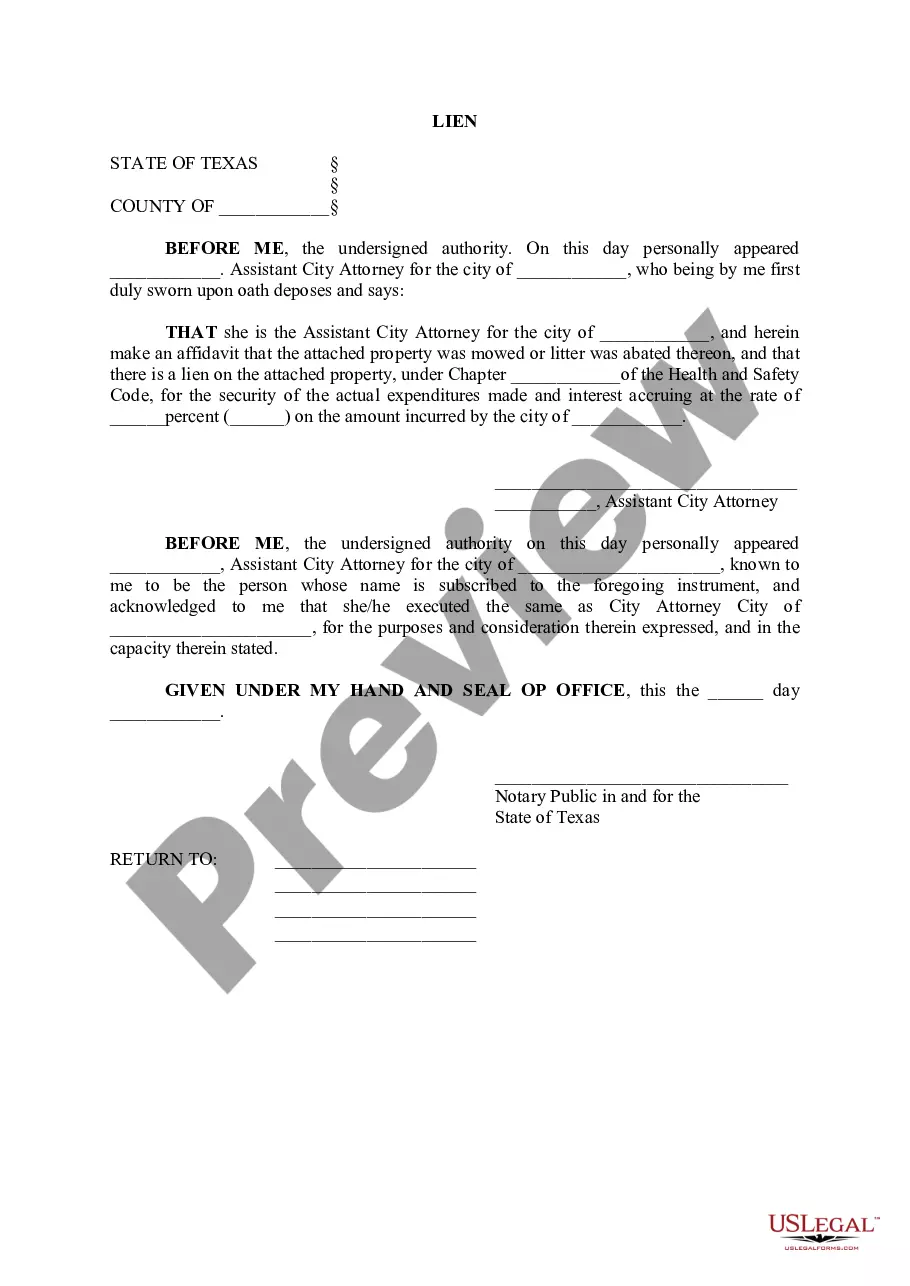

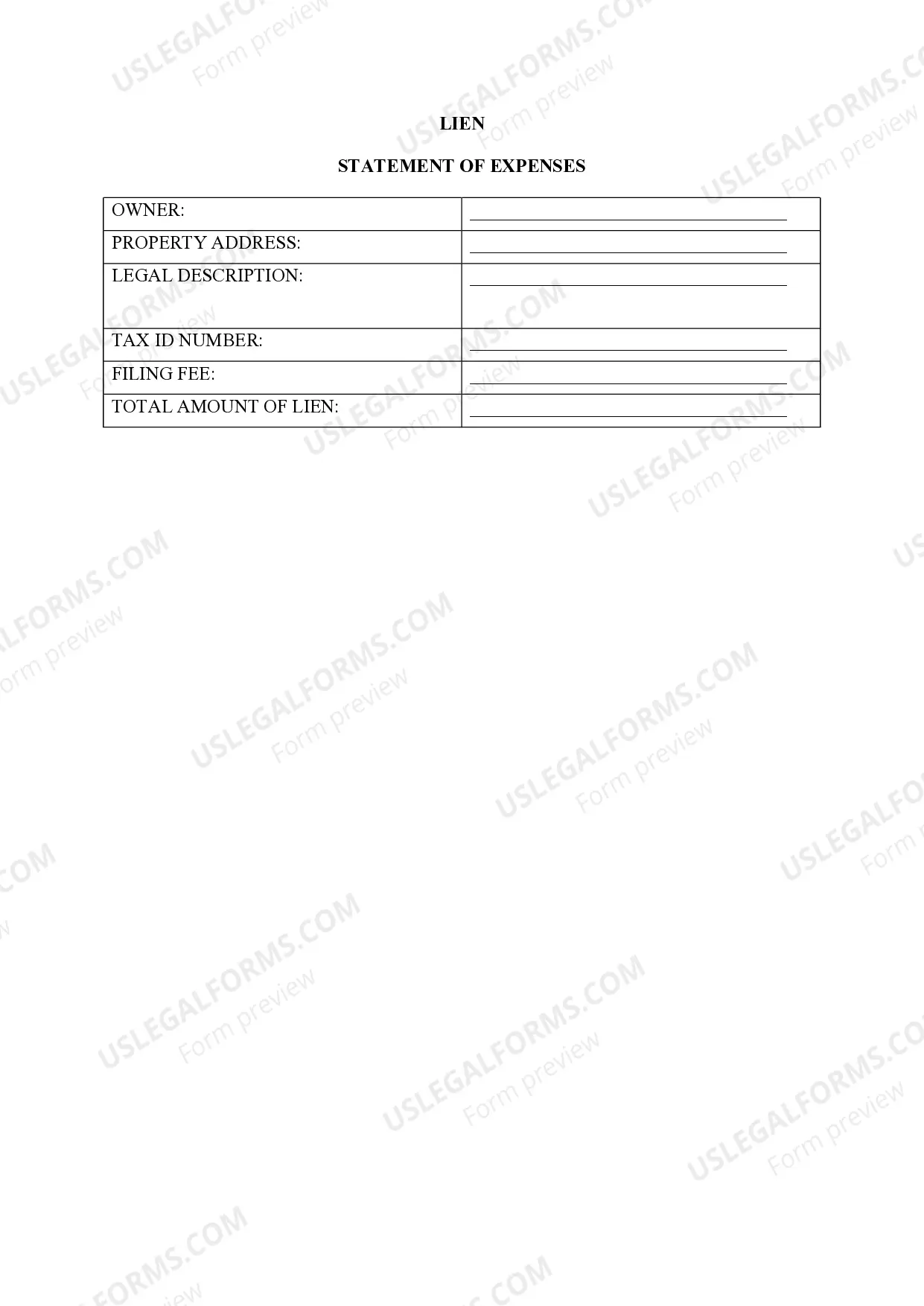

A San Antonio Texas Lien — Property refers to a legal claim or encumbrance on a property in San Antonio, Texas. It represents a right to hold or sell the property until a debt or obligation is satisfied. This mechanism is widely used to secure repayment of debts, taxes, or other financial obligations. There are several types of liens that can be imposed on properties in San Antonio, Texas. These include: 1. Mortgage Liens: This is the most common type of lien and is placed on a property when the owner takes out a loan to purchase the property or to secure a loan using the property as collateral. The mortgage lien gives the lender the right to foreclose and sell the property if the borrower fails to repay the loan. 2. Property Tax Liens: When property taxes are not paid, the local government may place a lien on the property to ensure payment. This allows the government to recover the outstanding taxes and any associated penalties. 3. Mechanic's Liens: These liens are commonly filed by contractors, subcontractors, and suppliers when they have provided labor, materials, or services to improve a property but were not fully compensated. Mechanic's liens give these parties the right to recover the unpaid amount by selling the property. 4. Judgment Liens: A judgment lien arises when a court issues a judgment against a property owner as a result of unpaid debts, such as credit card debt or a lawsuit settlement. It allows the creditor to collect the debt by placing a lien on the property. 5. Homeowner Association (HOA) Liens: In San Antonio, Texas, homeowner associations have the authority to place liens on properties belonging to members who fail to pay their dues or fees. These liens are enforceable and can result in foreclosure if the debts are not settled. 6. IRS Tax Liens: The Internal Revenue Service (IRS) may place a lien on a property if the property owner fails to pay their federal taxes. The lien ensures that the government has a legal claim to the property and can potentially seize and sell it to recover the owed taxes. In summary, a San Antonio Texas Lien — Property refers to a legal claim or encumbrance on a property in San Antonio, Texas, which can be imposed due to unpaid debts, taxes, or other financial obligations. The various types of liens include mortgage liens, property tax liens, mechanic's liens, judgment liens, HOA liens, and IRS tax liens. Understanding these liens is crucial for property owners and potential buyers in San Antonio, as they have significant implications on property ownership and can lead to foreclosure if left unresolved.

San Antonio Texas Lien -Property

Description

How to fill out San Antonio Texas Lien -Property?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney solutions that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the San Antonio Texas Lien -Property or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the San Antonio Texas Lien -Property adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the San Antonio Texas Lien -Property is proper for you, you can pick the subscription plan and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!