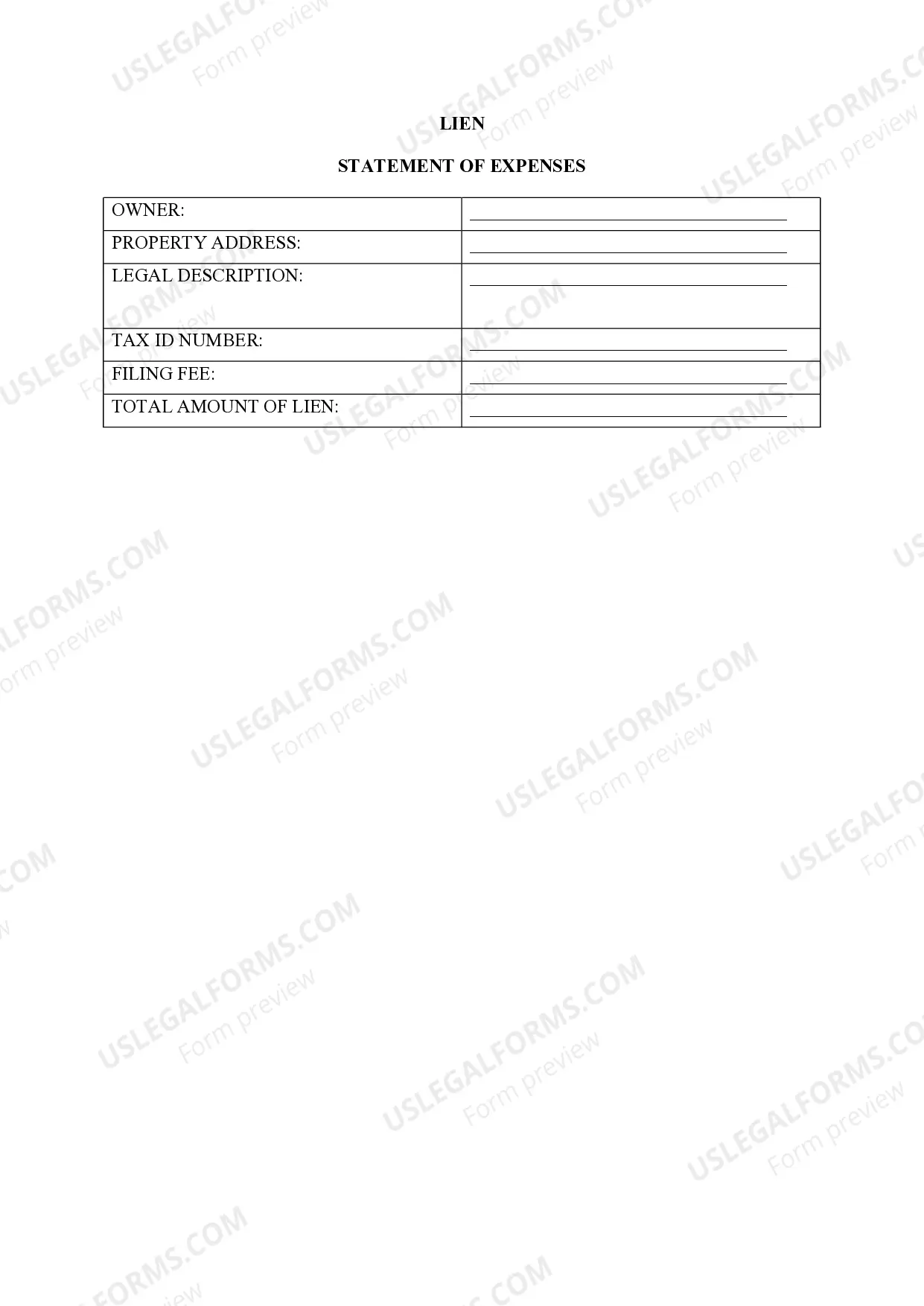

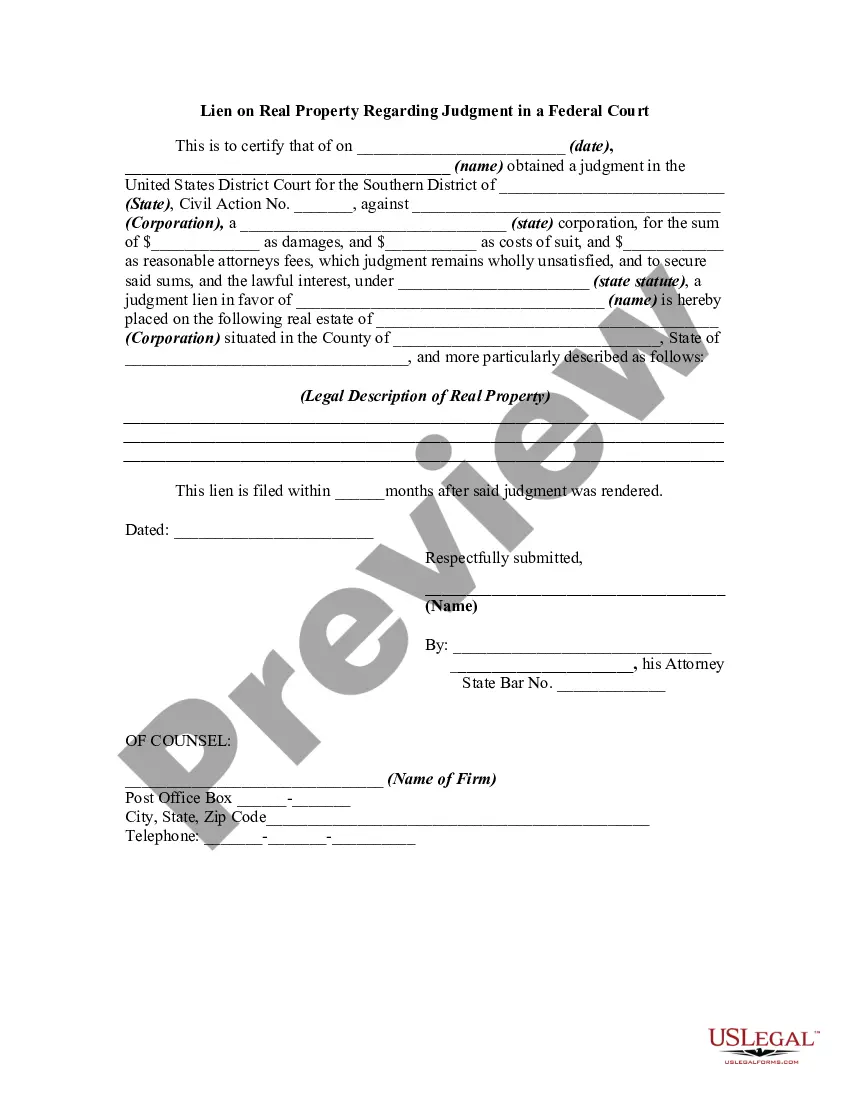

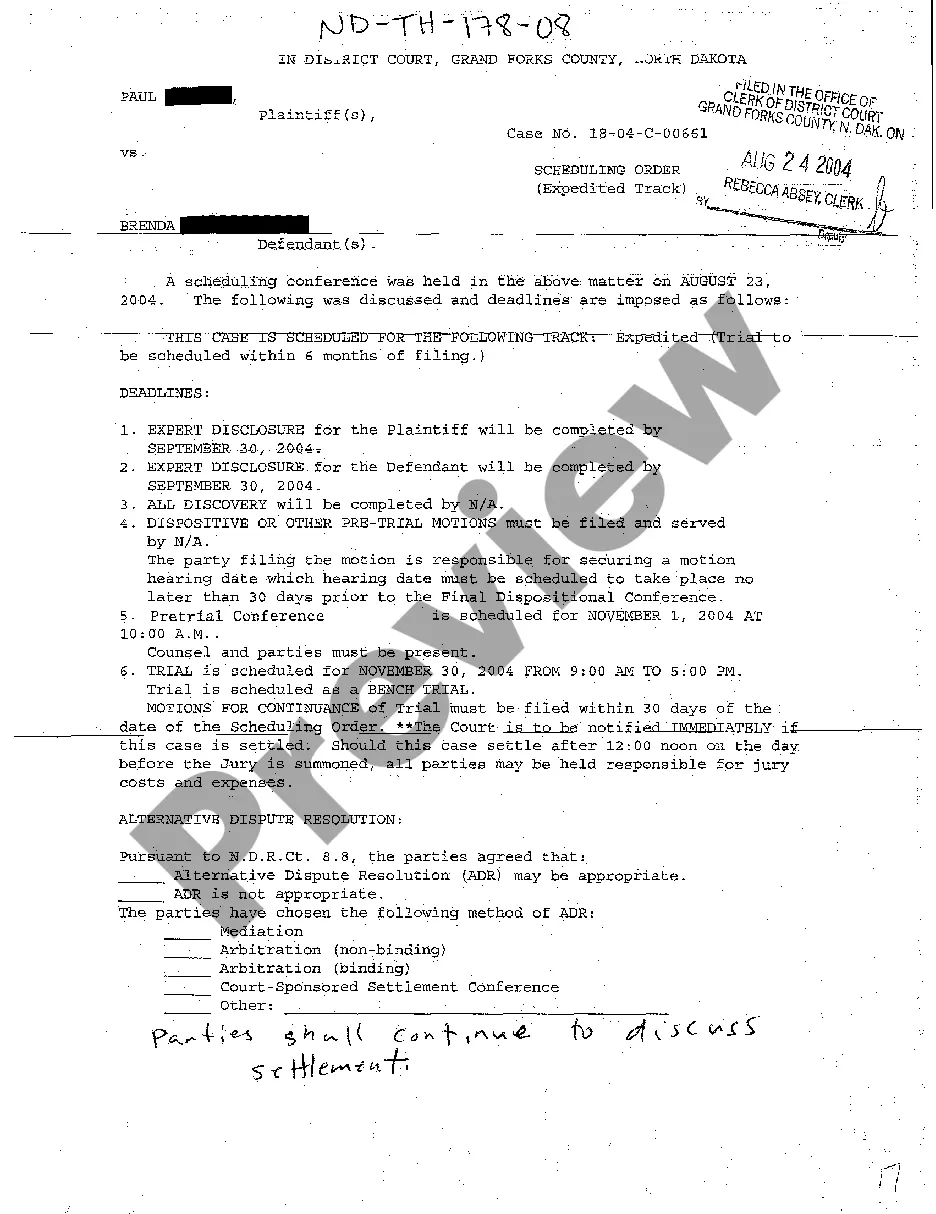

Filing a judgment lien in Texas involves specific steps to protect your interests. Start by obtaining a certified judgment from the court and completing a Judgment Lien Application. You will then need to file this application with the county clerk in the county where the property is based. For guidance through each step, consider using US Legal Forms, which can help you navigate the complexities of securing your Pearland Texas lien-property.

To file a judgment lien in Texas, you must first obtain a certified copy of the judgment from the court. Next, complete a Judgment Lien Application form and file it with the county clerk where the property is located. Ensure you do this within the time limits set by Texas law to secure your lien rights effectively. Resources on platforms like US Legal Forms can provide the necessary forms and instructions to file your Pearland Texas lien-property correctly.

Filing a lien in Texas requires specific documentation and proper procedures to ensure legal validity. You must complete a lien form, provide details about the property, and file it with the county clerk's office in the appropriate county. Additionally, you may need supporting documents, such as contracts or payment records. Utilizing platforms like US Legal Forms can simplify this process and guide you efficiently through filing a Pearland Texas lien-property.

When attending Pearland Municipal Court, it’s important to dress appropriately to show respect for the court. Generally, business casual attire is recommended, which includes slacks, collared shirts, and closed-toe shoes. Avoid wearing shorts, ripped clothing, or offensive graphics. By adhering to this dress code, you help create a serious atmosphere for the proceedings, which aligns with the importance of matters such as a Pearland Texas lien-property.

Removing a lien in Texas can take anywhere from a few days to several weeks, depending on how quickly the necessary documentation is completed and submitted. If you have resolved your debt, the lienholder must file a release, which is essential for clearing the property record. For proper guidance during this process in Pearland, Texas, consider the assistance of US Legal Forms.