San Angelo Texas Lien -Property refers to a legal claim or encumbrance placed against a property in San Angelo, Texas, by a creditor to secure the repayment of debt or to fulfill a legal obligation. This detailed description will cover the concept of liens, the different types of San Angelo Texas Lien-Property, and their significance. Keywords: San Angelo Texas Lien -Property, legal claim, encumbrance, creditor, repayment of debt, legal obligation, types of liens, significance. A lien, in general, is a legal right or claim against a property as collateral, ensuring repayment of a debt. In San Angelo, Texas, a variety of different liens can be placed on properties, each with its unique characteristics and implications. Understanding these types is crucial for property owners and potential buyers alike to navigate legal matters effectively. 1. Property Tax Lien: This type of lien is imposed by local governments when property taxes remain unpaid by the property owner. The lien allows the government to seize the property or auction it off to recover the outstanding taxes. 2. Mechanic's Lien: A mechanic's lien can be filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services for property improvement or construction projects but have not received payment. This lien gives them the right to force a sale of the property to satisfy the unpaid debt. 3. Mortgage Lien: When a property is purchased with a mortgage loan, the lender (mortgagee) often places a lien on the property as security for the loan. If the borrower (mortgagor) fails to repay the loan, the lender can initiate foreclosure proceedings to sell the property and recoup the unpaid debt. 4. Judgment Lien: A judgment lien is created when a court grants a judgment in favor of a creditor. If the debtor fails to pay the judgment amount, the creditor can place a lien on the debtor's property, including real estate, to secure payment. 5. HOA Lien: Homeowners' Associations (Has) can place a lien on a property if a homeowner fails to pay monthly dues, special assessments, or charges for violation of HOA rules. The HOA lien allows them to initiate legal proceedings to recover the unpaid fees or dues. 6. IRS Tax Lien: The Internal Revenue Service (IRS) may place a lien on a property if the property owner is delinquent on federal tax payments. An IRS tax lien gives the government priority over other creditors and can result in the forced sale of the property to repay the debt. Understanding the significance of these different types of liens is crucial for property owners. Liens can affect a property's marketability, ability to refinance, and may even lead to foreclosure if not addressed. It is advisable to consult legal experts or professionals, such as real estate attorneys or title companies, to navigate the complexities associated with San Angelo Texas Lien-Property. In summary, a San Angelo Texas Lien-Property refers to a legal claim or encumbrance placed against a property in San Angelo, Texas, to secure the repayment of debt or fulfill a legal obligation. Various types of liens exist, including property tax liens, mechanic's liens, mortgage liens, judgment liens, HOA liens, and IRS tax liens. Understanding the implications of these liens is essential to protect property rights and address any potential legal issues effectively.

