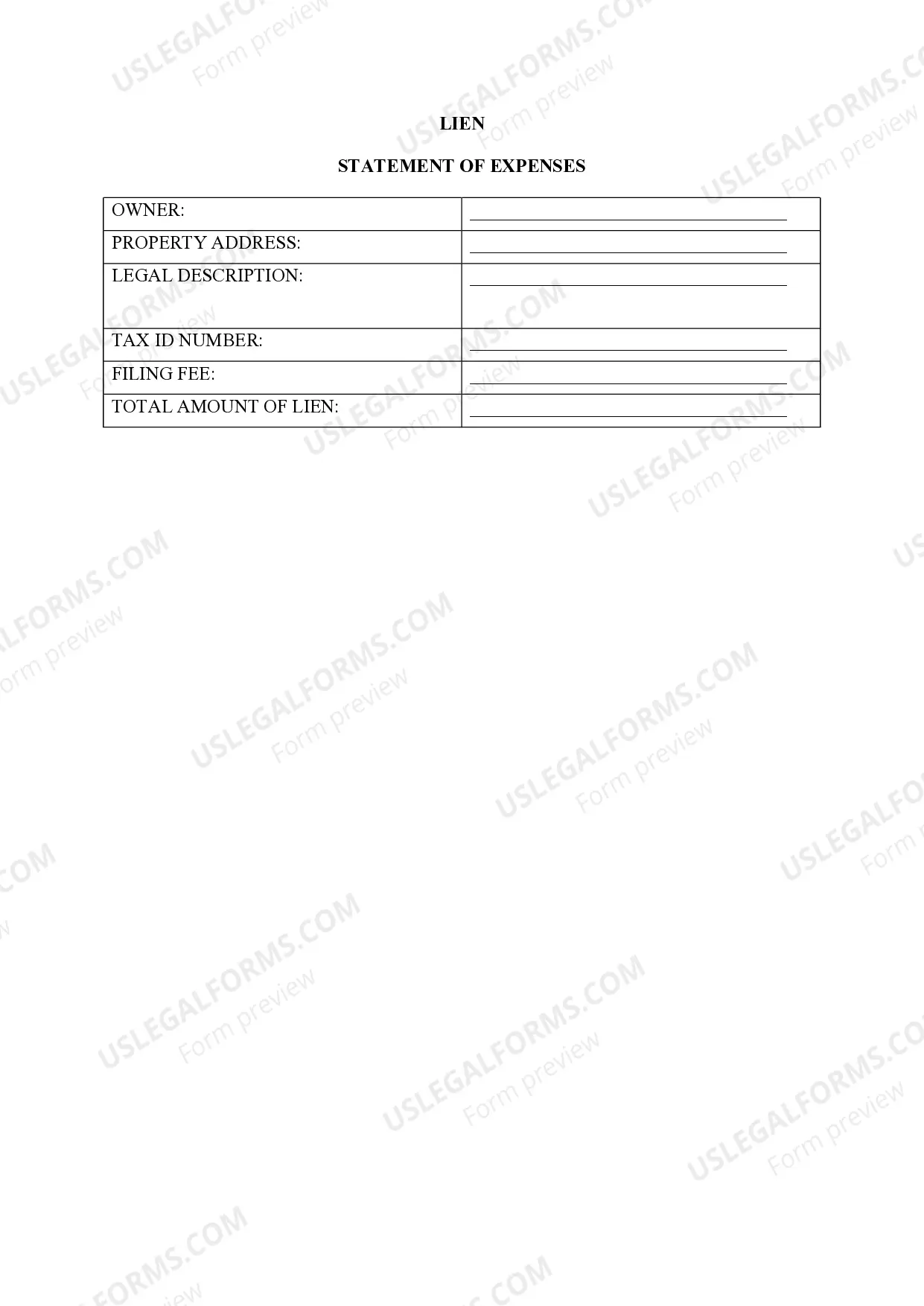

Round Rock Texas Lien-Property refers to a legal claim placed on a property in Round Rock, Texas, typically to secure payment of a debt or to satisfy a judgment. It serves as a way for creditors or individuals to ensure that their interests are protected and that they have a right to the property if the debt is not repaid. Here are some key types of liens that can be encountered in Round Rock, Texas: 1. Mechanics Lien: A mechanics lien is a claim filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services for the improvement of a property but haven't received payment. This type of lien helps ensure that these parties are compensated for their contribution to the property. 2. Tax Lien: A tax lien is issued by a government entity, such as the IRS or the Texas Comptroller's Office, when a property owner fails to pay their property taxes. This lien allows the government to recover the unpaid taxes by claiming the property if necessary. 3. Mortgage Lien: A mortgage lien is a common type of lien that is placed on a property by a lender as collateral for a mortgage loan. If the borrower defaults on the loan, the lender has the right to foreclose on the property and recoup their investment through its sale. 4. Judgment Lien: A judgment lien is created when a court grants a judgment against a debtor. The judgment becomes a lien on the debtor's property, including real estate, and is used to ensure that the creditor can collect the owed amount. 5. Homeowners Association (HOA) Lien: HOA liens are placed on properties in Round Rock that belong to a homeowners' association. They typically arise when homeowners fail to pay their HOA dues or violate the association's rules. These liens allow the association to seek payment or other remedies through legal means. 6. Li's Pendent: Although not technically a lien, an is pendent is a notice filed in the county records indicating that a lawsuit has been initiated regarding a specific property. It alerts potential buyers or lenders about the pending litigation, which may impact the property's value or marketability. In conclusion, Round Rock Texas Lien-Property encompasses various types of liens that are placed on properties in Round Rock, Texas. These liens serve different purposes, such as securing payment for contractors or suppliers, ensuring tax payment, protecting lenders, satisfying judgments, enforcing HOA dues, or disclosing pending lawsuits.

Round Rock Texas Lien -Property

Description

How to fill out Round Rock Texas Lien -Property?

Are you looking for a reliable and inexpensive legal forms provider to get the Round Rock Texas Lien -Property? US Legal Forms is your go-to option.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of separate state and area.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Round Rock Texas Lien -Property conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is good for.

- Start the search over if the form isn’t good for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Round Rock Texas Lien -Property in any provided file format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal papers online once and for all.