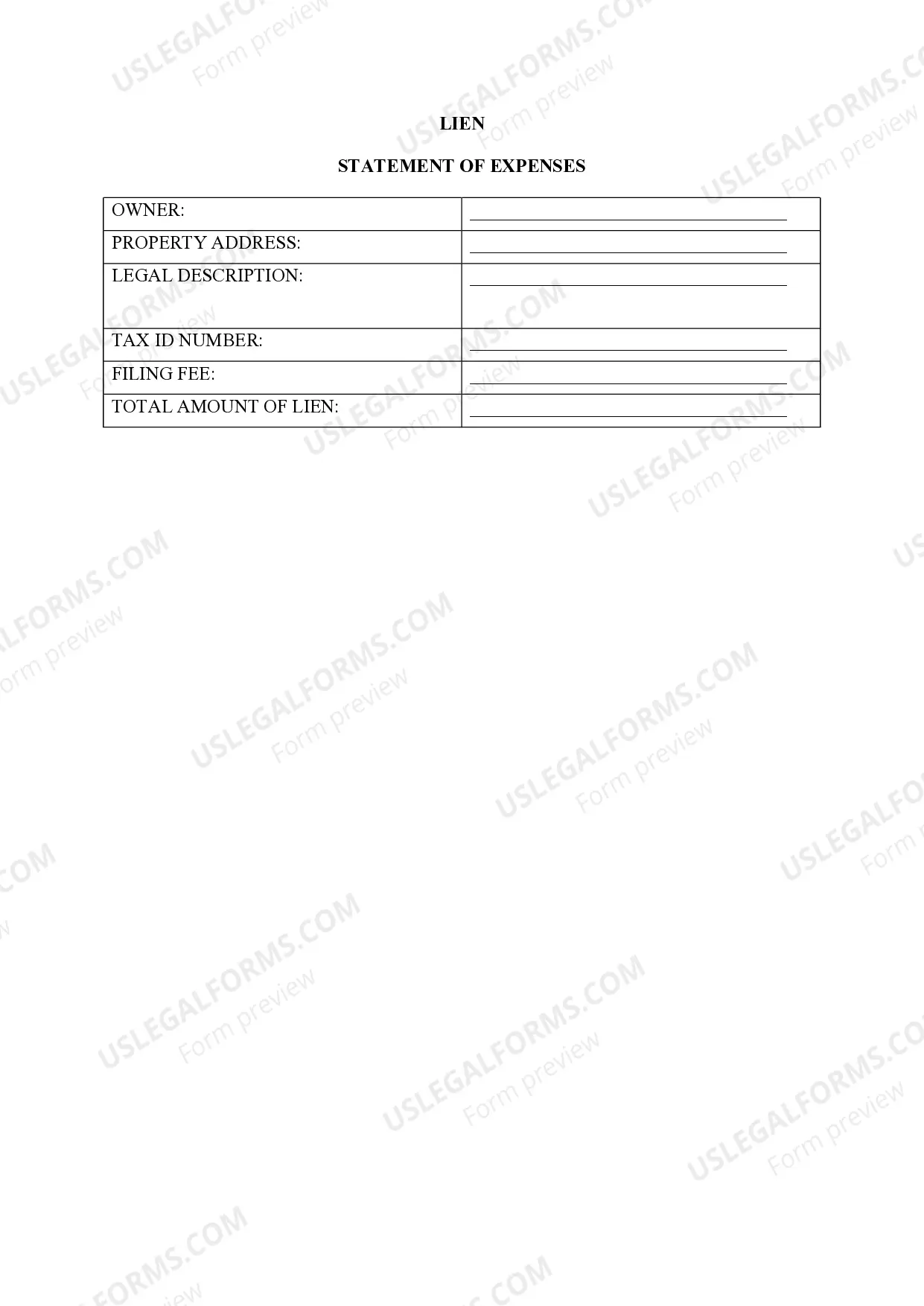

San Angelo Texas Lien -Property

Description

How to fill out San Angelo Texas Lien -Property?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the San Angelo Texas Lien -Property becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the San Angelo Texas Lien -Property takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the San Angelo Texas Lien -Property. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

To transfer an Out-of-State titled vehicle, bring in or mail the following to our offices: Out of State title, signed and dated by the seller(s) and buyer(s).VTR-130U (Application for Texas title), signed and dated by the seller(s) and buyer(s) or a Bill of Sale from the out of state seller.

According to the Texas Department of Motor Vehicles, people cannot register their out-of-state vehicle online. With that being said, you can register your vehicle in person once you move to Texas.

The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317). The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

The title fee is $33, plus motor-vehicle sales tax (6.25 percent). There is also a $2.50 transfer of a current registration fee. If the license is not current, there may be a registration fee.

Fees one can expect to pay when buying a car in Texas are as follows: Sales Tax: 6.25% of the total vehicle purchase price. Title Transfer Fee: $28 to $33 (varies by county) Tag / License Fee: $51.75 base fee, $10 local fee.

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: PREFERRED METHOD If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

How do I renew my registration if I am not in Texas? You can renew your registration by ?self-certifying? as the vehicle owner, that you are entitled to renew your Texas registration, but you and your vehicle are currently out of state and you are unable to complete the required Texas vehicle inspection.

Registration To do this, you must visit your local county tax-assessor collector office. You will need your insurance card, proof of vehicle inspection (the Vehicle Inspection Report from the inspection station), and proof you own the vehicle, such as the registration or title from your previous state.

ETitle Transfer allows qualified sellers and buyers to transfer vehicle ownership electronically. Utilizing a secure online system, customers can complete the process without visiting an MVD office.

To transfer a Texas titled vehicle, bring in or mail the following to our offices: Texas title, signed and dated by the seller(s) and buyer(s).VTR-130U (Application for Texas title), signed and dated by the seller(s) and buyer(s).Proof of insurance in the buyer's name. Acceptable form of ID. Proof of inspection. Fees.